Why Rent Declines Are Accelerating Despite Strong Demand

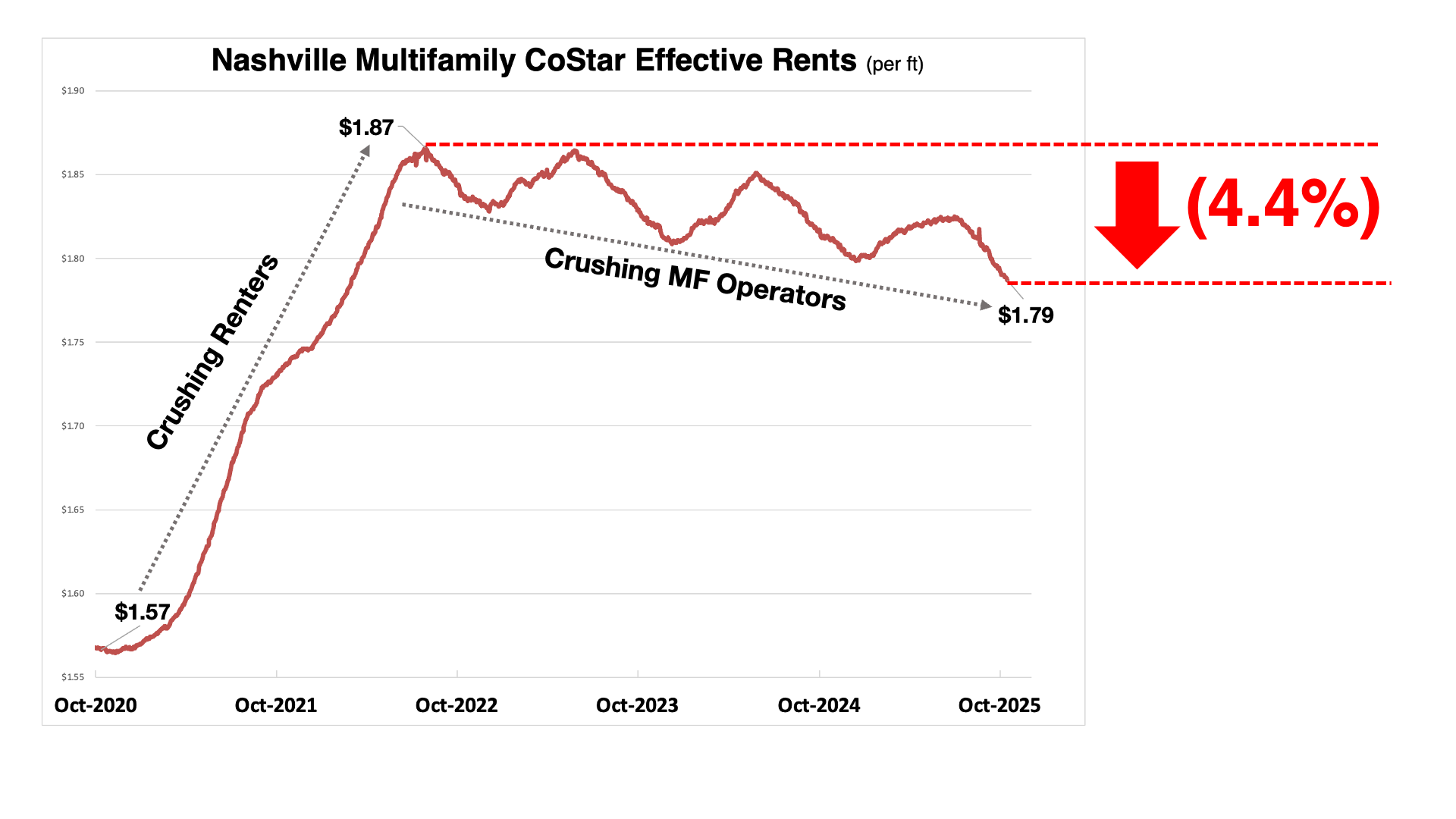

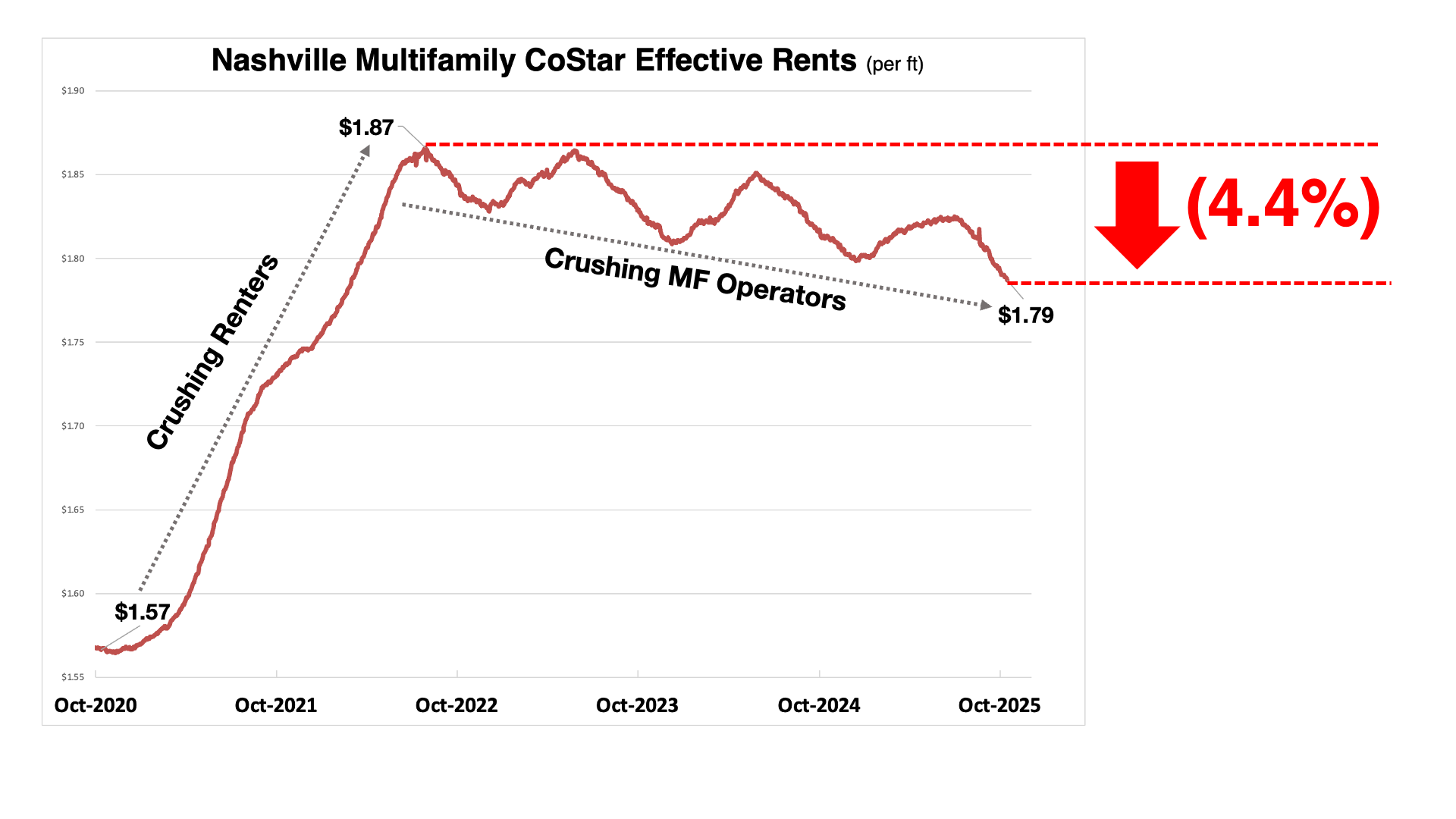

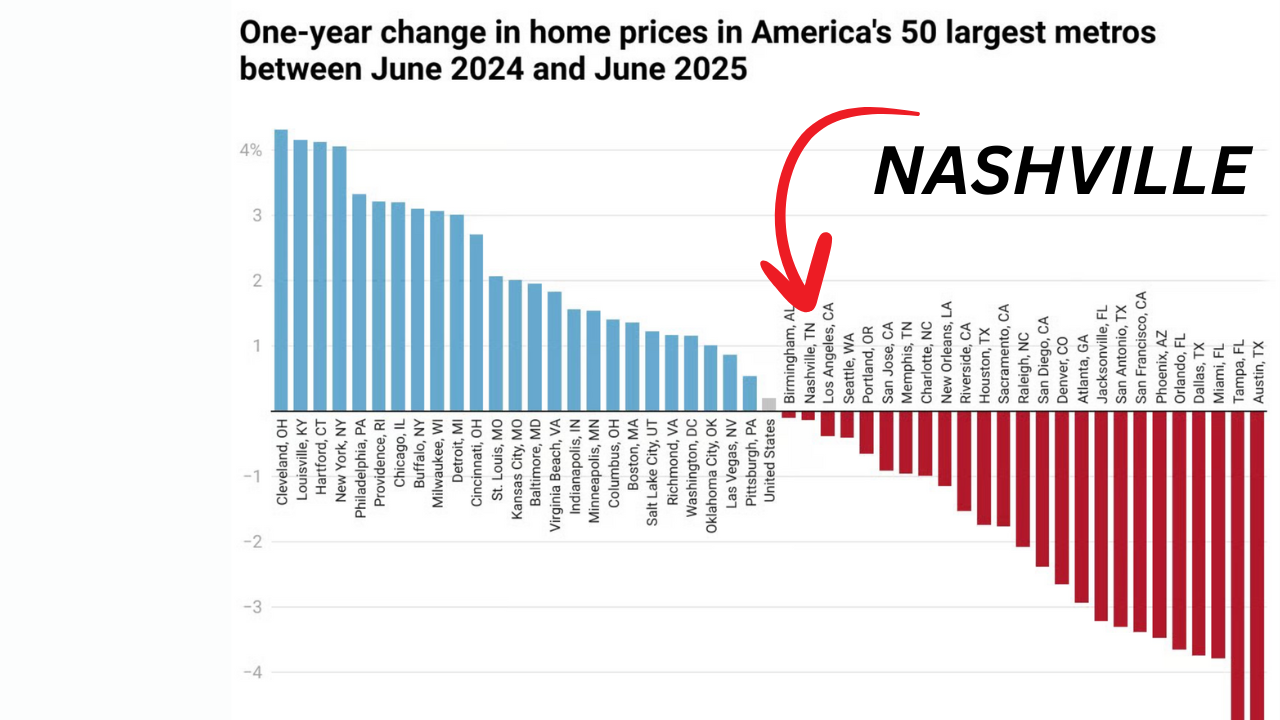

Nashville's multifamily rents drop 4% since 2022 due to oversupply from a 2020-2021 building boom, despite strong demand. Condo conversions flood the market; single-family rents still rising.

Ethan Flynn

Analyst

Seller motivation in the Nashville real estate market is as high as it’s been in years. In fact, we haven’t seen this level of motivation since 2022.

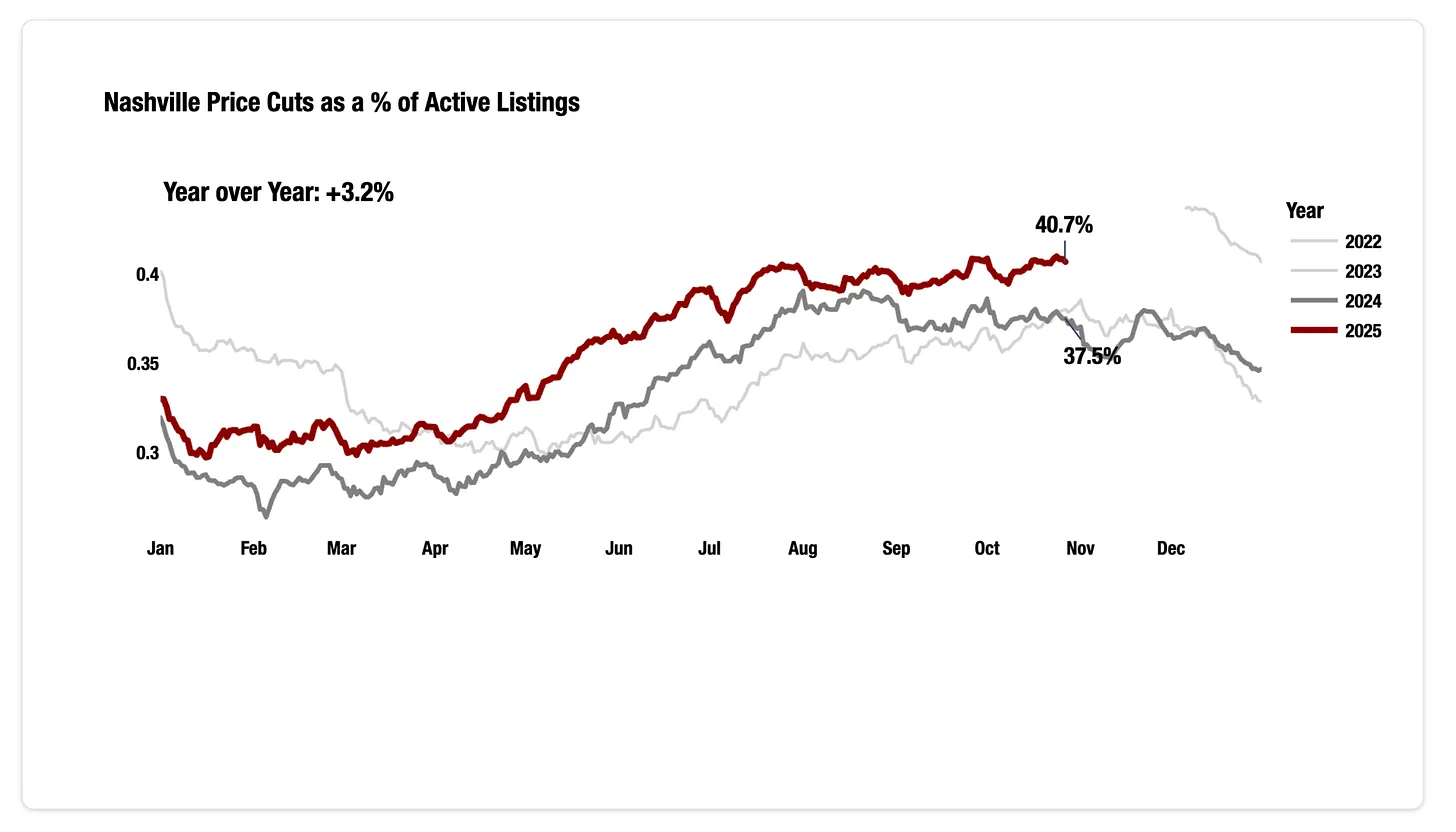

The clearest sign is the number of price cuts. As of late October, 41% of all active listings in Nashville have had a price cut—a year-to-date high. The last time we saw numbers this high was in December 2022, when it hit 44%.

Historically, anytime this metric gets above 35%, we see home values fall.

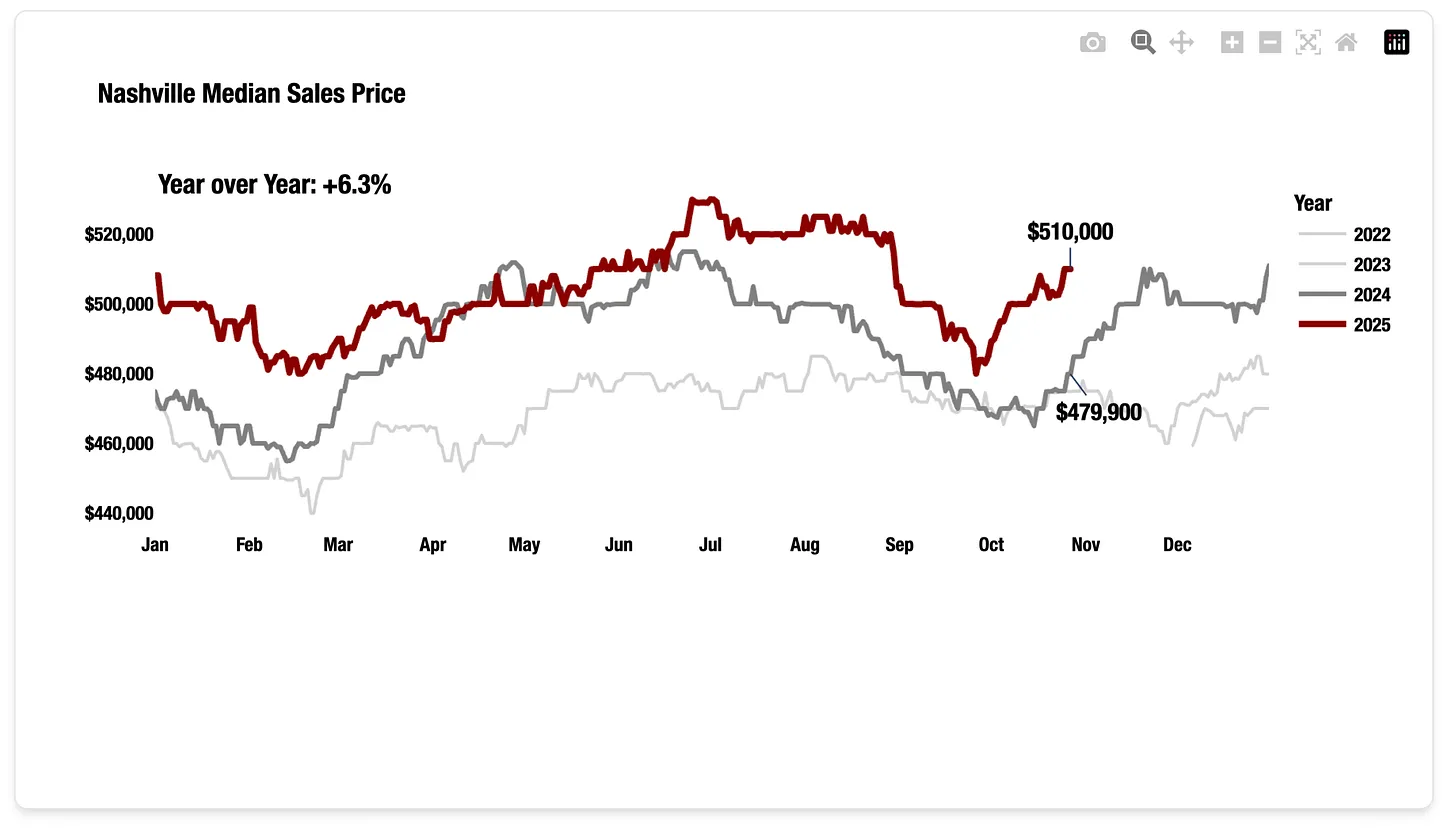

But this creates a confusing picture, because the median sales price is still higher than it was last year. How can home values be falling if the median price is up?

It’s all about what’s actually selling. Let’s look at the key performance indicators (KPIs) to see where the softness in the market is hiding.

Key Market Indicators

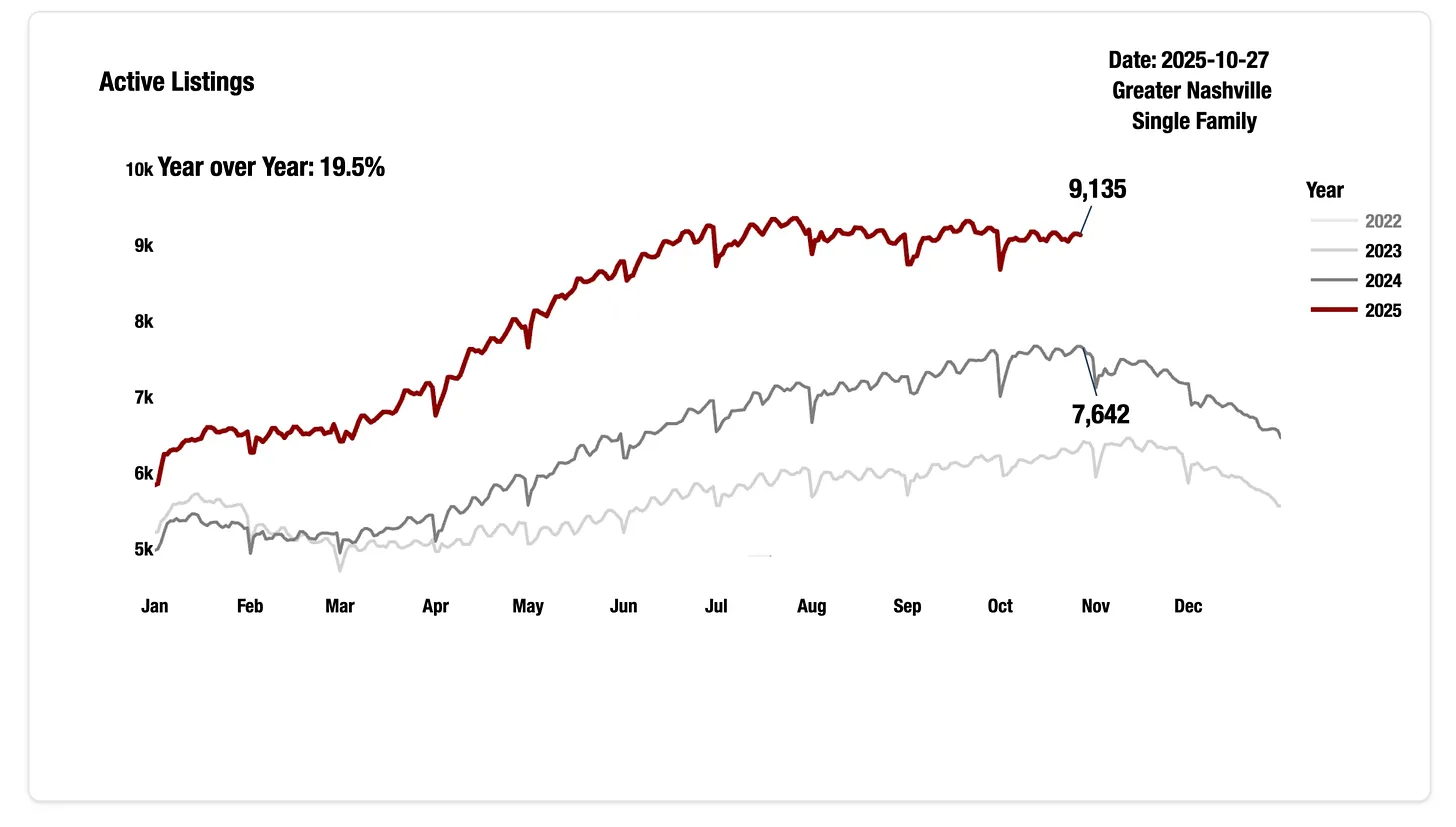

Active listings are up almost 20% year-over-year, sitting at about 9,135. With ~28,000 homes likely to sell this year, that 9,135 listings give us about a four-month supply of inventory.

Now, historically, you need to be at a six-month supply before you see massive, market-wide price drops. But underneath the surface, there is a lot of volatility. It’s not that all prices are dropping for all properties, but the ground is definitely shifting.

This is why agents are feeling like the market is much slower. Even though we have approximately the same number of buyers as last year, those buyers have 20% more options to choose from.

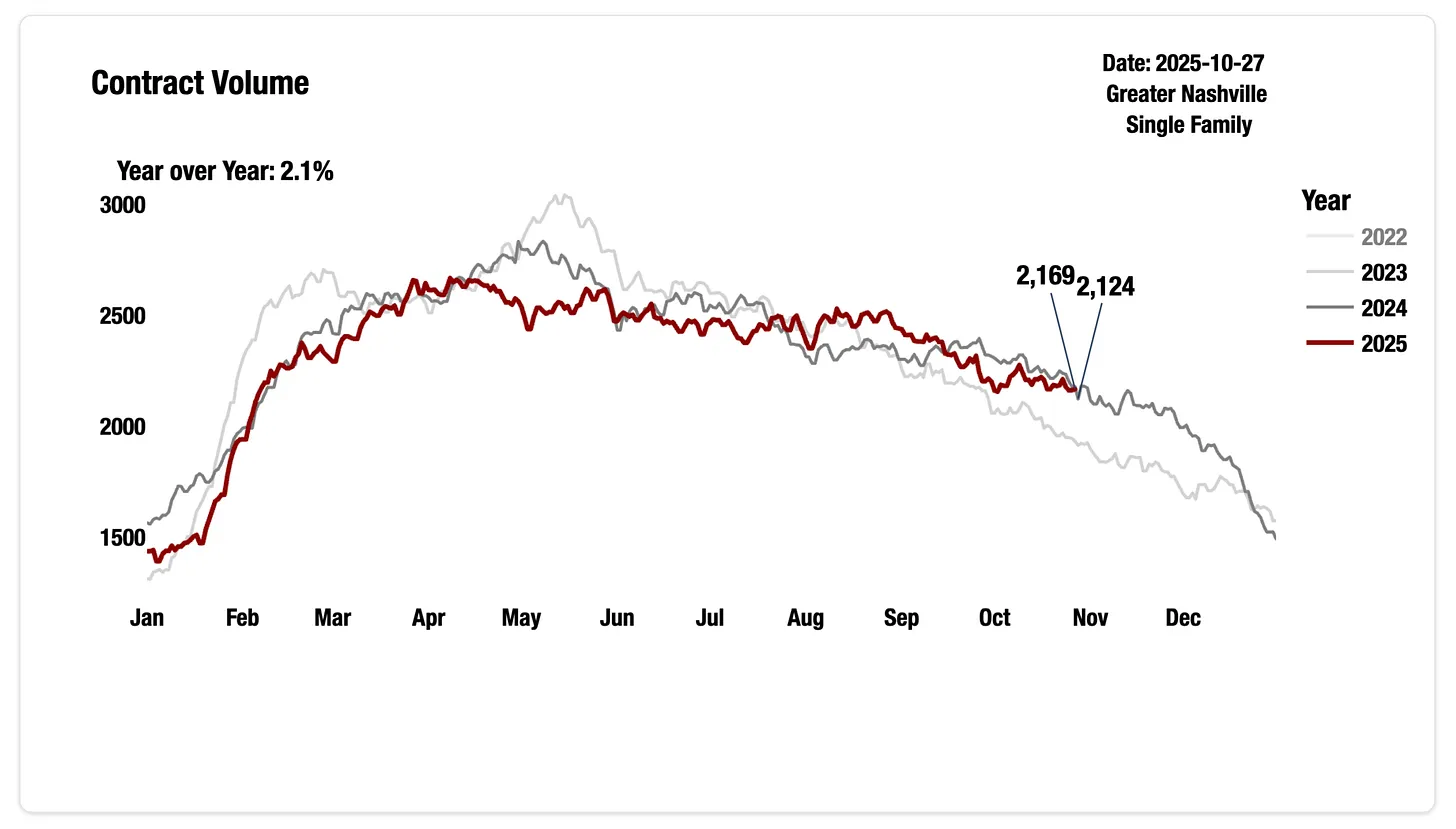

The best barometer for the greater Nashville economy right now is contract volume. And right now, contract volume is basically flat compared to this time last year.

Here’s why that’s so important: a year ago, we were heading toward 7% mortgage rates. Today, rates are around 6.17%—almost a full percentage point lower.

I expect this number to continue to shift positive since affordability is significantly different from a year ago. However, if it doesn’t, this will be a warning sign of economic weakness locally.

Why Median Price is a Misleading Metric

I don’t believe median price is the right tool to understand home values right now. There’s a shift happening in who is purchasing.

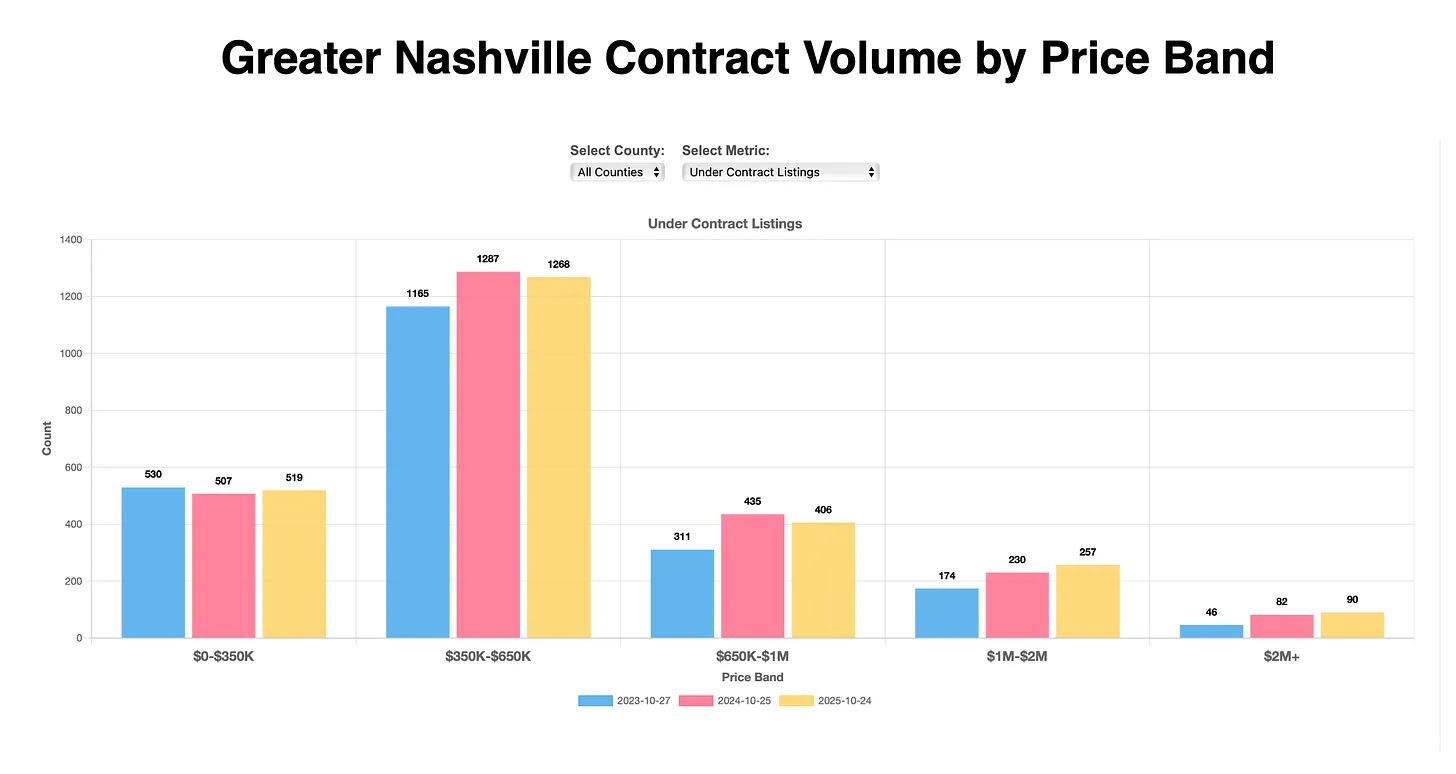

If you look at contract volume broken down by price, a clear pattern emerges:

$350k - $650k: Contract volume is up ~2%.

$650k - $1M: Contract volume is down 1%.

$1M - $2M: Contract volume is up 12%.

$2M+: Contract volume is up 10%.

The median price is being pushed up because the pool of active buyers is purchasing more expensive homes. This masks the weakness in the lower and middle price bands.

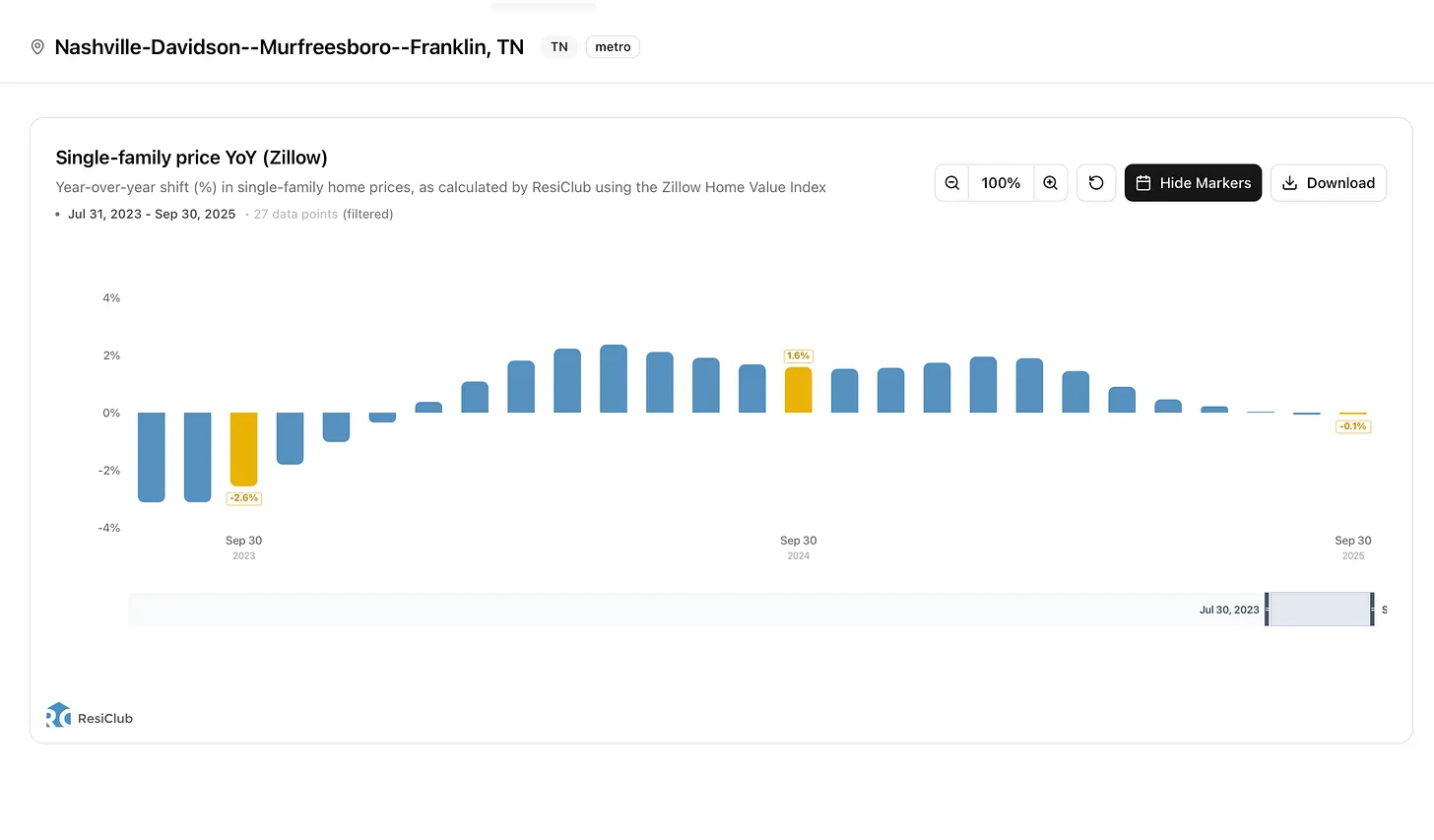

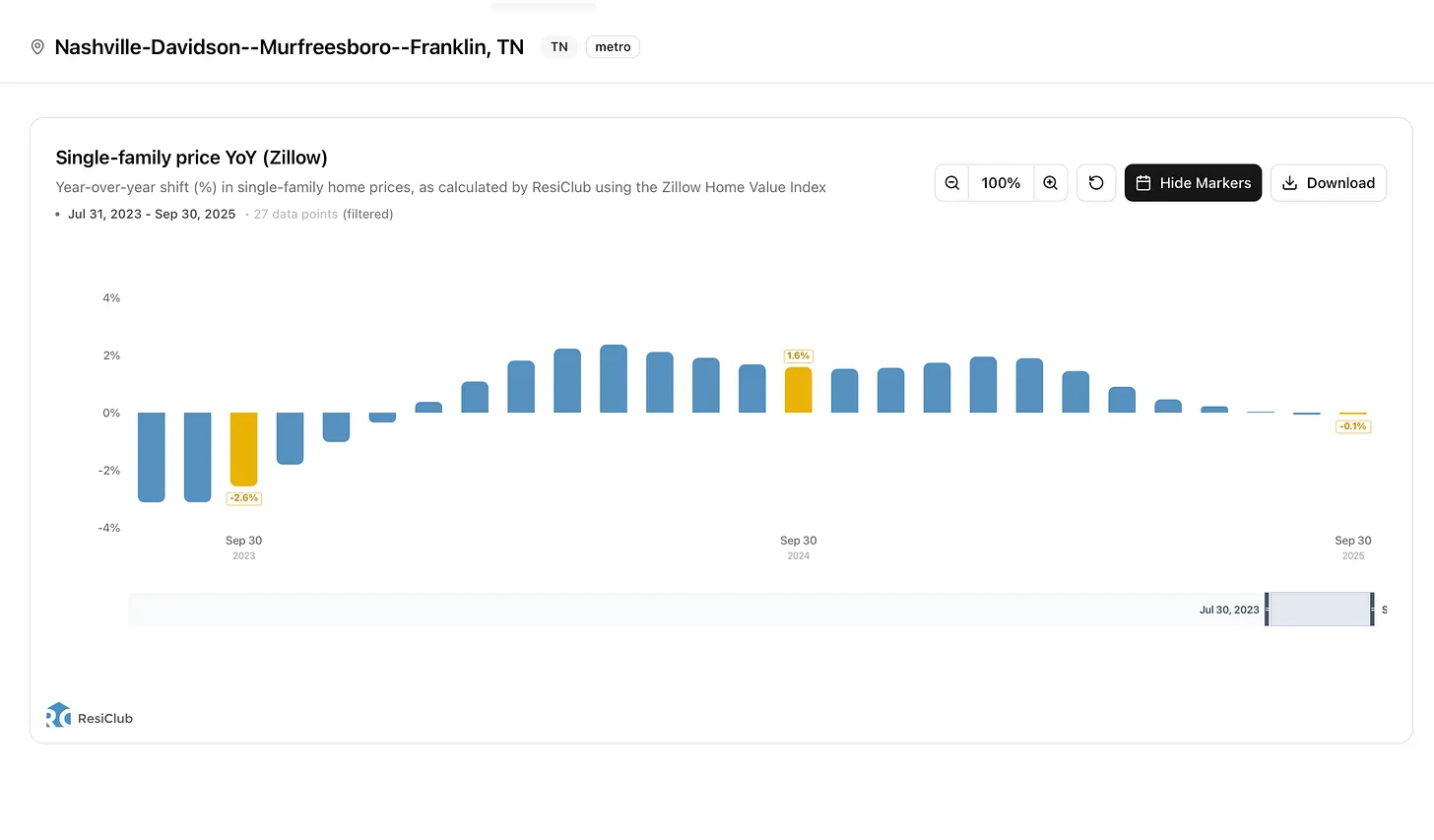

Zillow’s own home value index shows the market as essentially flat (down 0.1%), but this fails to explain the volatility we’re seeing on the ground.

Some properties that were in high demand are now struggling—think of Airbnbs far from downtown, certain condos like Twelve Twelve, or homes with functional issues (bad lot, weird floor plan).

With a four-month supply, buyers can be picky. A home that might have been worth $500,000 two years ago could be selling for $400,000 today.

What This Means for You

We’re pushing up against the holidays. Thanksgiving is about a month away, and this is typically the last big weekend for real estate activity before inventory drops off a cliff for the winter.

For Buyers: This is your window of opportunity. With high seller motivation and clear evidence of price drops on specific properties, you have a chance to be aggressive. Active Listings will start shrinking as many cancel/expire on November 1.

For Sellers: You must be flexible. The market is going to feel 20% slower simply because of the increased competition. You have to be priced correctly from day one if you’re serious about selling.

For Agents: It feels slower! But it’s not. There’s way more to choose from and that increasing competition is isolating properties that would have had showings. With the lower mortgage rates, I expect a small Fall bounce, and we should be busier than last year, even if it doesn’t feel like it. Buyers have the edge, but it’s more affordable than a year ago and this will create competition with the best listings. I could see more multiple offers popping up in the next week.

Thanks for reading!

Nashville's multifamily rents drop 4% since 2022 due to oversupply from a 2020-2021 building boom, despite strong demand. Condo conversions flood the market; single-family rents still rising.

But Price Cuts Tell a Better Story