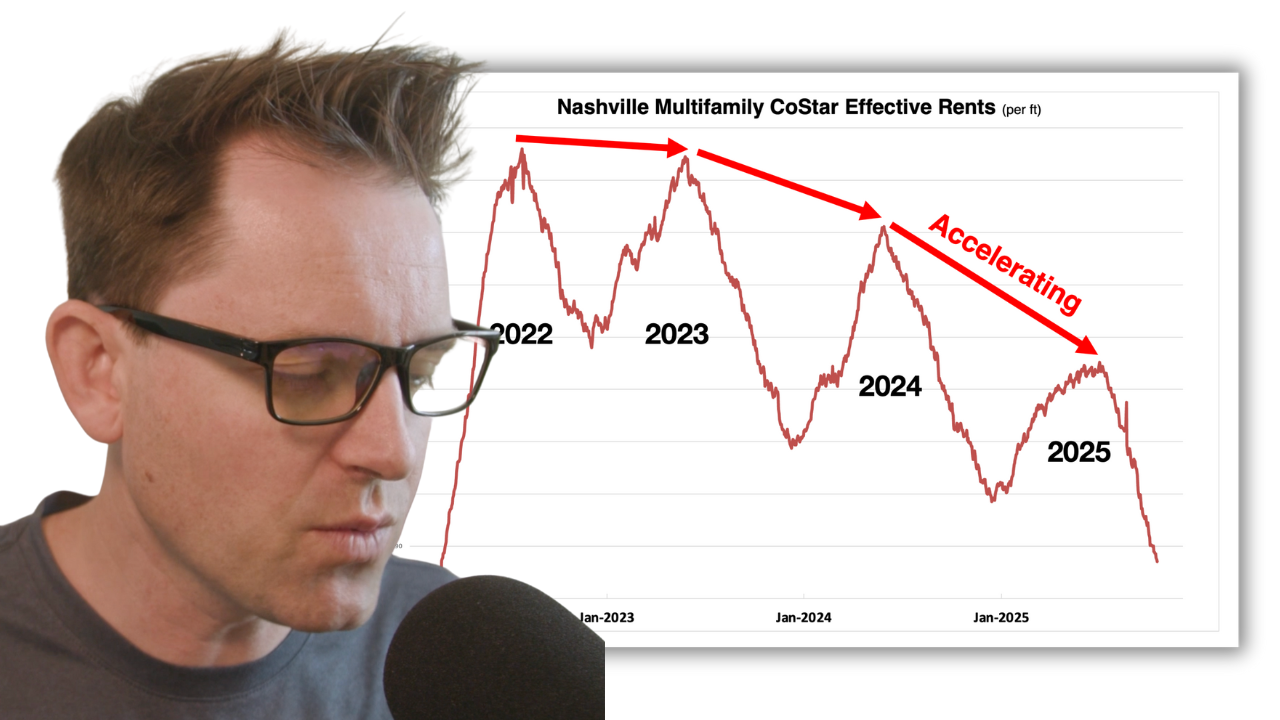

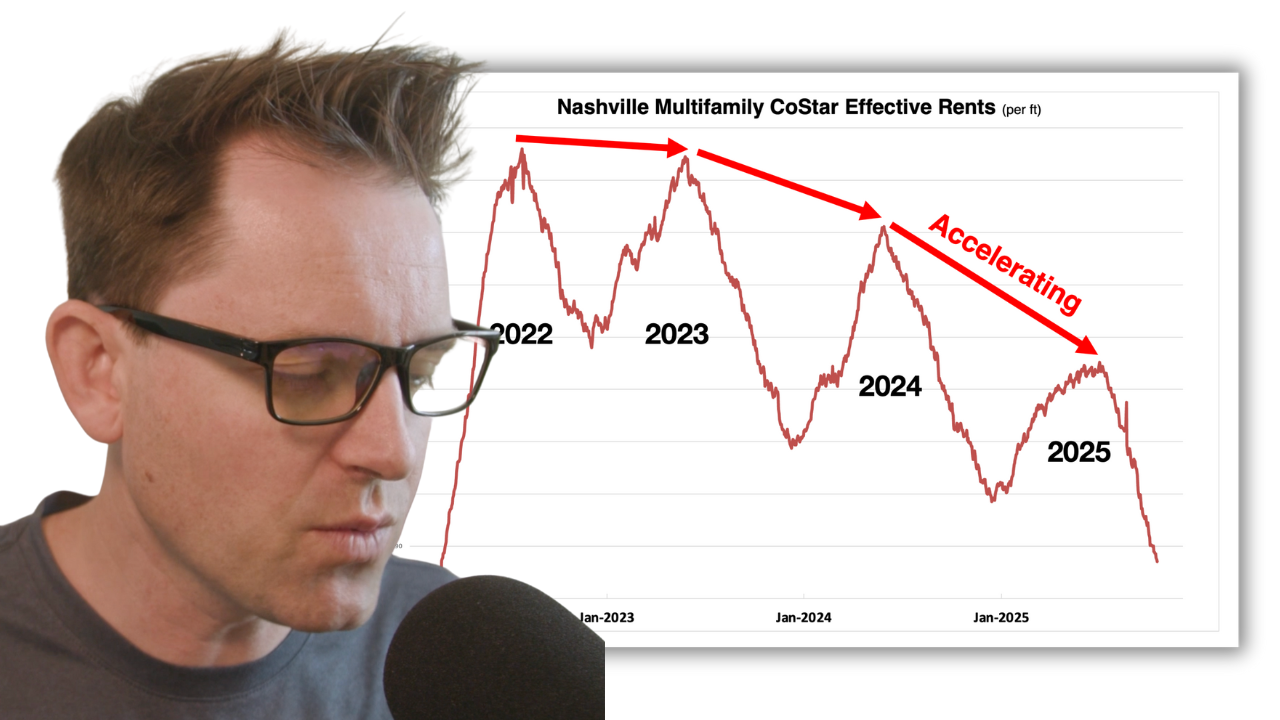

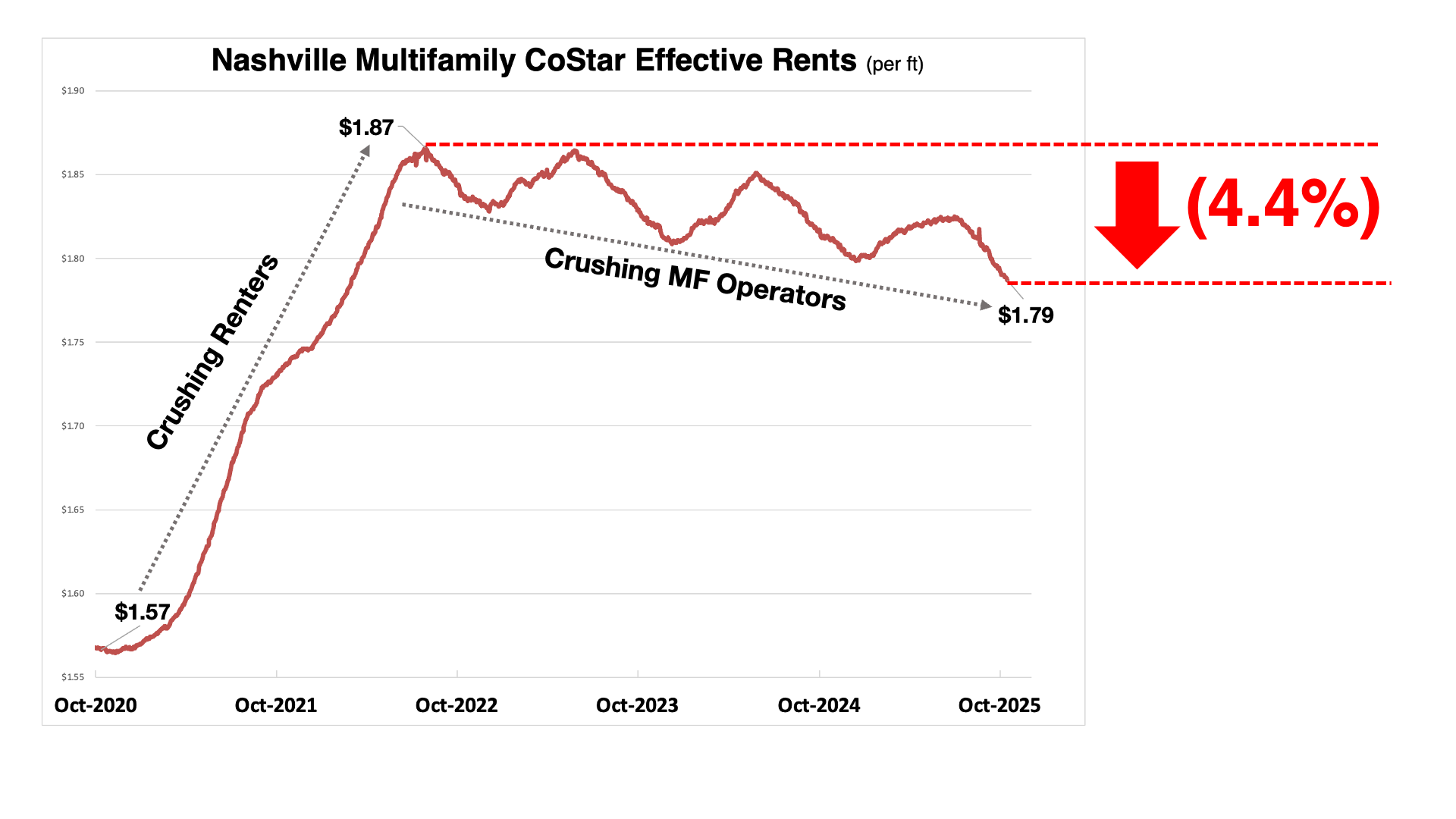

Nashville’s rental market is signaling more pain for investors. The city is experiencing yet another year of accelerating rent declines. This pattern of compounding downturns is becoming one of the most important real estate stories today.

2025 was supposed to be when things started to stabilize. However, when looking at the multifamily rent rates, things actually look worse right now than they have in the past three years.

Accelerating Rent Decline

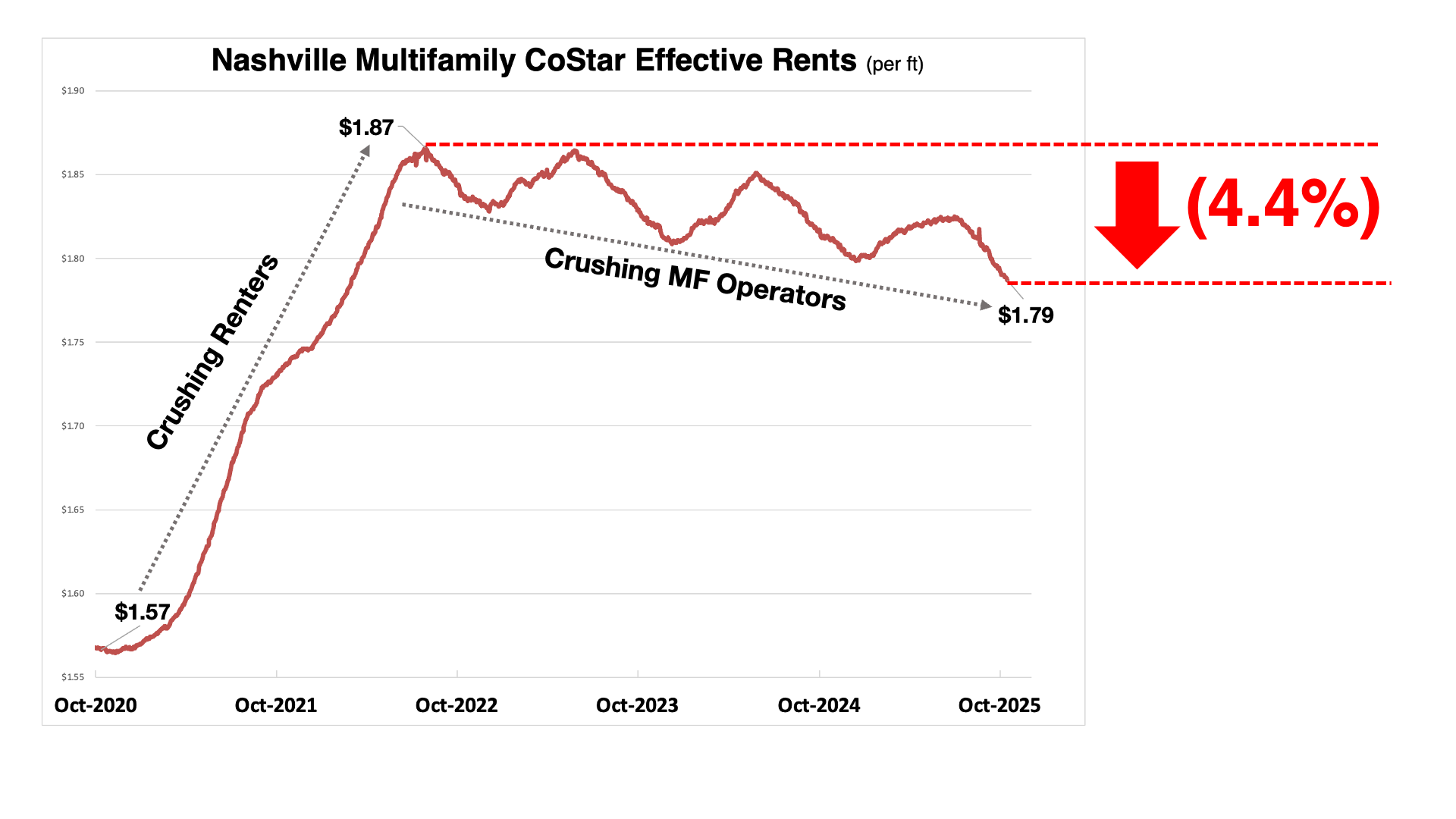

The CoStar rental data for Nashville shows a troubling trend: the highs are getting lower, and the lows are getting lower. While the total drop from 2022 to current is only about 4% (approximately 1% per year) , the rate of decline is accelerating as we head into 2026.

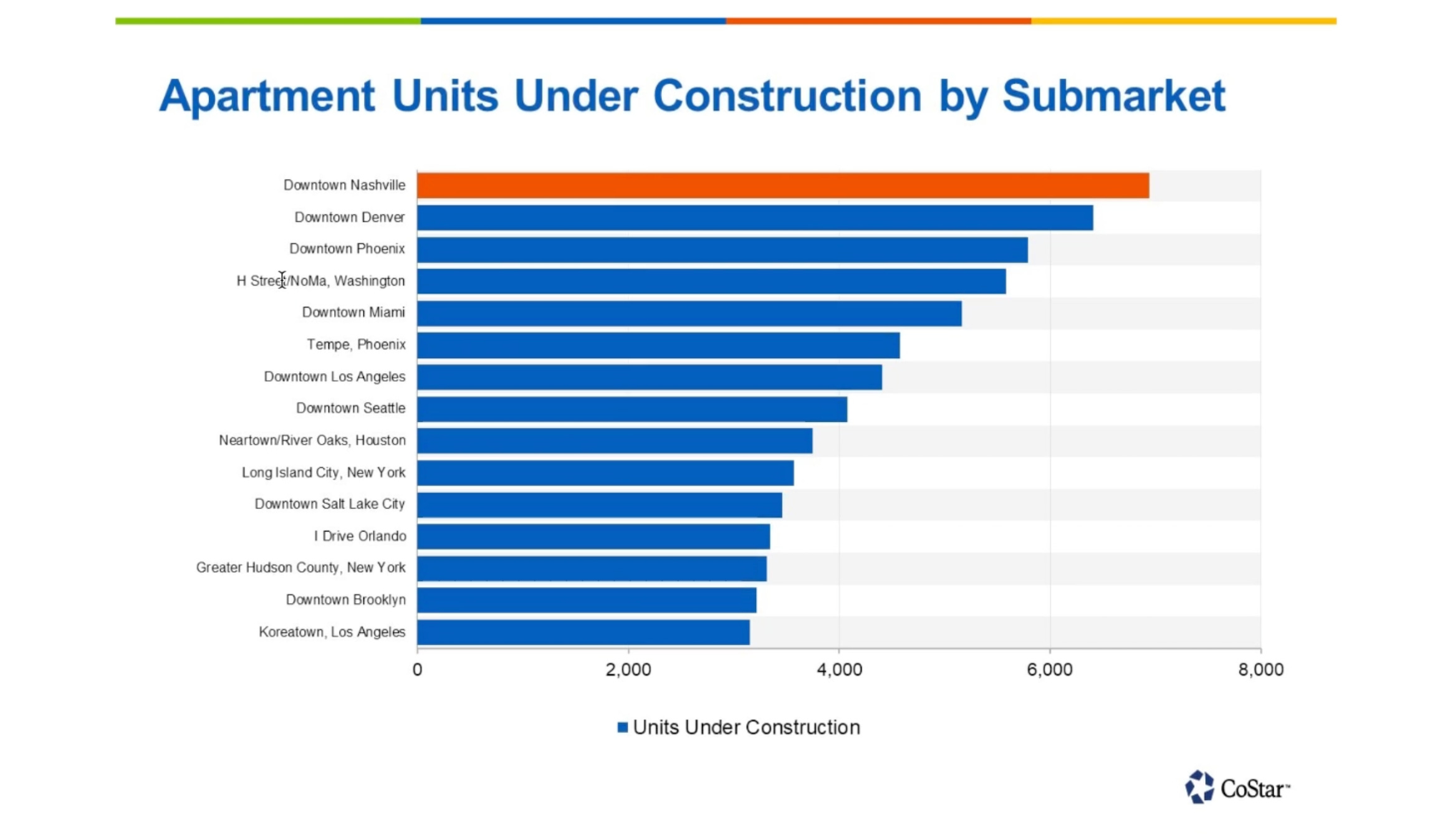

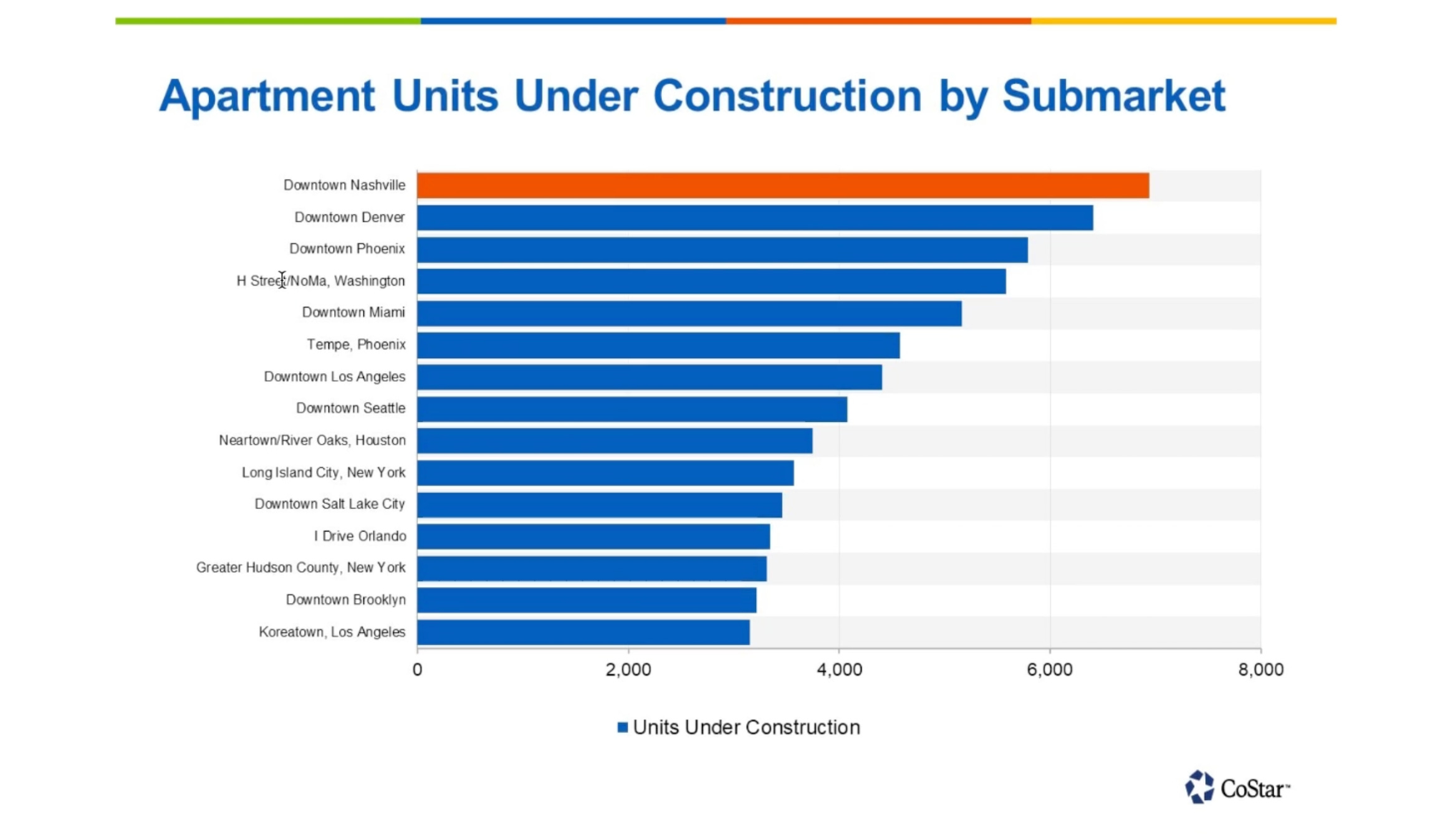

The Crane Warning: A Supply Deluge

Famed Apartment investor Ken McElroy: “when you’re surrounded by cranes, you’re probably late to the game”.

When Ken visited Nashville he noticed the massive number of cranes in the air, he passed on any opportunities to invest even though the market checks a lot of boxes. The massive increase in supply gave him pause. And now we are seeing why.

The driver of the rent drops is overwhelmingly supply.

The deluge of apartments and condos started in 2020 and 2021

Nashville, a small market relative to many others, at one point had more under construction than any other metro in the United States.

CoStar is reporting Supply is expected to continue as there are now 11,000 units under construction, however it has slowed from the 20,000 under construction 2 years ago

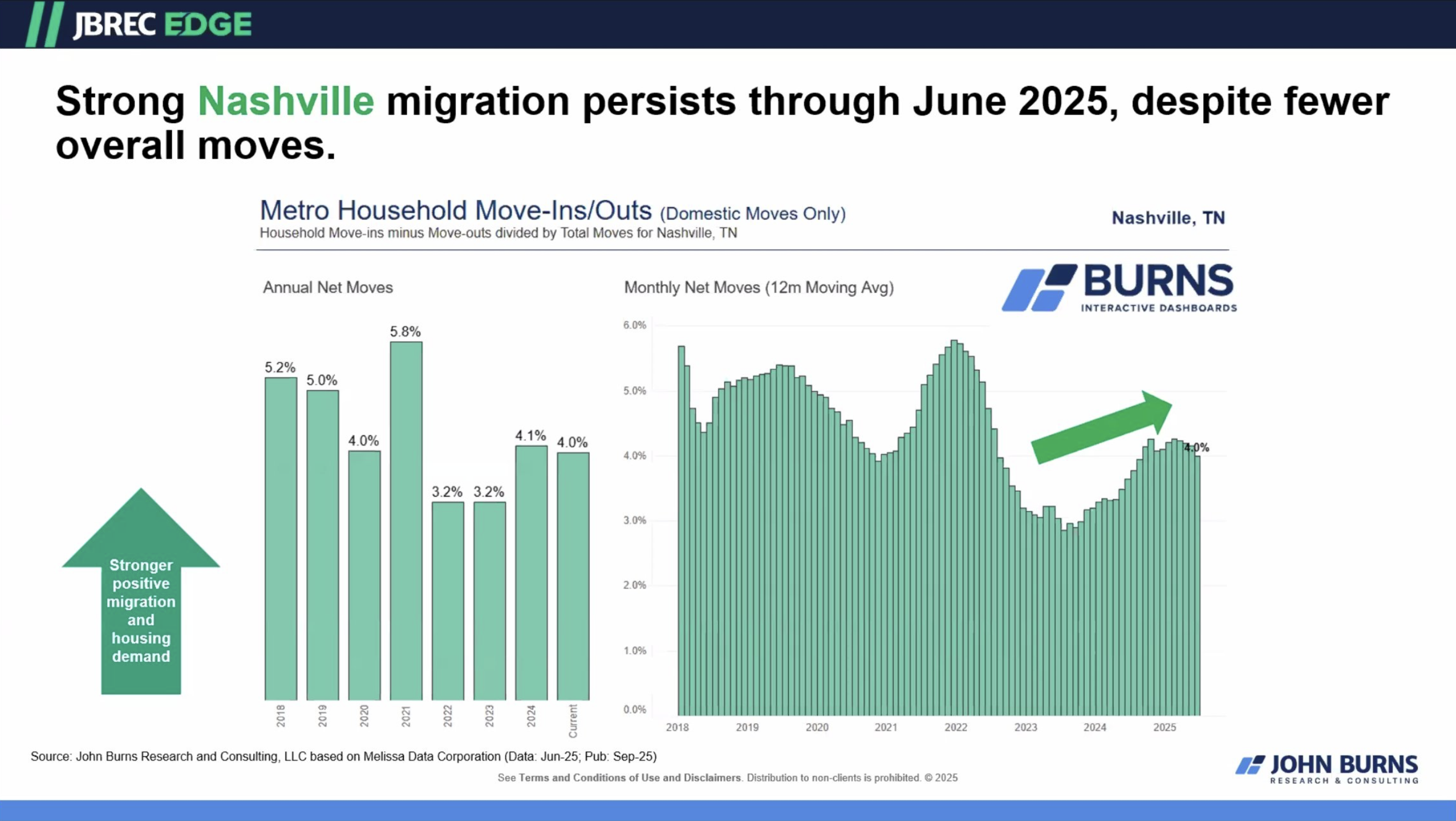

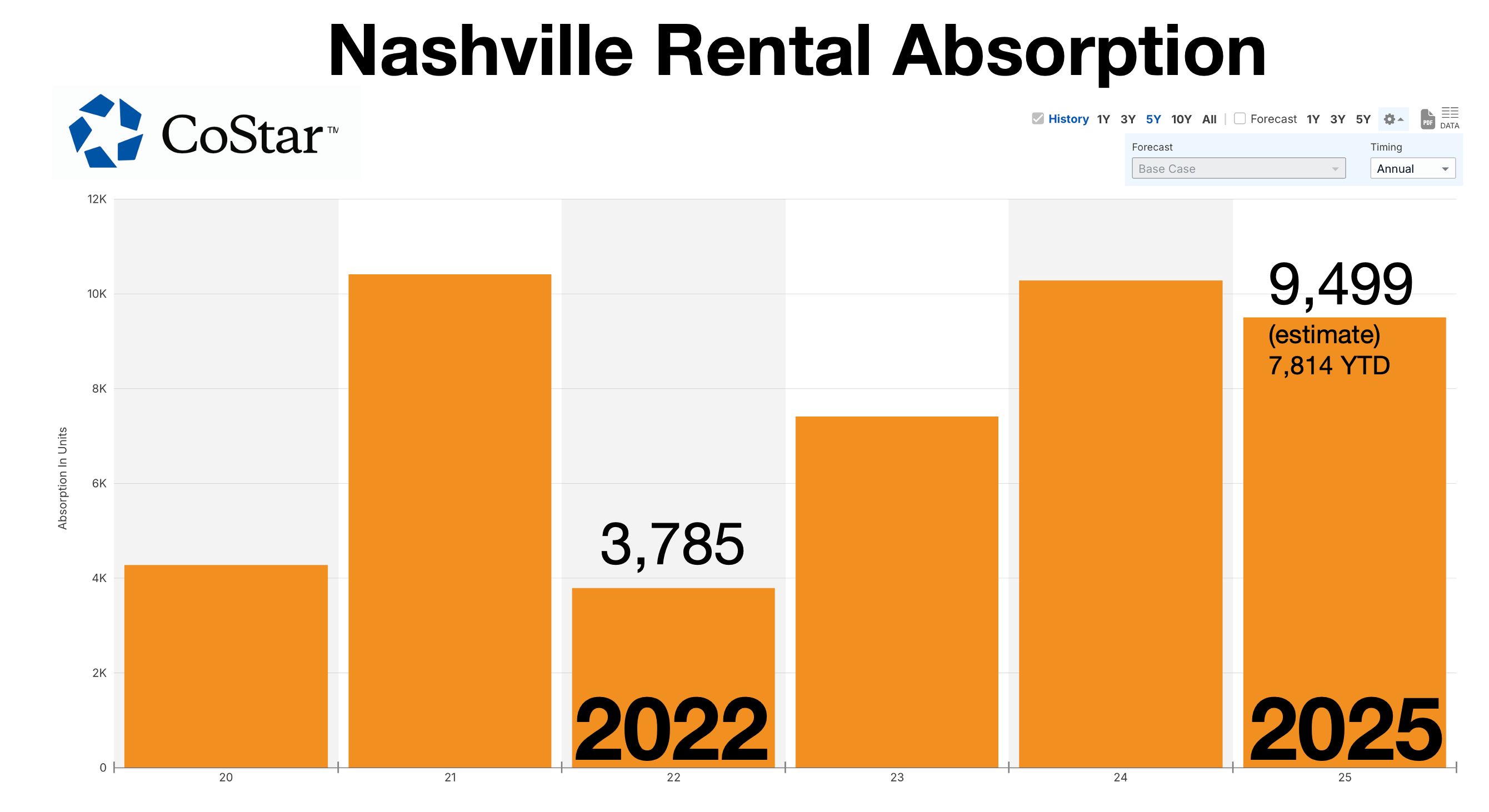

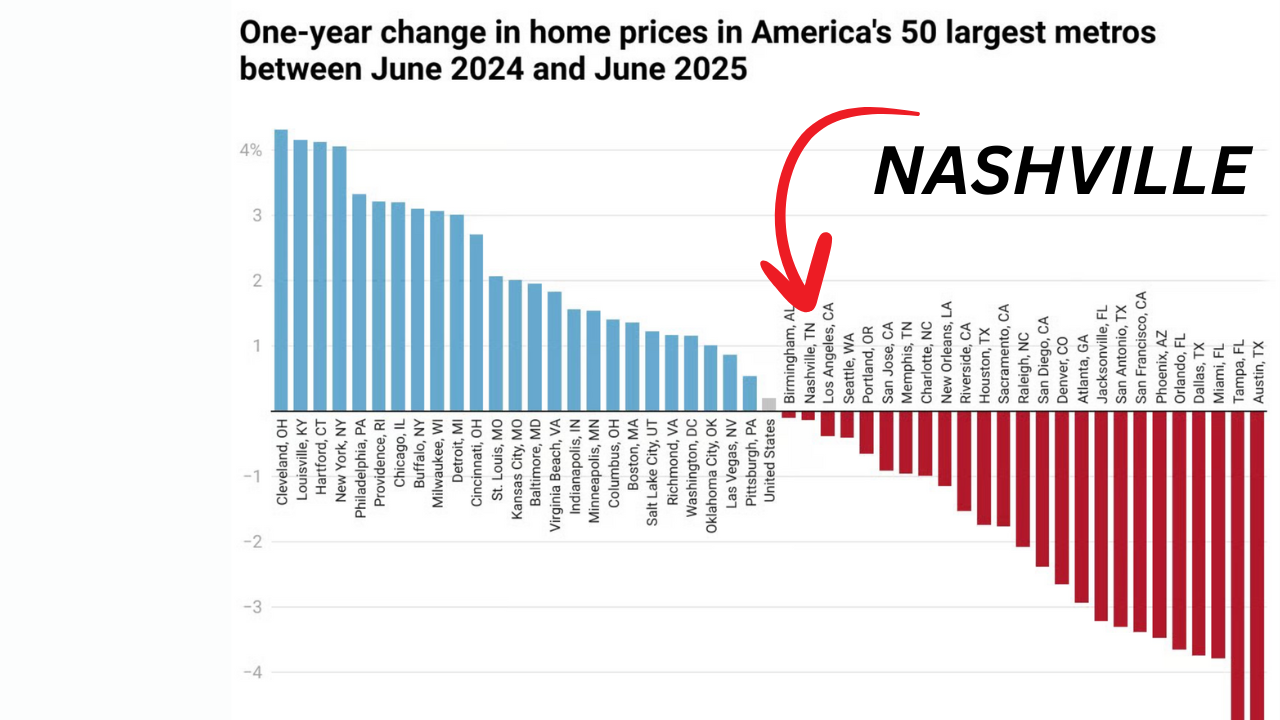

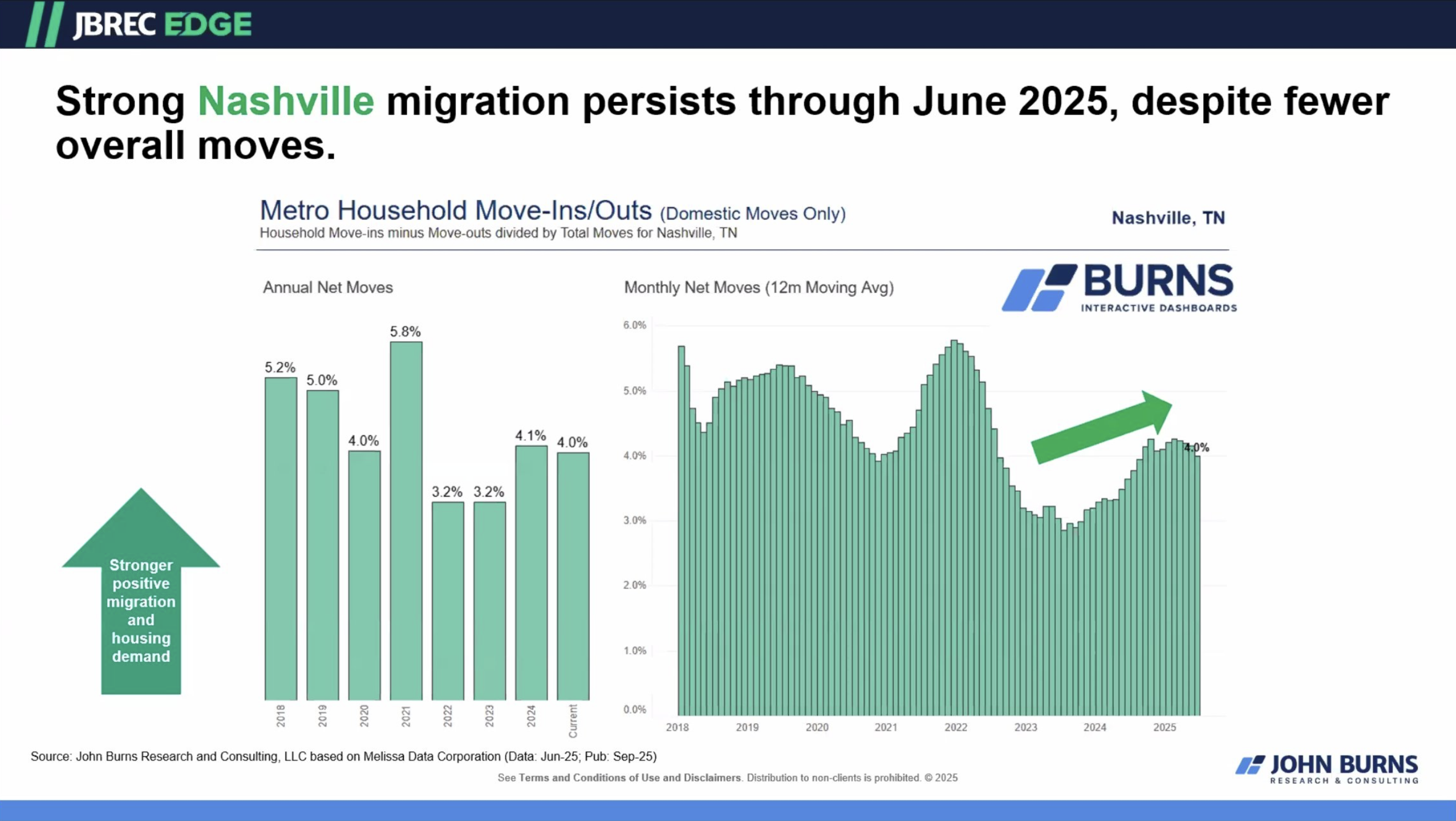

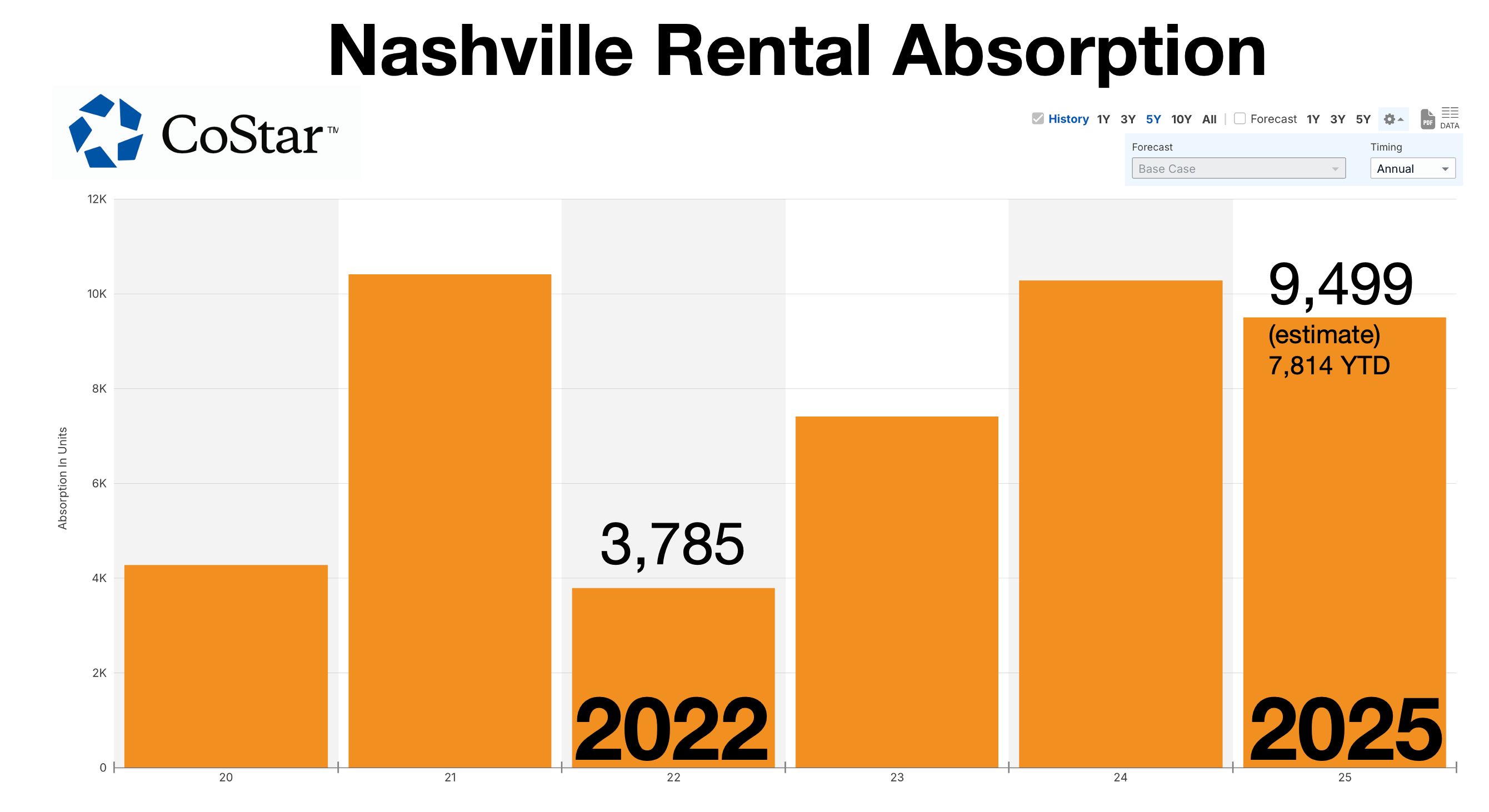

This is a supply story, not a demand story. Data from John Burns Research Consulting and CoStar suggests demand remains strong:

Nashville migration remains strong.

Even though Home Purchases are flat, Demand for renters is growing. CoStar is reporting 2025 is expected to end the year between 9,000 to 10,000 additional incremental renters. This is more than double the 3,785 renters added in 2022.

Warning Signs: Strange Things are Happening

There have been a few High Profile warning signs in the multifamily market, even though the overall foreclosure rate has been low.

1) One example is Adam Neumann’s 2010 West End. That project folded this year, and equity investors lost 100% of their equity. The property was bought for $160 million with $120 million borrowed in December of 2021 at a 4% cap rate when the building was leased up. No real opportunity to add value.

2) Apartment buildings like Prime, Emory, and Pullman have pivoted to condos.

This is having a cascade effect on the Luxury Condo market with multiple years of supply right now. Avg ~300 Sales Per Year

MLS reports 235 Active High Rise Condos and only 223 have closed in the last 12 months, and inventory is not including off market availability from Cancelled Listings and condo conversions: Pullman, Emory, and Prime.

No Spike in Renter Distress

Evictions are only up about 5.5% year-to-date, and given the increase in renters, this is not a renter distress story.

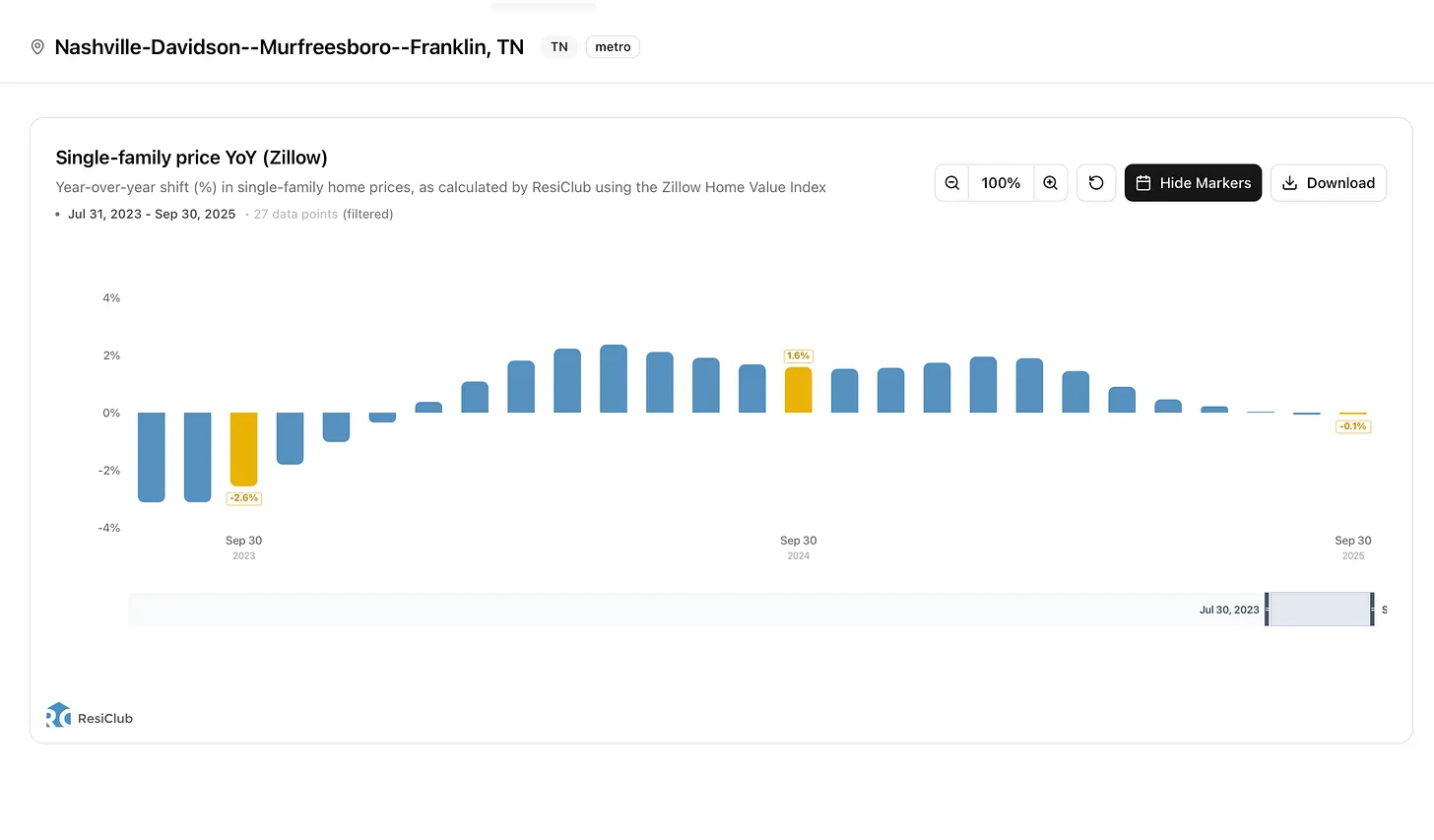

The Single-Family Exception

Single-family rents have been much stronger, with Zillow reporting they have been moving up consistently for years.

Conclusion

The current multifamily rental market downturn is a classic supply story that started with everyone having the same idea in 2020, build Luxury Apartments. Even with strong demand, rents are not stabilizing. The market is going into 2026 “much gloomier” than anticipated.

I personally think we will see more strange Multifamily changes in 2026. This could be foreclosures, or more pivots to condos or vice versa. Despite the pain, I’m surprised there’s not more distress or foreclosures than what we’ve seen. The pain in commercial real estate is real but mostly flying under the headlines in Nashville. Renter demand remains strong, and that’s helped hold up the market, for now.

Thanks for reading!