The Big Picture: From National Trends to Nashville's Reality

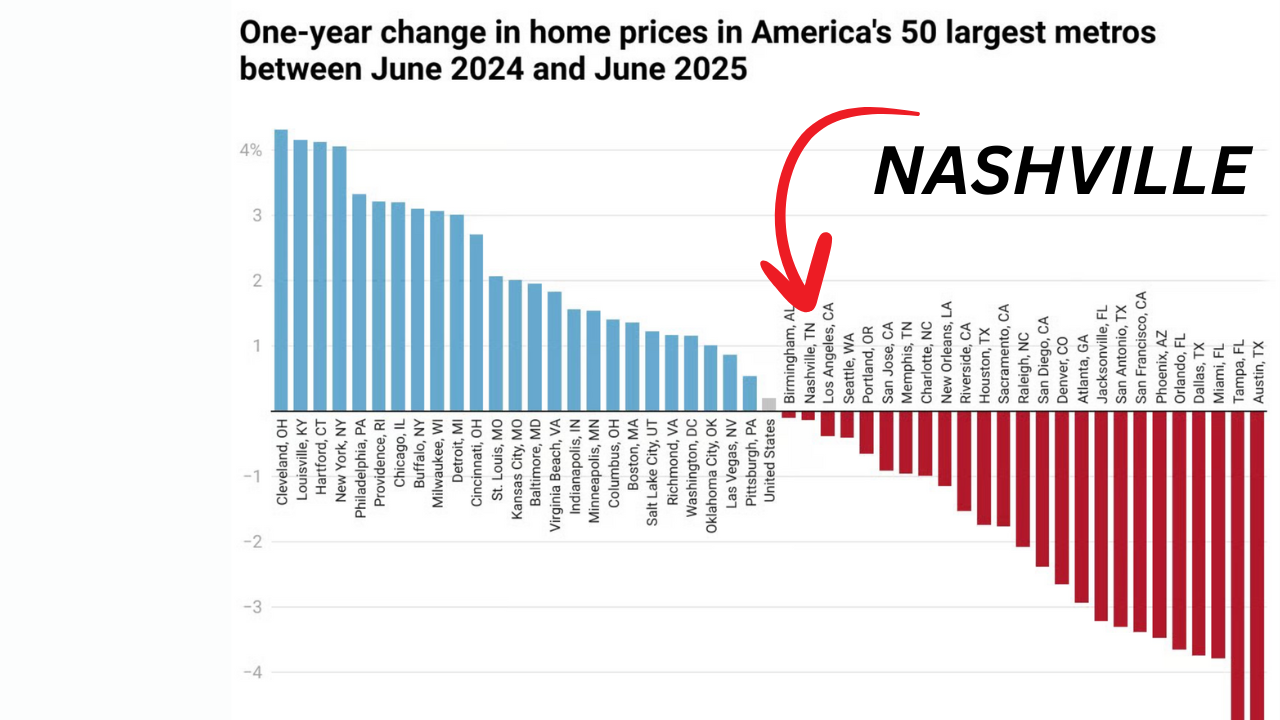

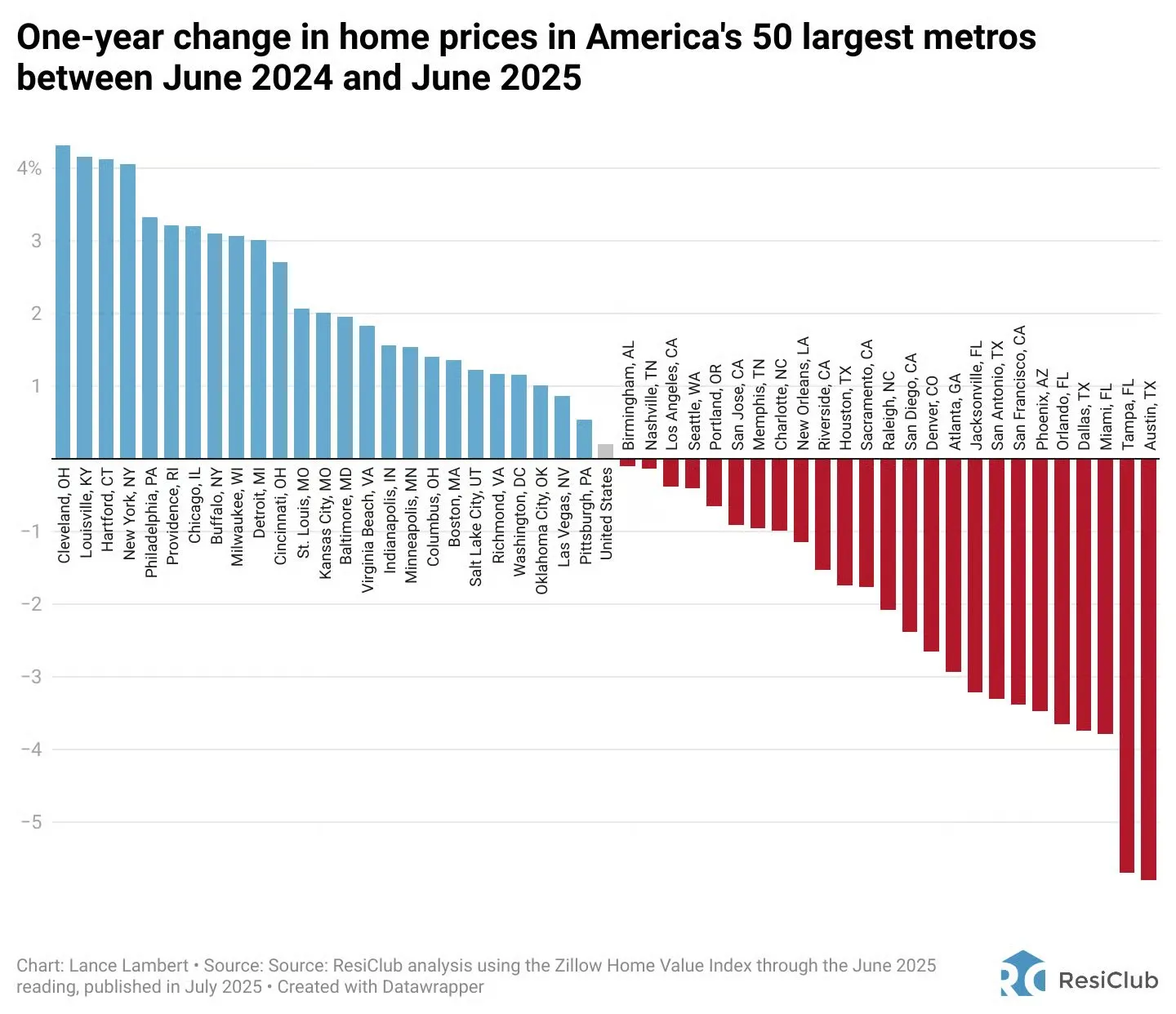

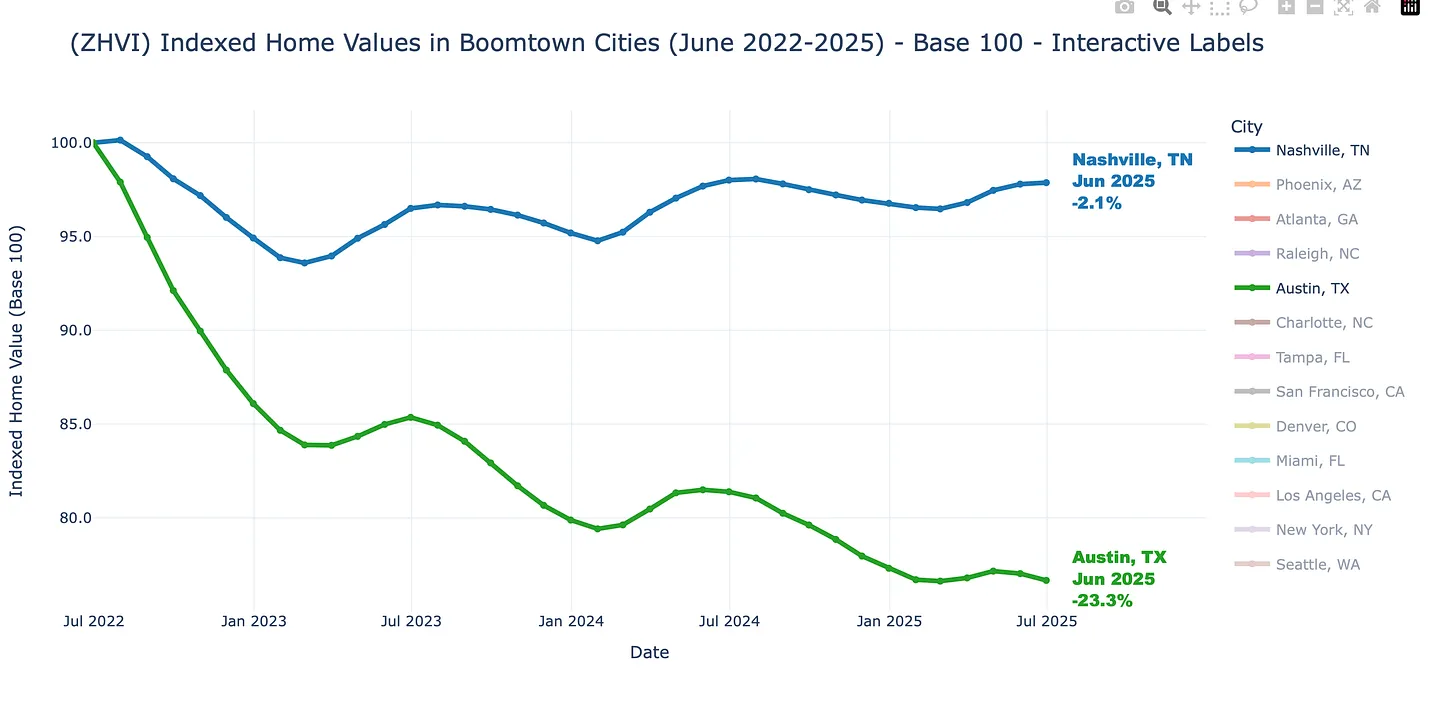

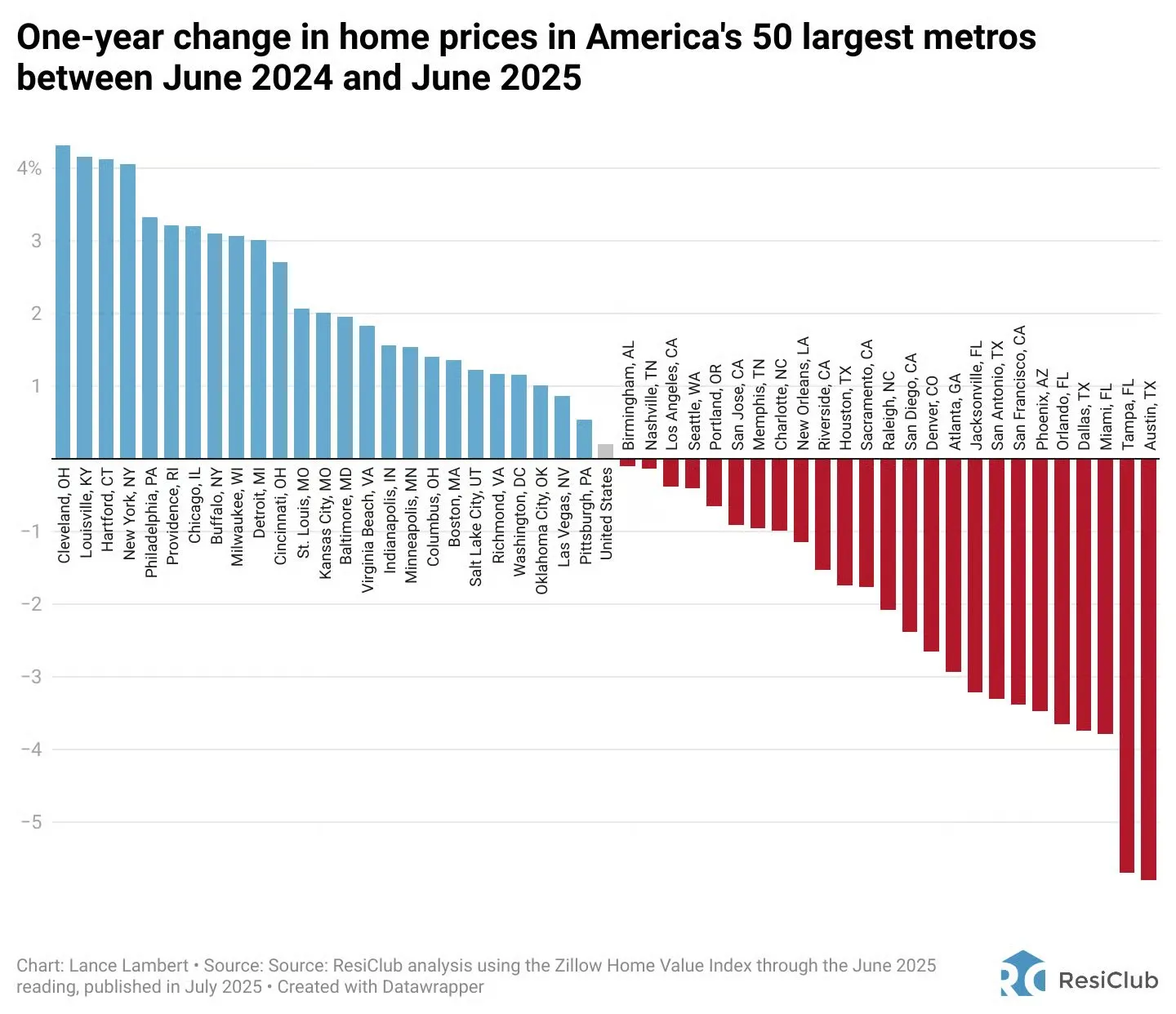

Back in November 2024, Lance Lambert tweeted that only 7 out of the 50 largest U.S. metros were seeing year-over-year home price declines. Fast forward to the end of June 2025, and that number has jumped to half—25 metros with falling prices.

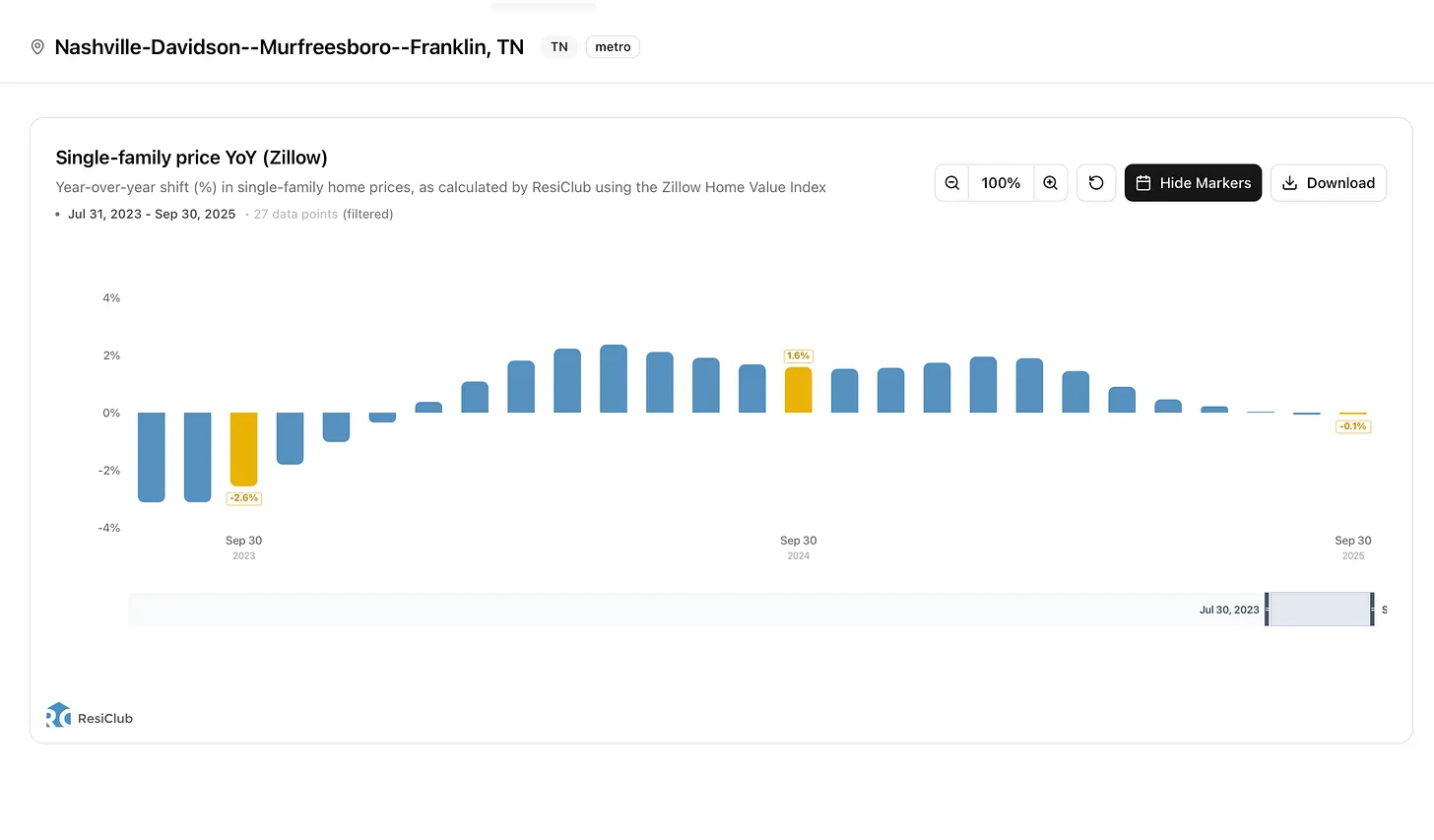

Nashville just joined the club, tipping into negative territory.

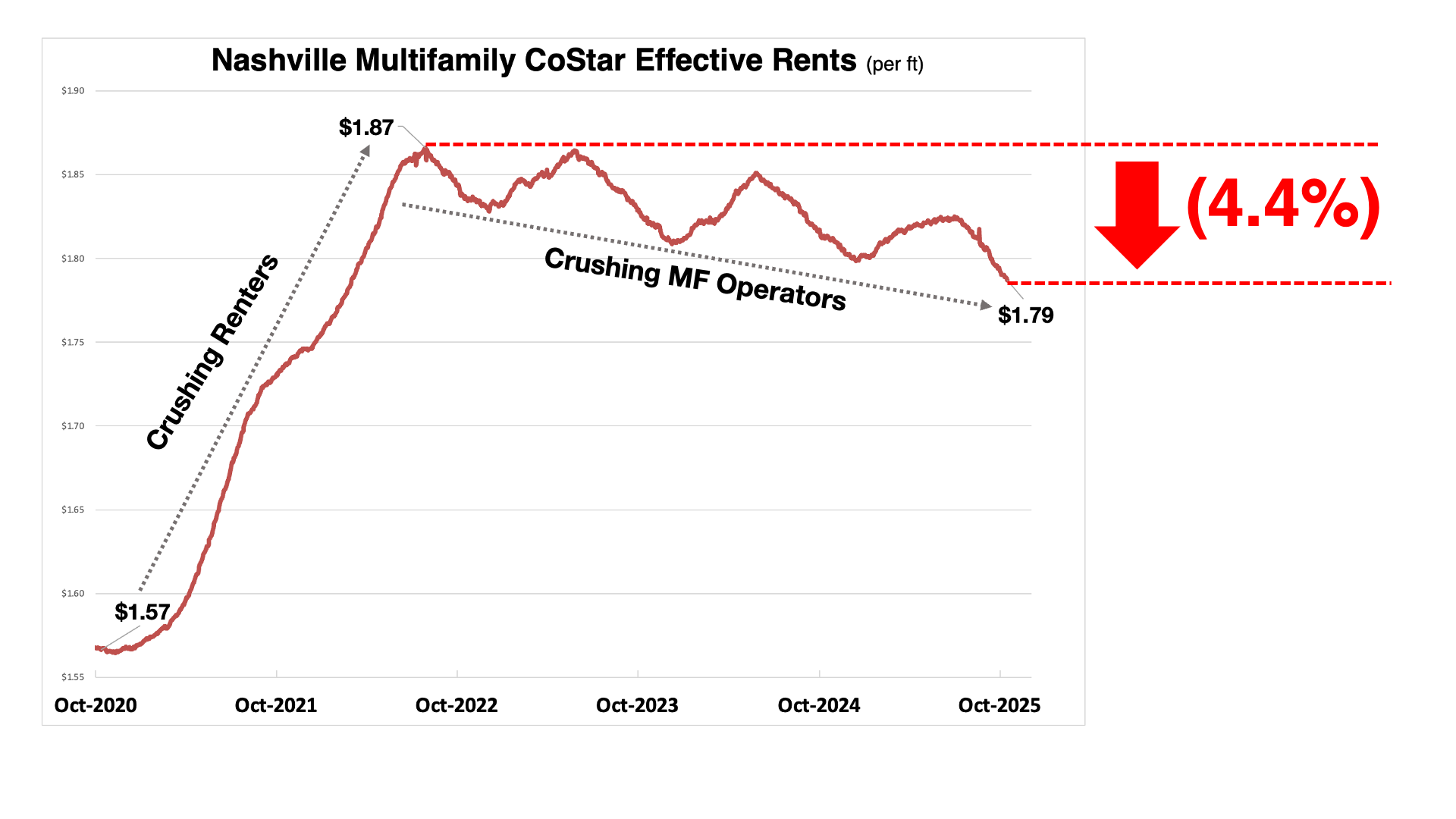

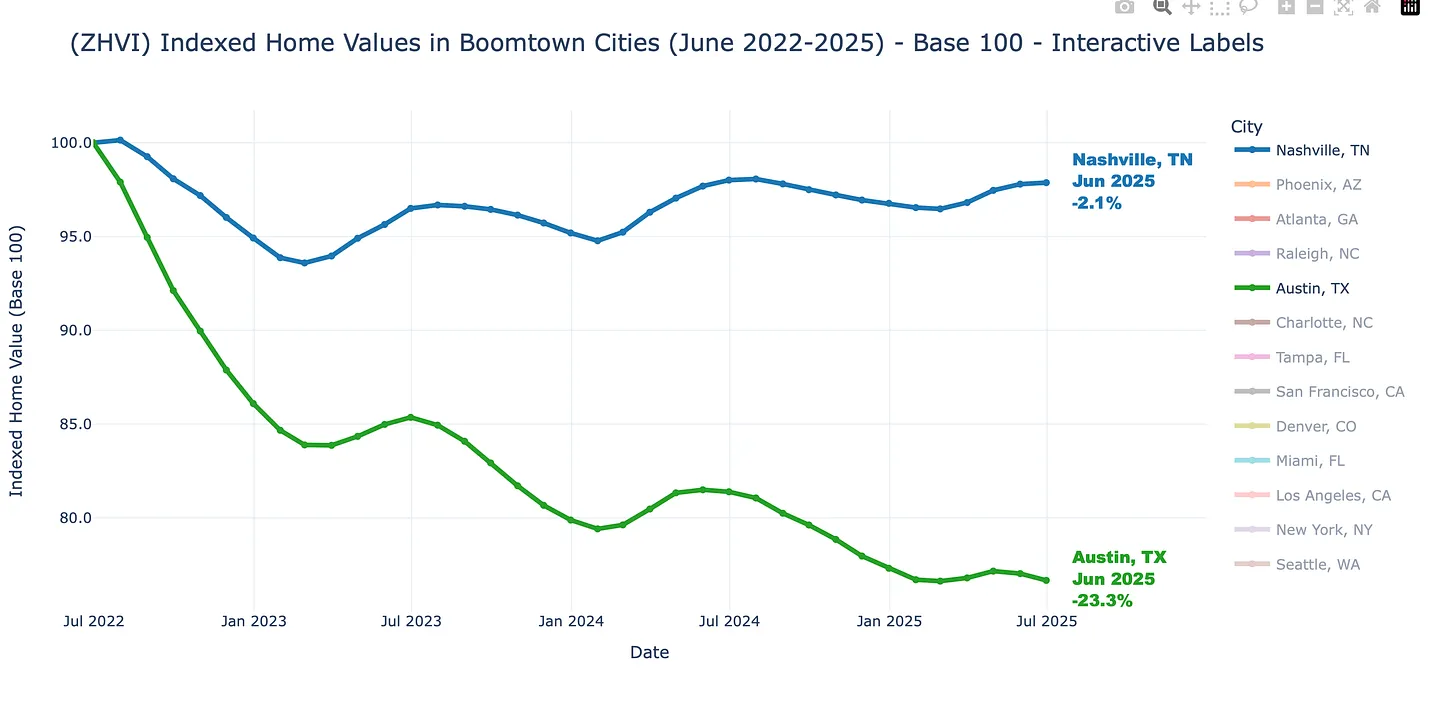

But before you get too excited (or worried), let's look closer. I'm a big fan of Zillow's Home Value Index for tracking median prices, as it gives a solid snapshot. Nationally, places like Austin are feeling the pain, down well over 5% year-over-year and 23.3% from peak.

Turns out, Austin had the declines that I expected for Nashville.

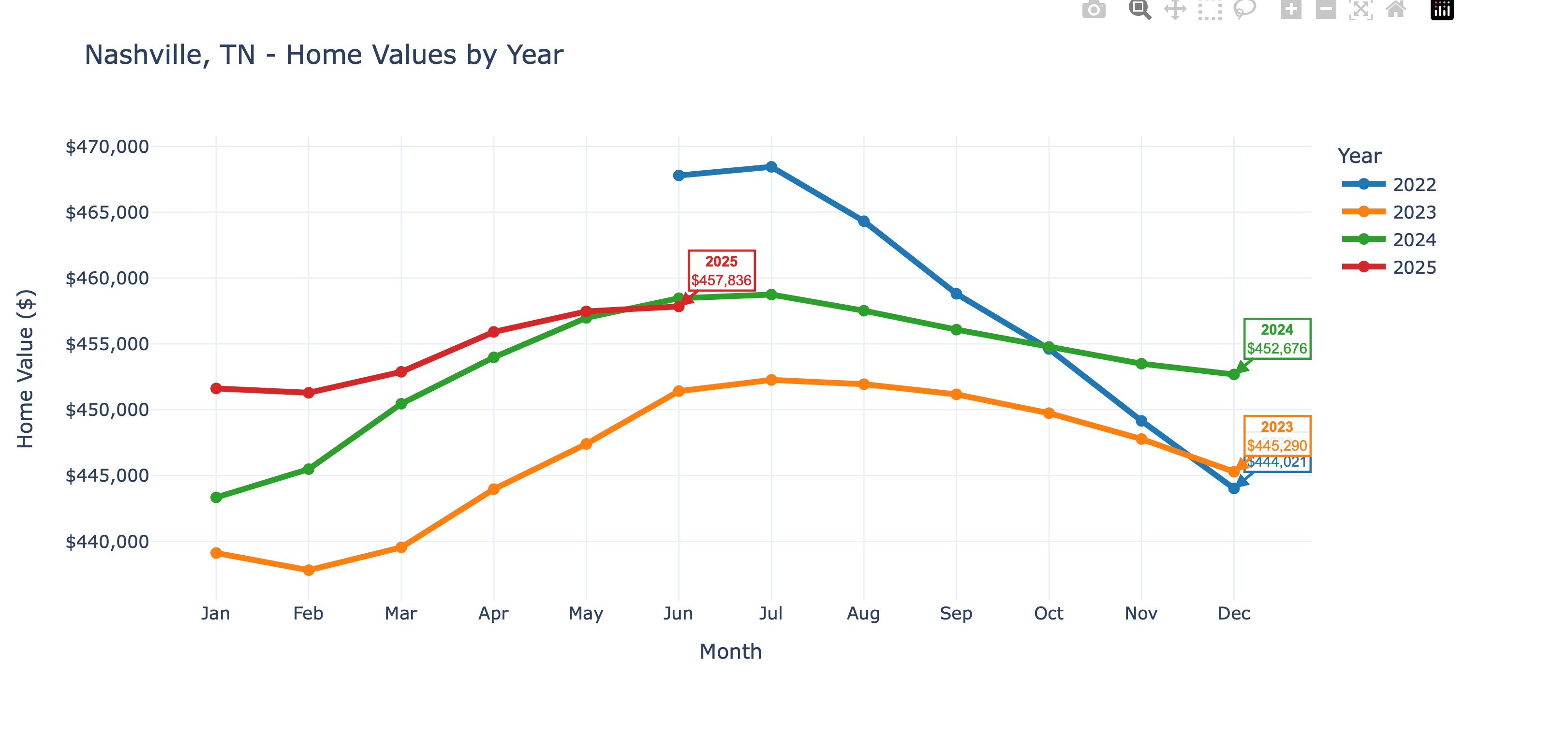

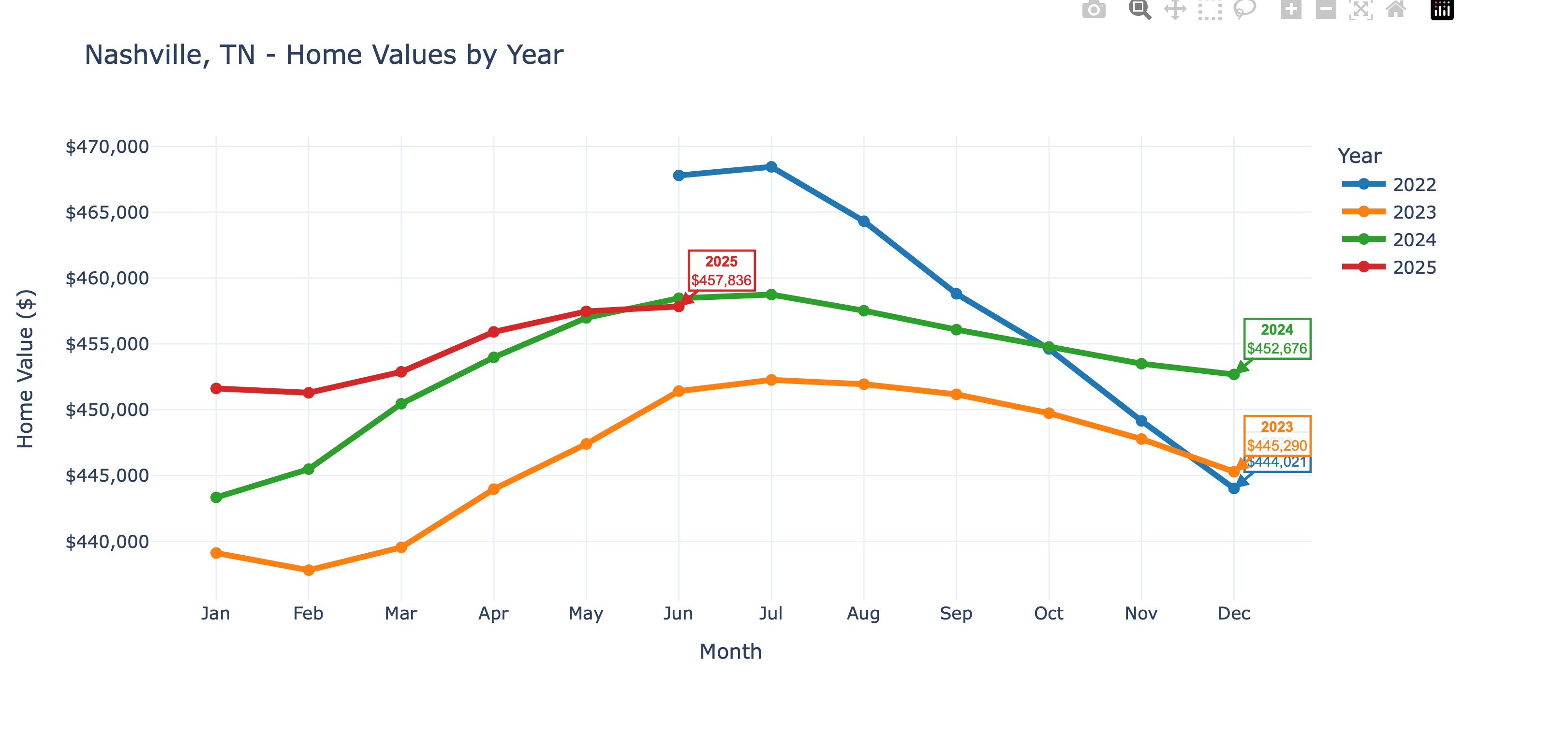

Nashville’s home prices are down just 2% from our peak in July 2022. Prices have been edging up almost every year since then. Even between May and June 2025, values ticked higher. So why the "negative" label?

It's all about that year-over-year comparison: Last June, the index sat at $458,465; this June, it's $457,836—a whopping ~$600 drop.

As a buyer advocate, I'm pretty disappointed. I don't want prices sky-high and look forward to the day when mortgage payments and rents are balanced again, but this tiny dip feels more like a rounding error.

Price Cuts: The Real Indicator of Market Softness

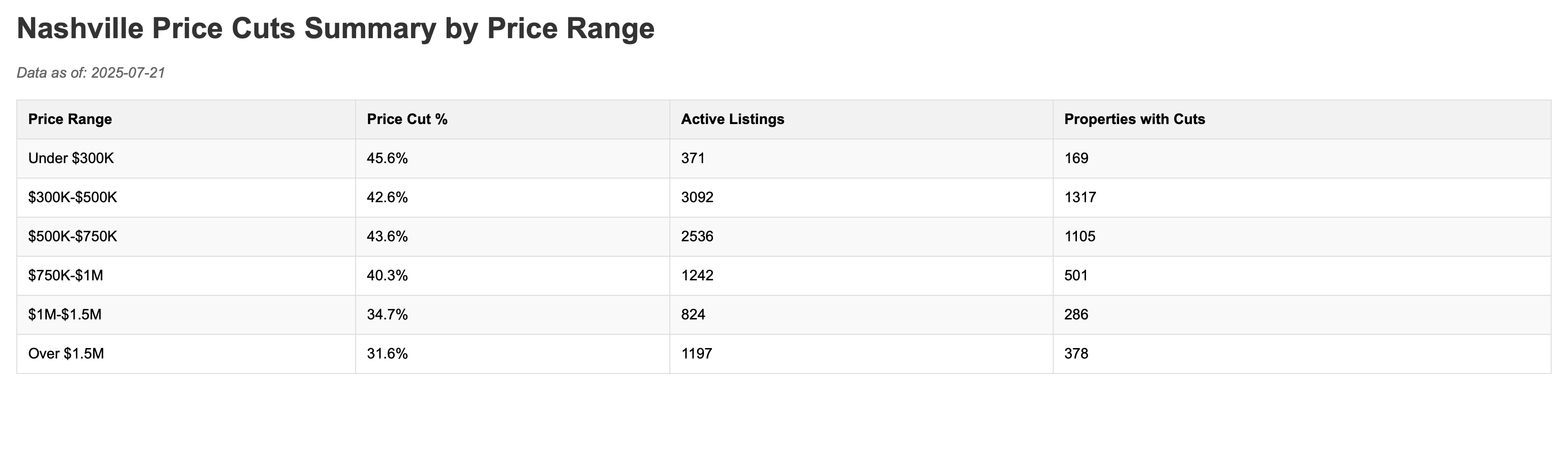

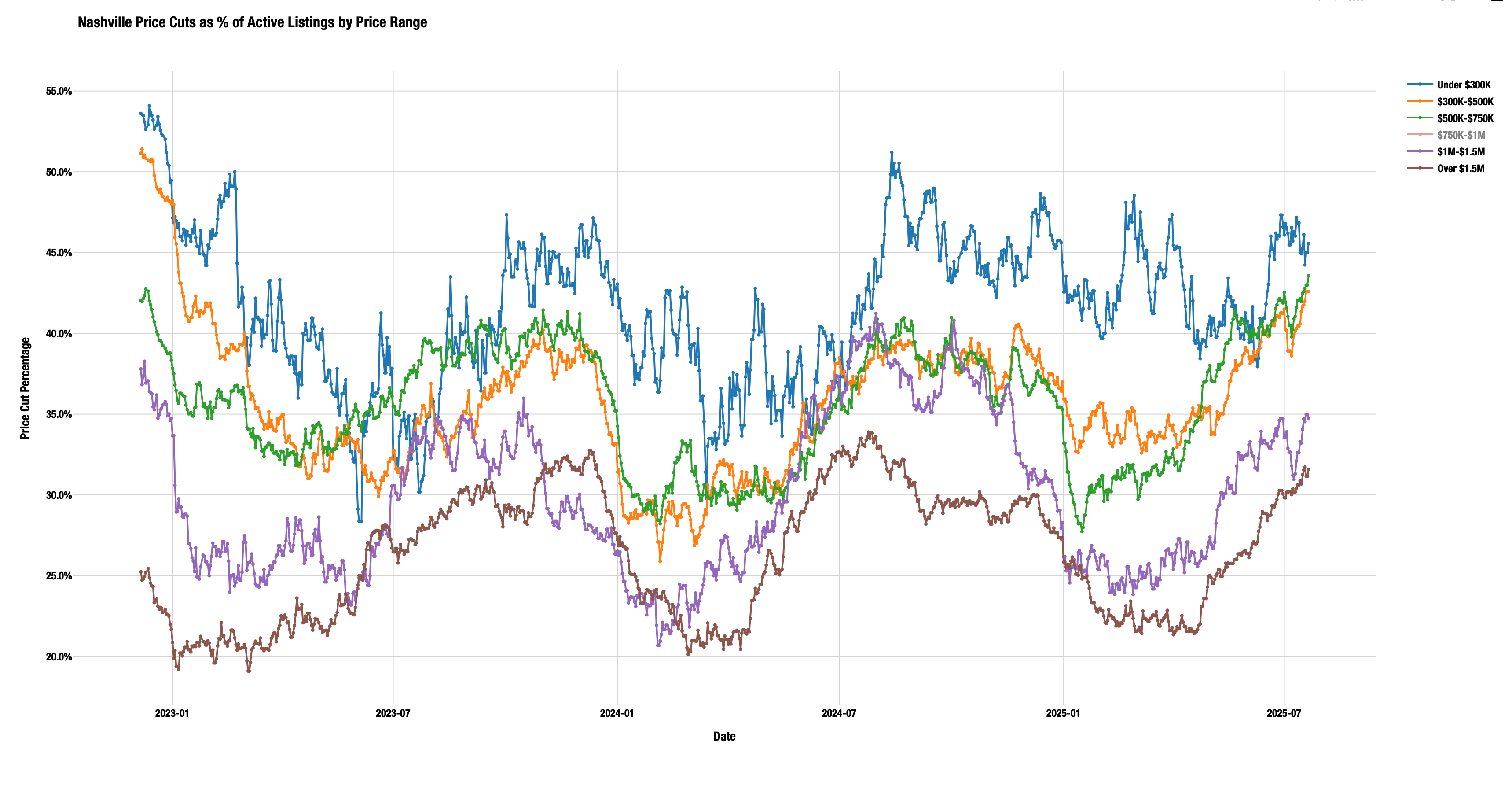

Tracking home prices can be helpful, but they don't tell the full story. Let’s look at Price Cuts by Price Bands:

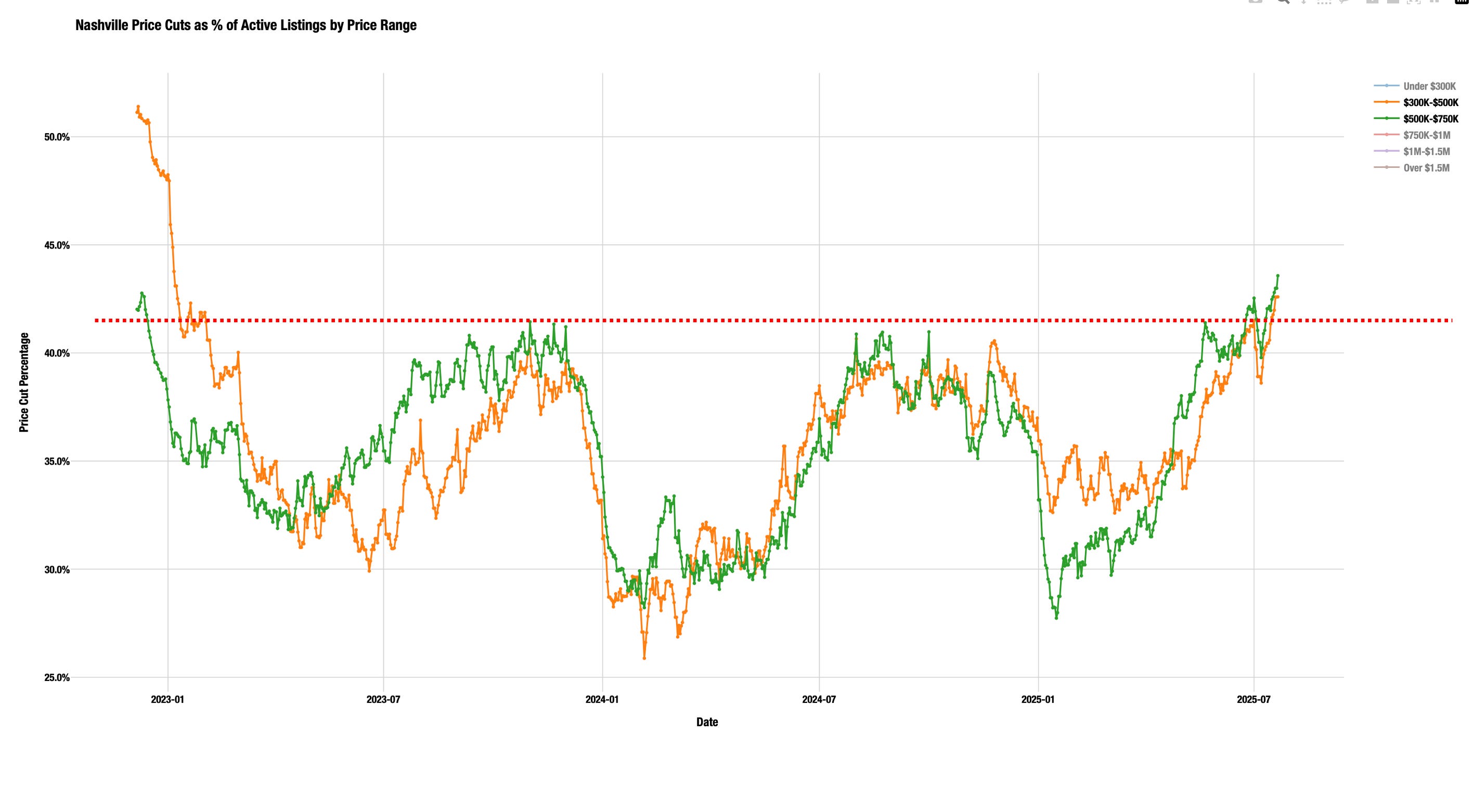

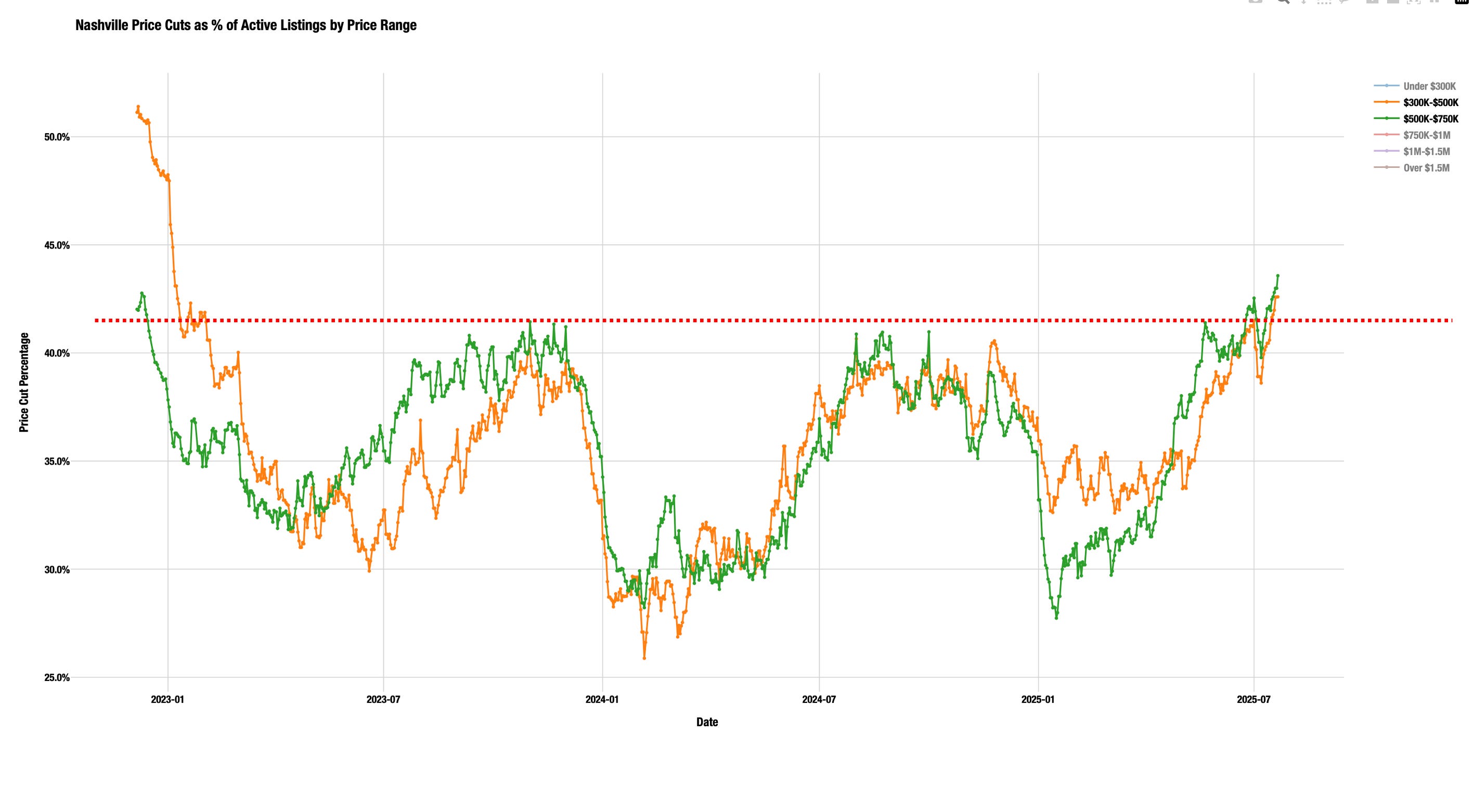

Keep an eye on the $300K - $750K Listings - Rapid Increase in Price Cuts

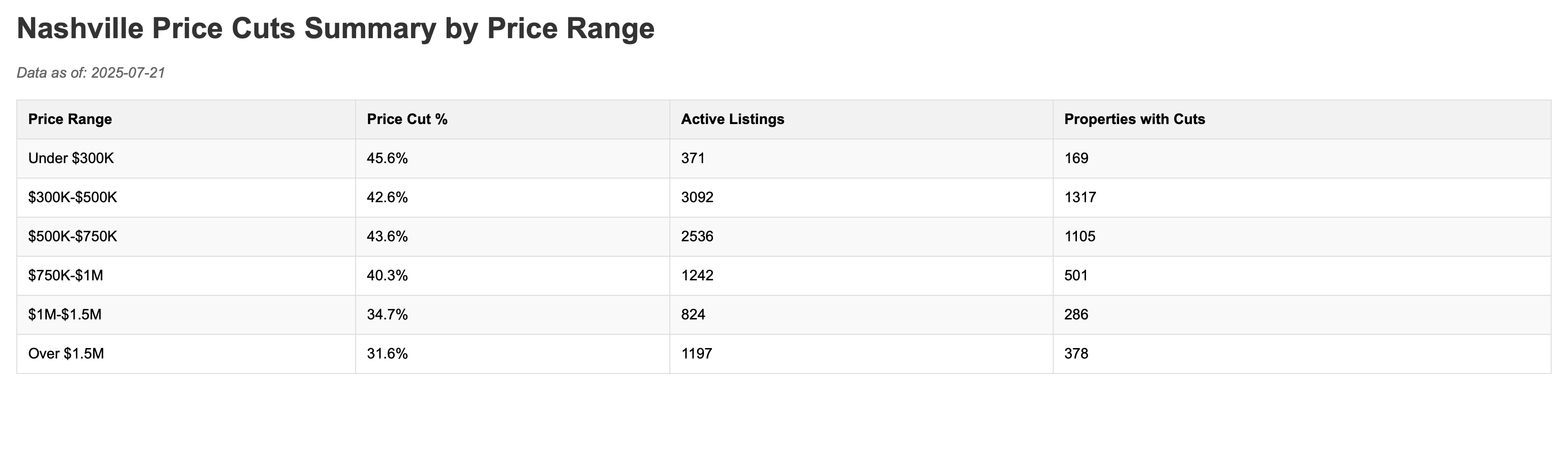

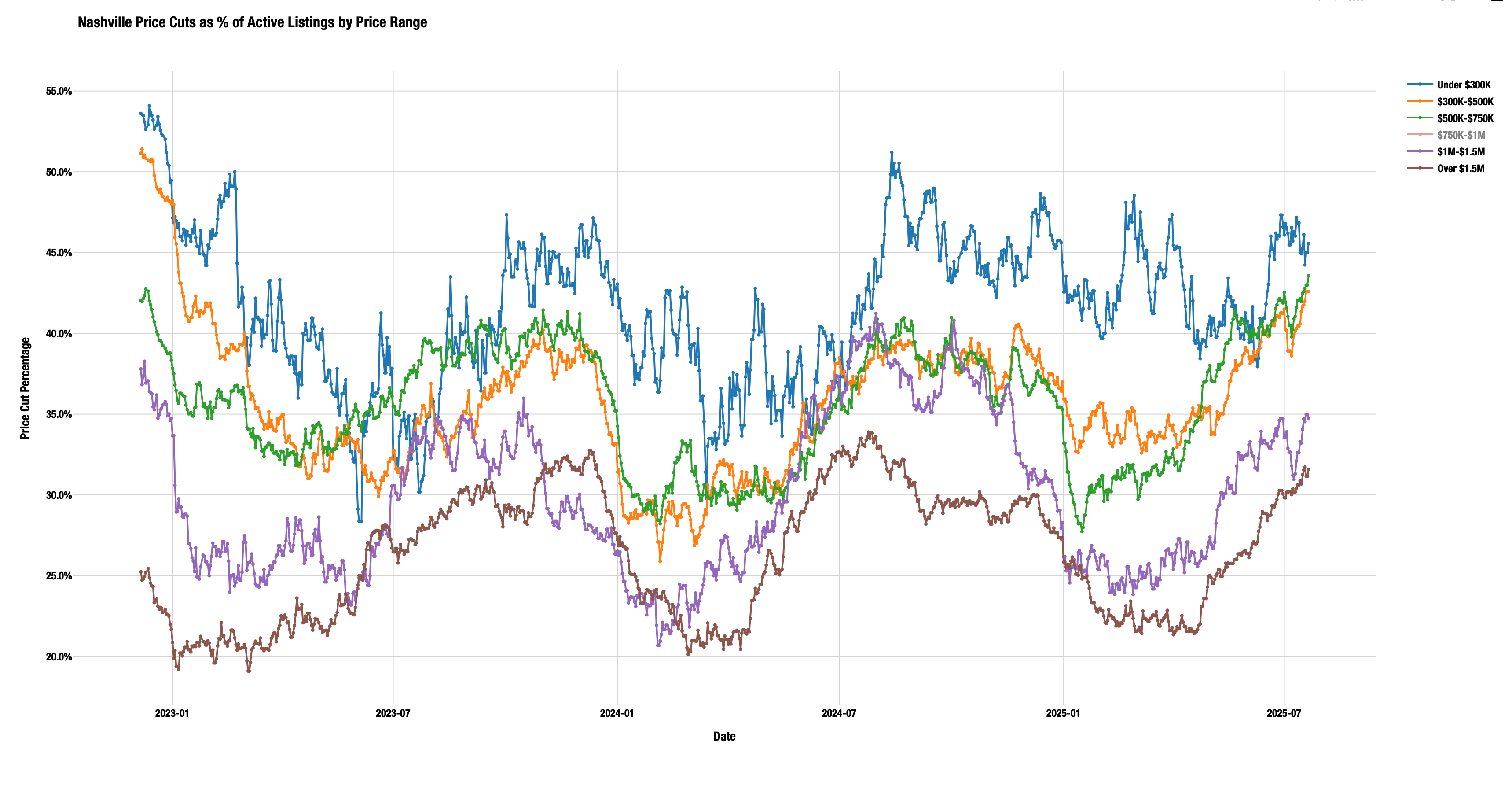

Astonishingly, nearly half of homes under $300K have slashed prices. I always assumed anything in that range would fly off the shelves, but that's not the case anymore. The 300K–750K bands aren't far behind at around 42-43%, but they are increasing at a rapid pace, this to me shows the most change in motivation.

In the luxury segment over $1.5M—with almost 1,200 active listings—the cut rate is only 31.6%, though it's been climbing since April.

Overall, 40% of all active listings in Nashville have had price reductions. Why does this matter? Most agents price homes to sell quickly—they don't want to waste time. When cuts exceed 35%, it signals widespread mis-pricing to current market conditions. Sellers are adjusting expectations, which could create opportunities for buyers, especially in the second half of 2025.Looking at trends over time:

Under $300K cuts have hovered around 45% all year. BUT it’s stable to slightly declining.

Higher tiers (e.g., over $1M) are seeing faster increases in cuts, pointing to building pressure but still lower than last year.

The middle tiers 300-750K however, are breaking out to a new multi-year high and are increasing rapidly. These are the ones to keep an eye on IMO.

Thanks for reading!