Nashville Real Estate Prices Hit All-Time-High

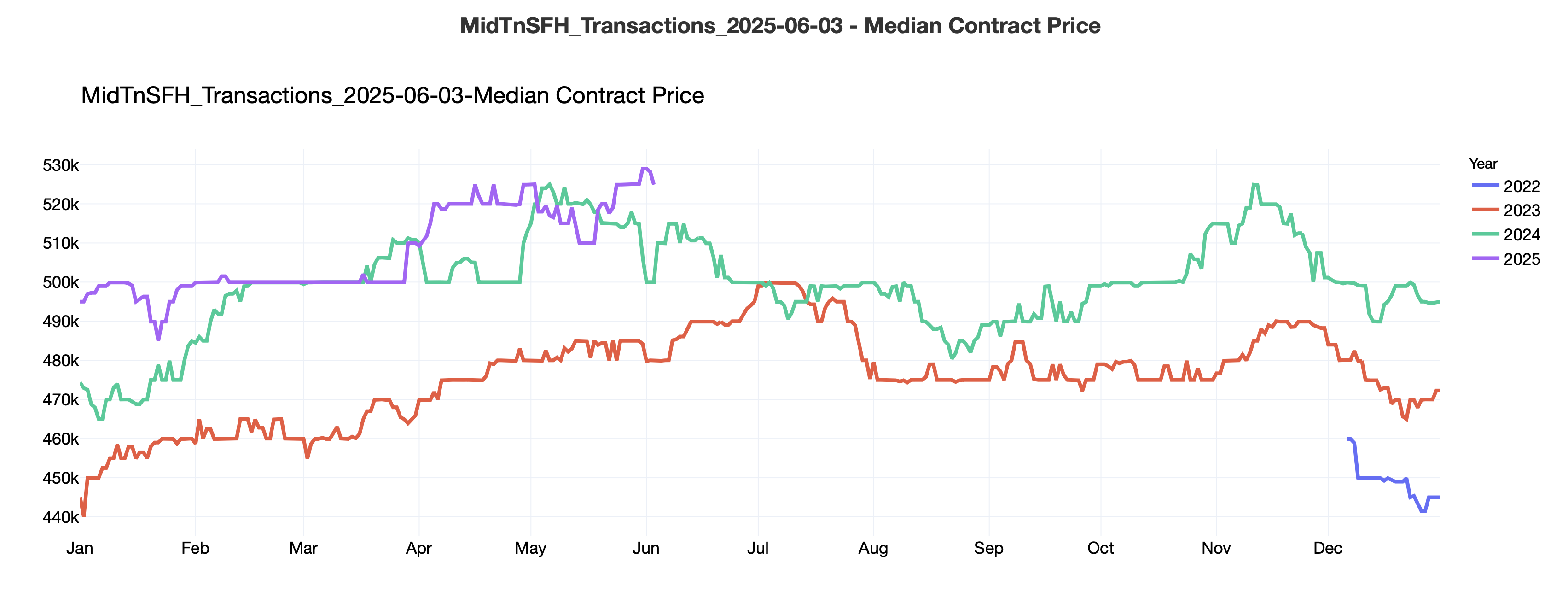

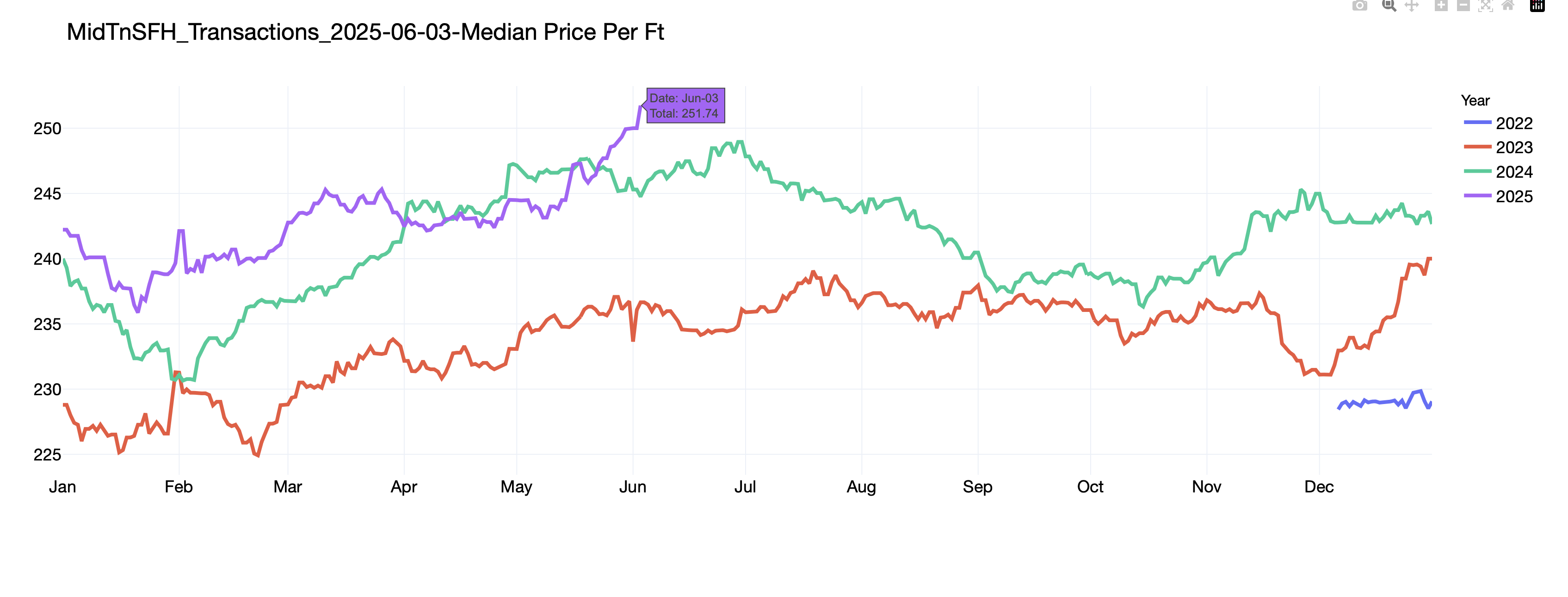

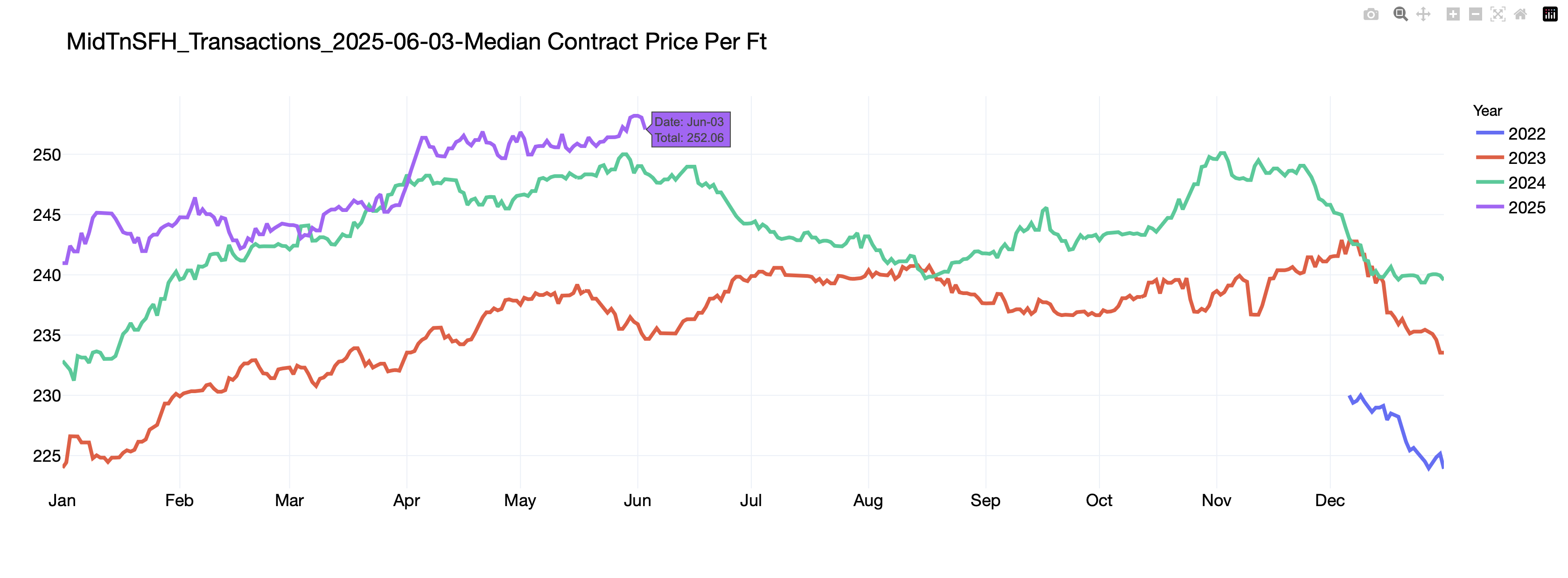

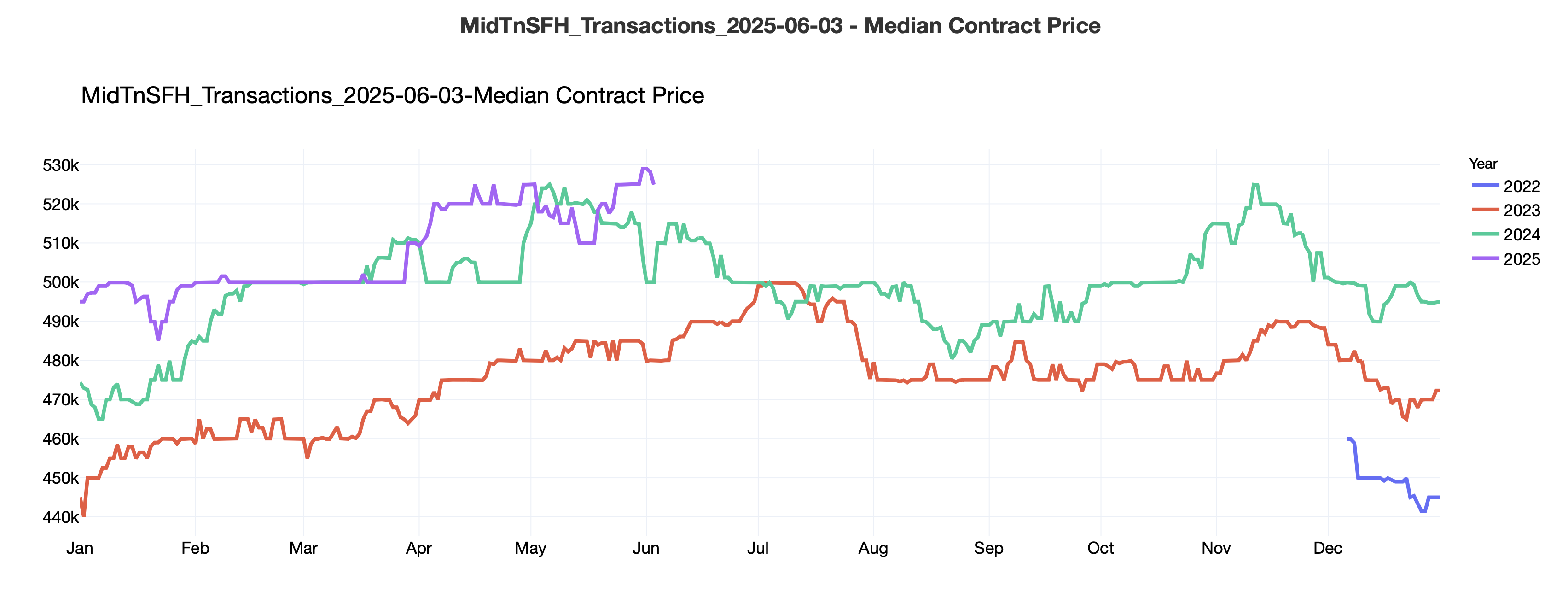

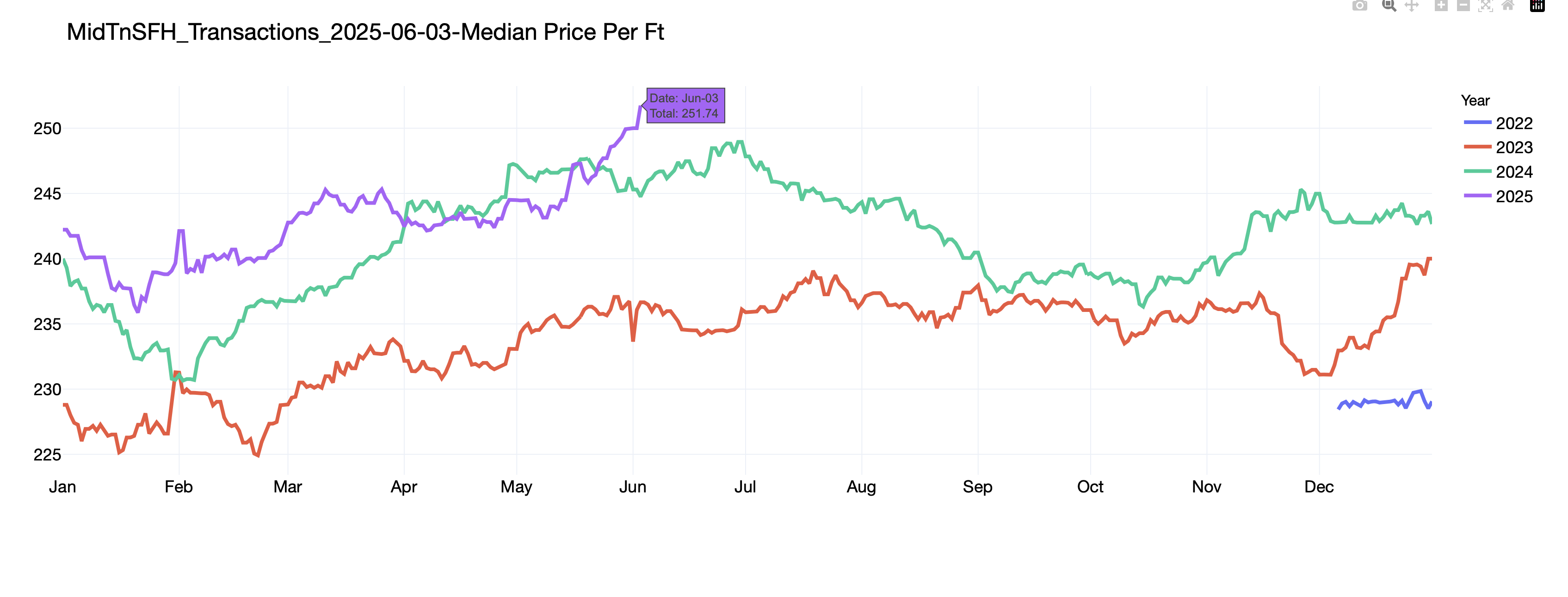

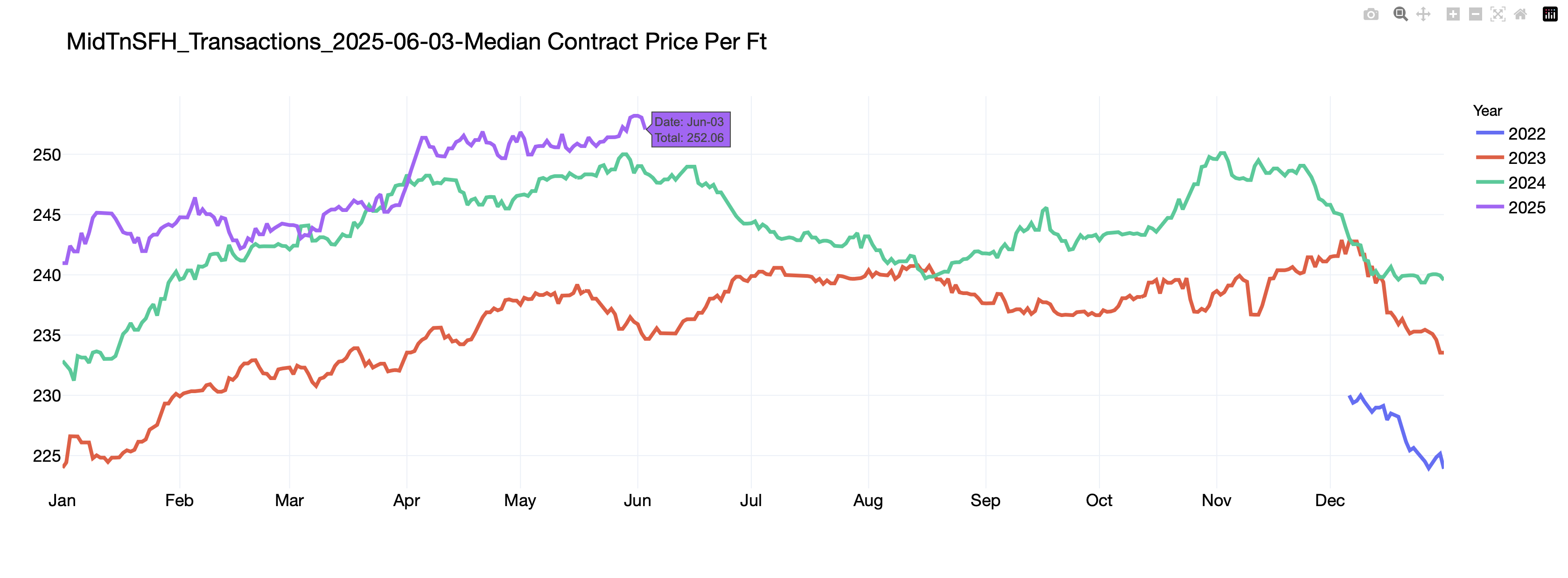

Despite an increased inventory and nearly 30% lower demand compared to pre-pandemic levels, Nashville's median single-family home prices hit record highs in May 2025. Median sales prices and contract prices both touched historical peaks:

- Median Contract Price: $525,000 (matching previous all-time highs from November 2024 and May 2024). Median Sales Price typically comes in about $10-15K lower ~30 days later. This is a great leading indicator for where prices are headed.

- Median Price per Square Foot: $251.74, another record high.

- Median Contract Price per Square Foot: $253, also an all-time peak.

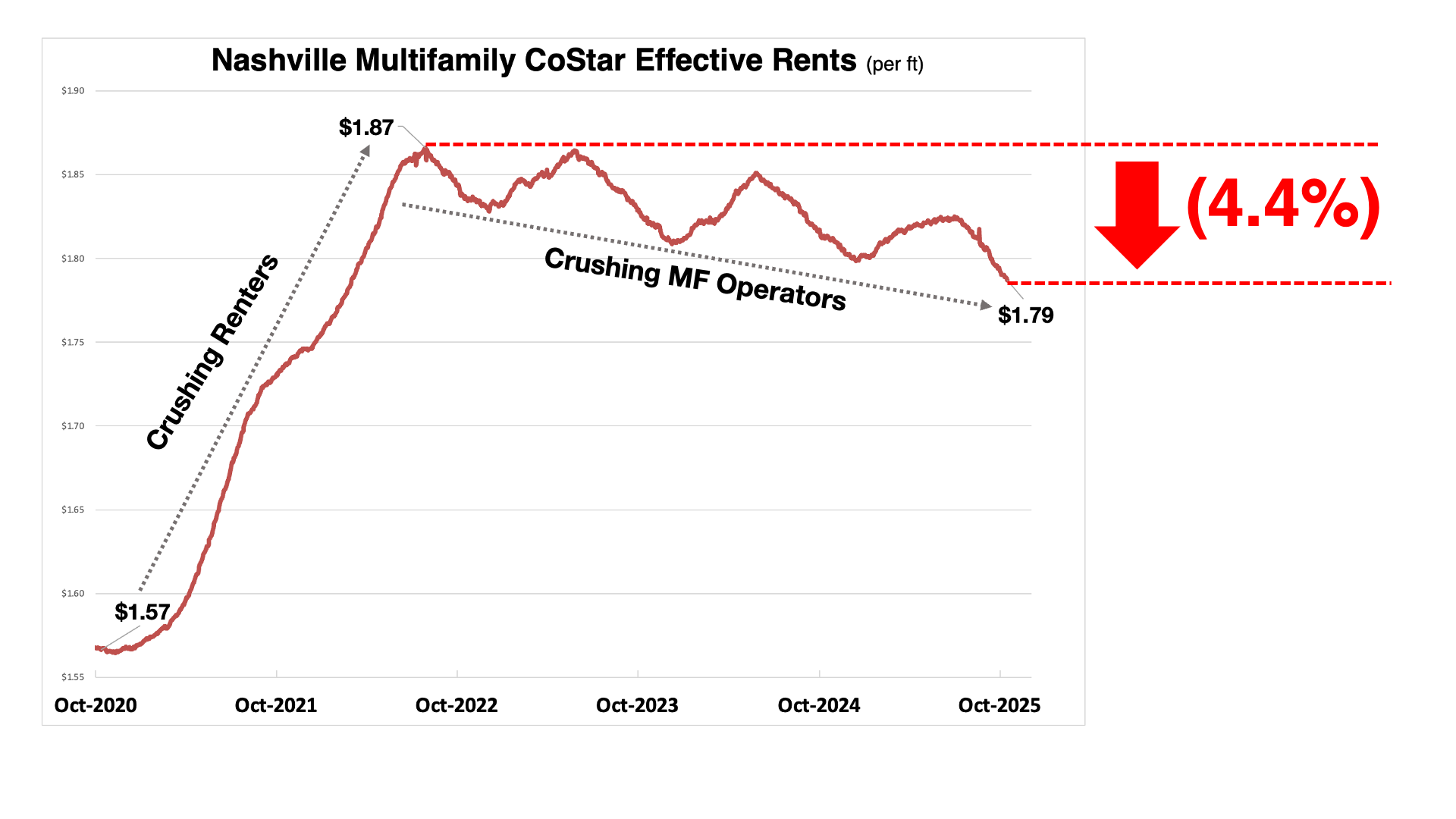

These unprecedented prices amid lower demand reflect a fascinating market paradox similar to what’s observed in downtown office spaces—where premium, newer buildings are thriving while older spaces struggle.

Housing Market Crashes Within Nashville

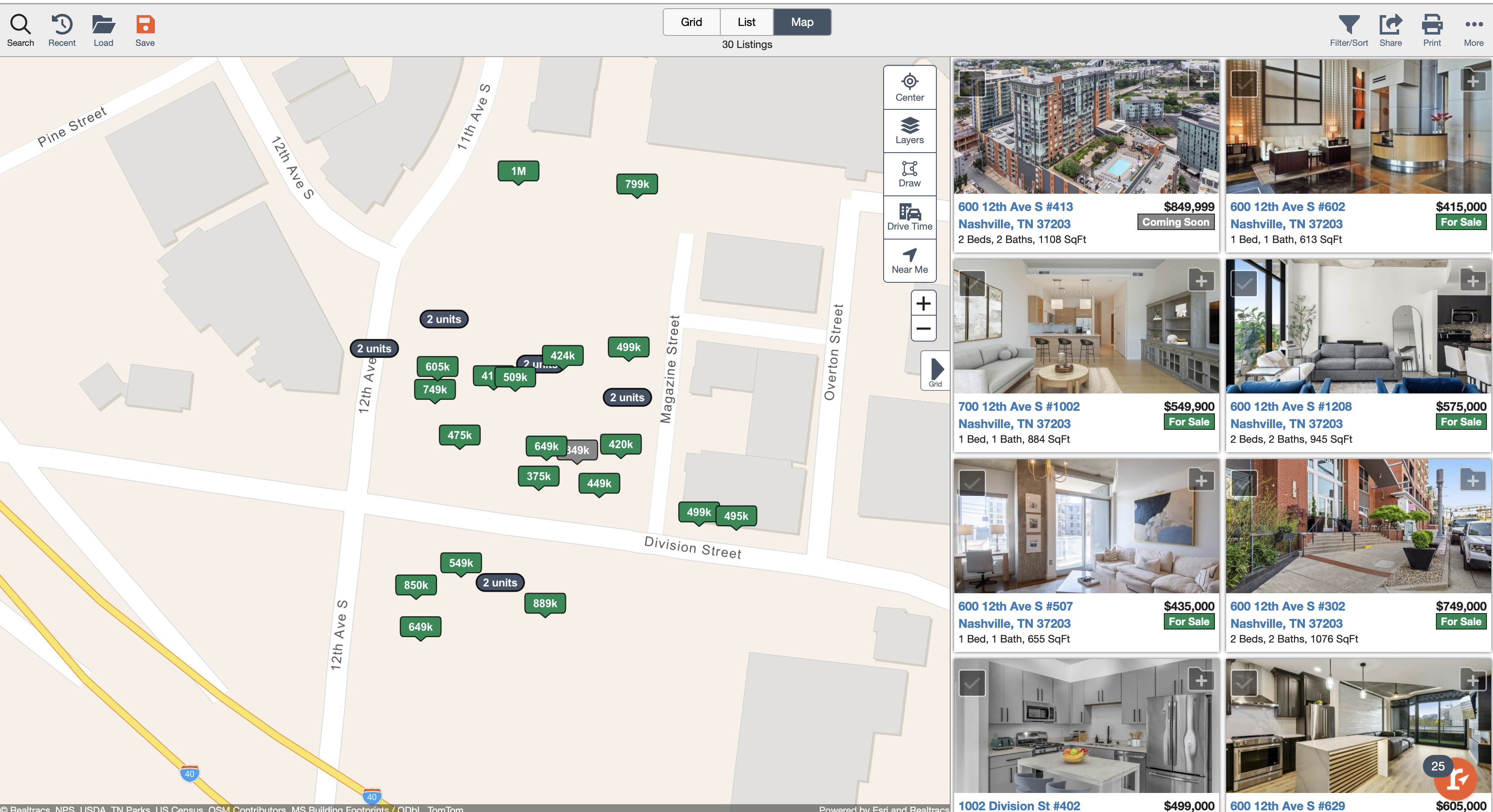

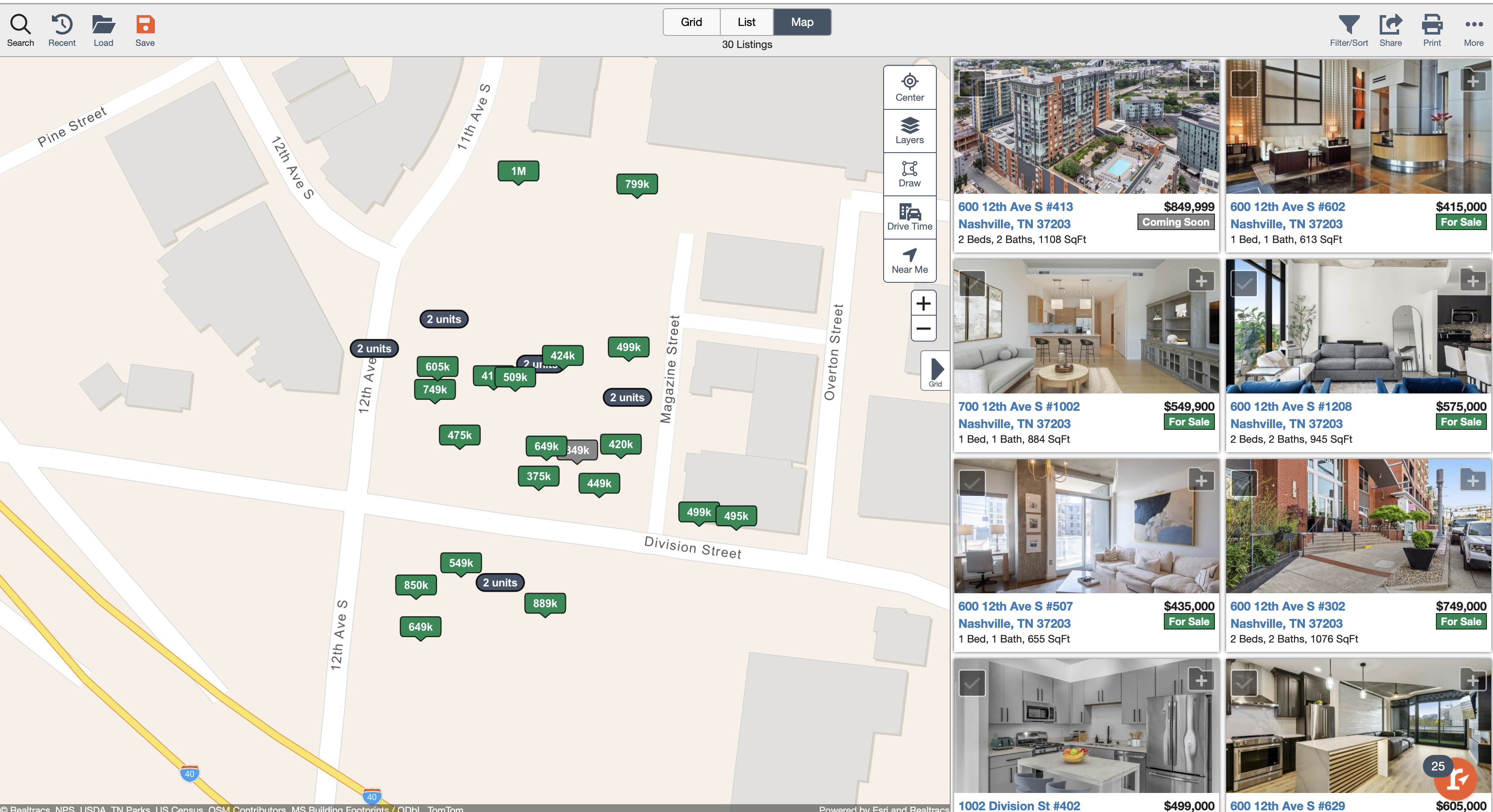

However, not all Nashville real estate is booming. Specific areas, particularly high-rise condos, some luxury developments, and overbuilt areas are experiencing significant downturns. For instance:

- High-rise condos: In some buildings, like the Enclave and other older downtown condos, not a single unit is currently under contract despite numerous active listings, reflecting a market crash scenario.

- Luxury neighborhoods: Troubadour, known for its multi-million-dollar homes, is currently experiencing dramatically reduced demand, showing over a year’s worth of inventory compared to last year’s more robust sales environment.

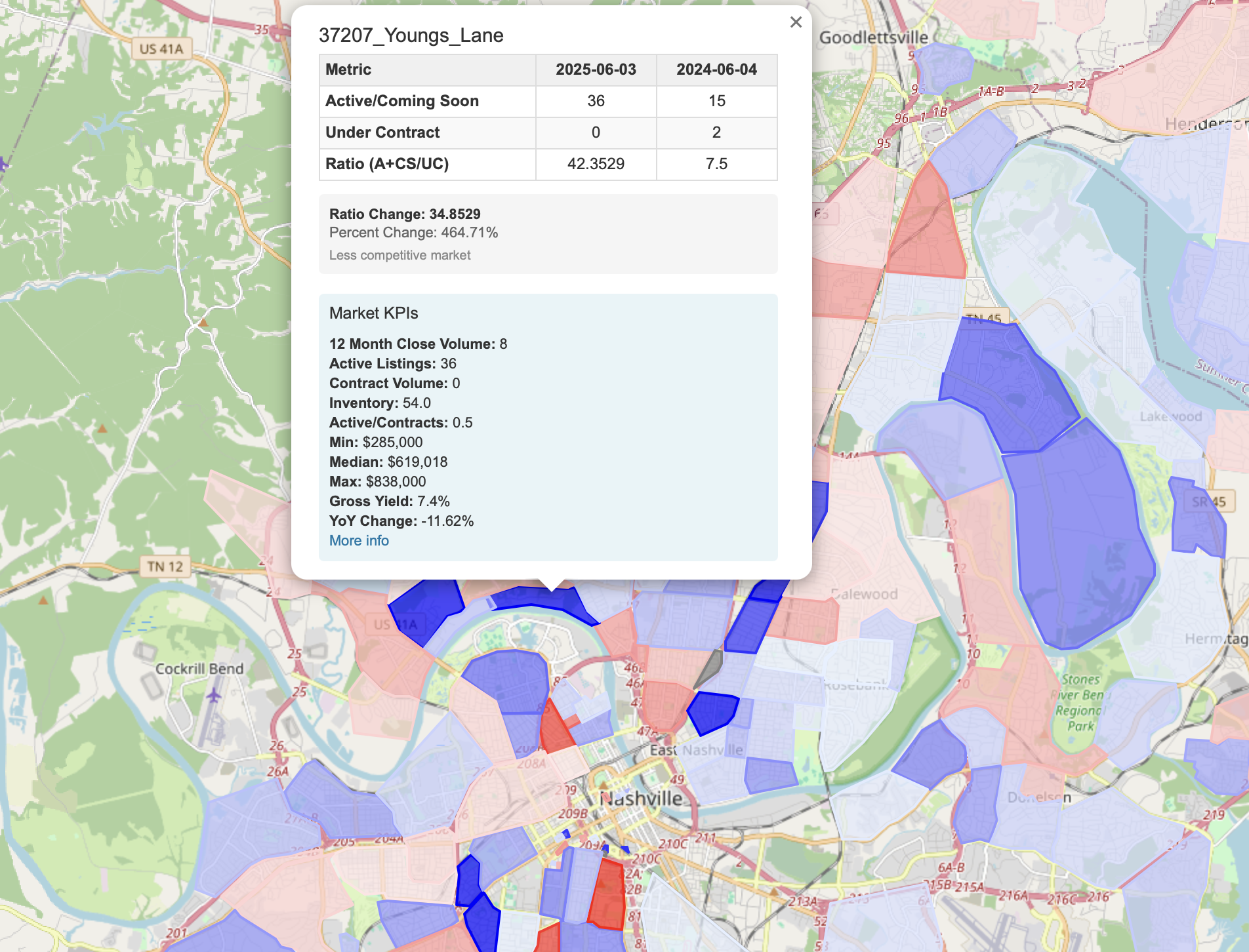

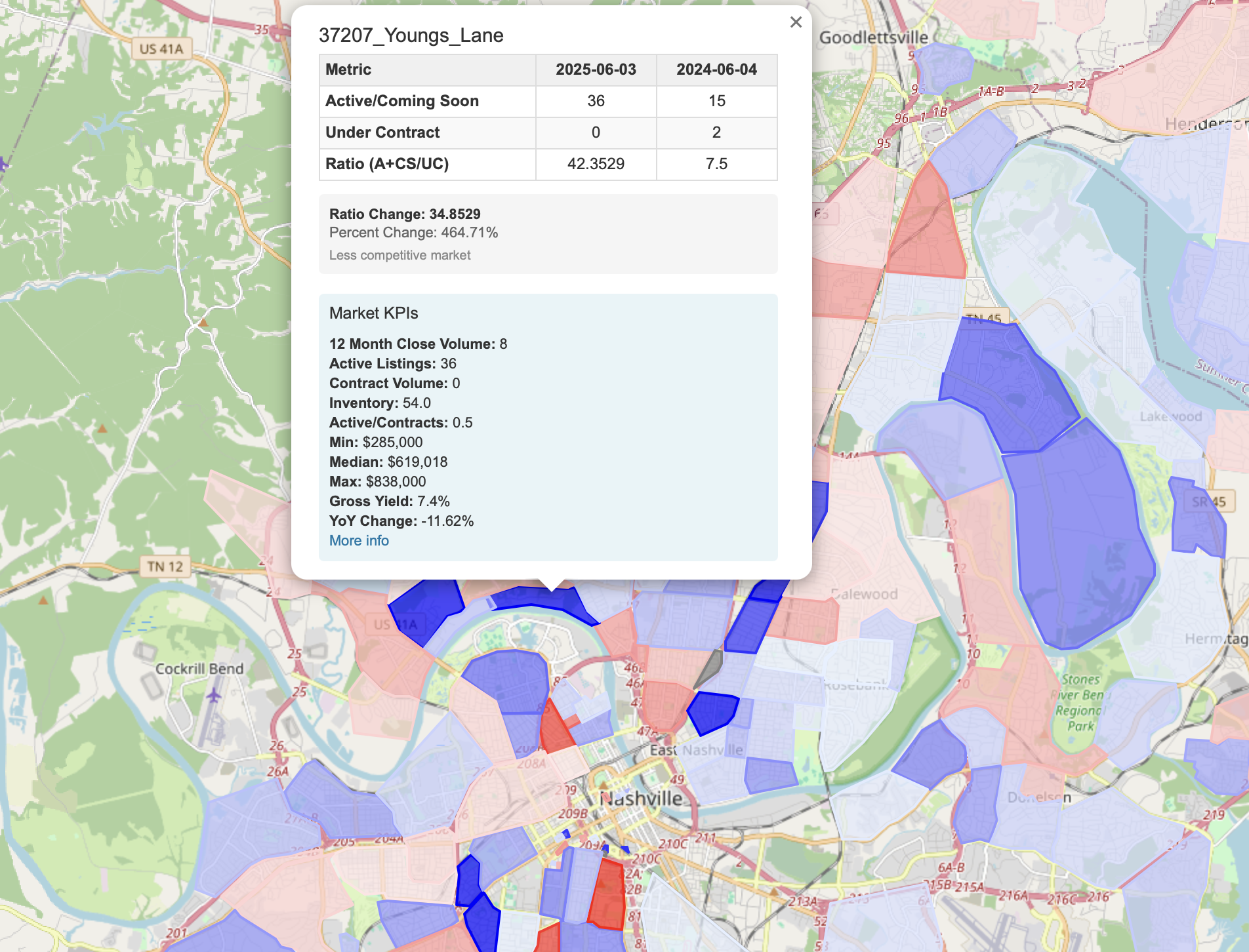

- Trinity Lane: Homes just north of the Cumberland River off of Trinity Lane are sitting longer and much lower demand.

This divergence illustrates a critical trend: buyers are increasingly selective, favoring beter quality, unique characteristics, and great locations.

How to Spot Potential Market Crashes

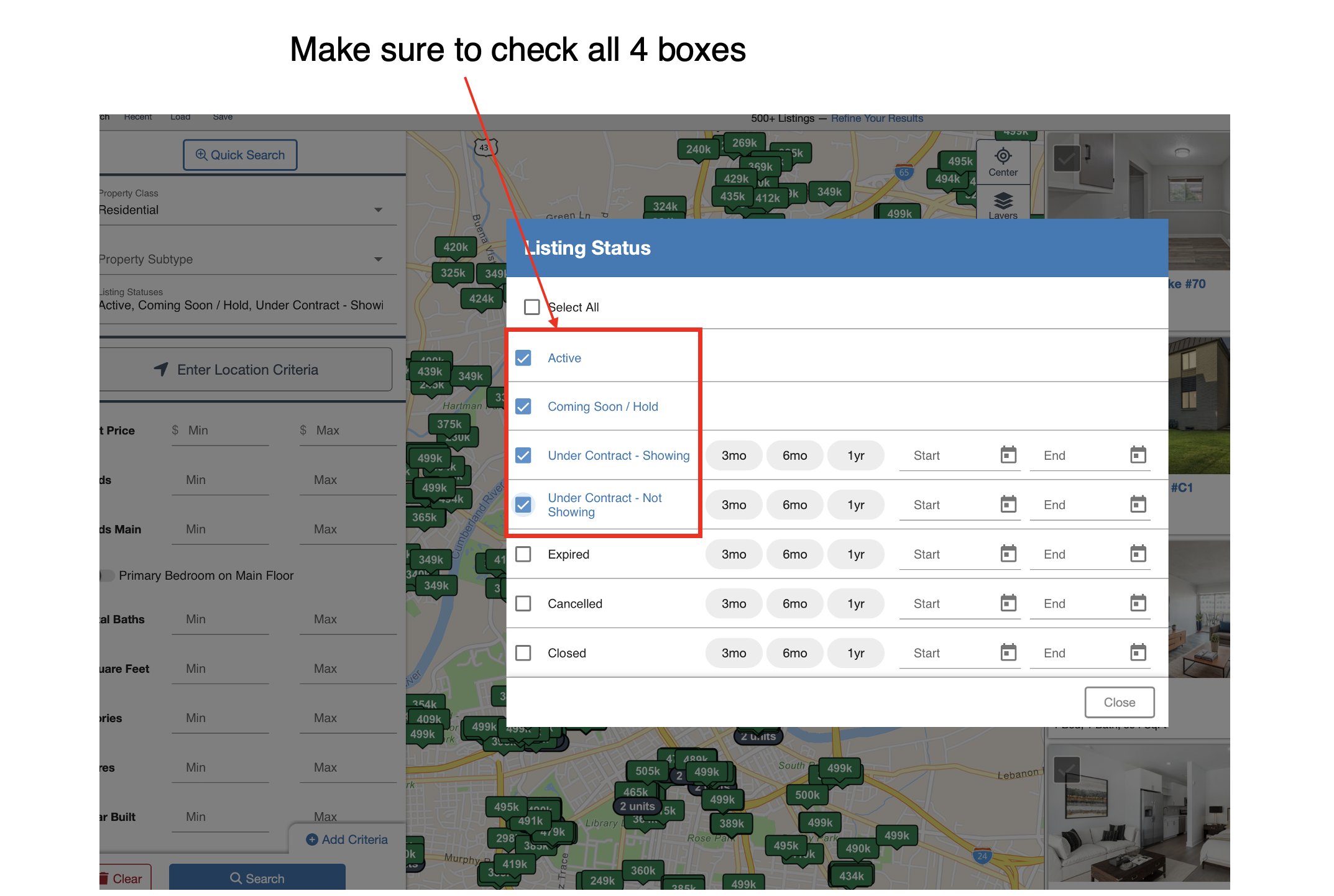

For investors or potential buyers, understanding where the market is softening is crucial. A practical method is to track the ratio of active listings to properties under contract:

- Look for neighborhoods with high active listings and few or no properties under contract. These areas likely indicate declining prices or sellers willing to take a larger than price cut.

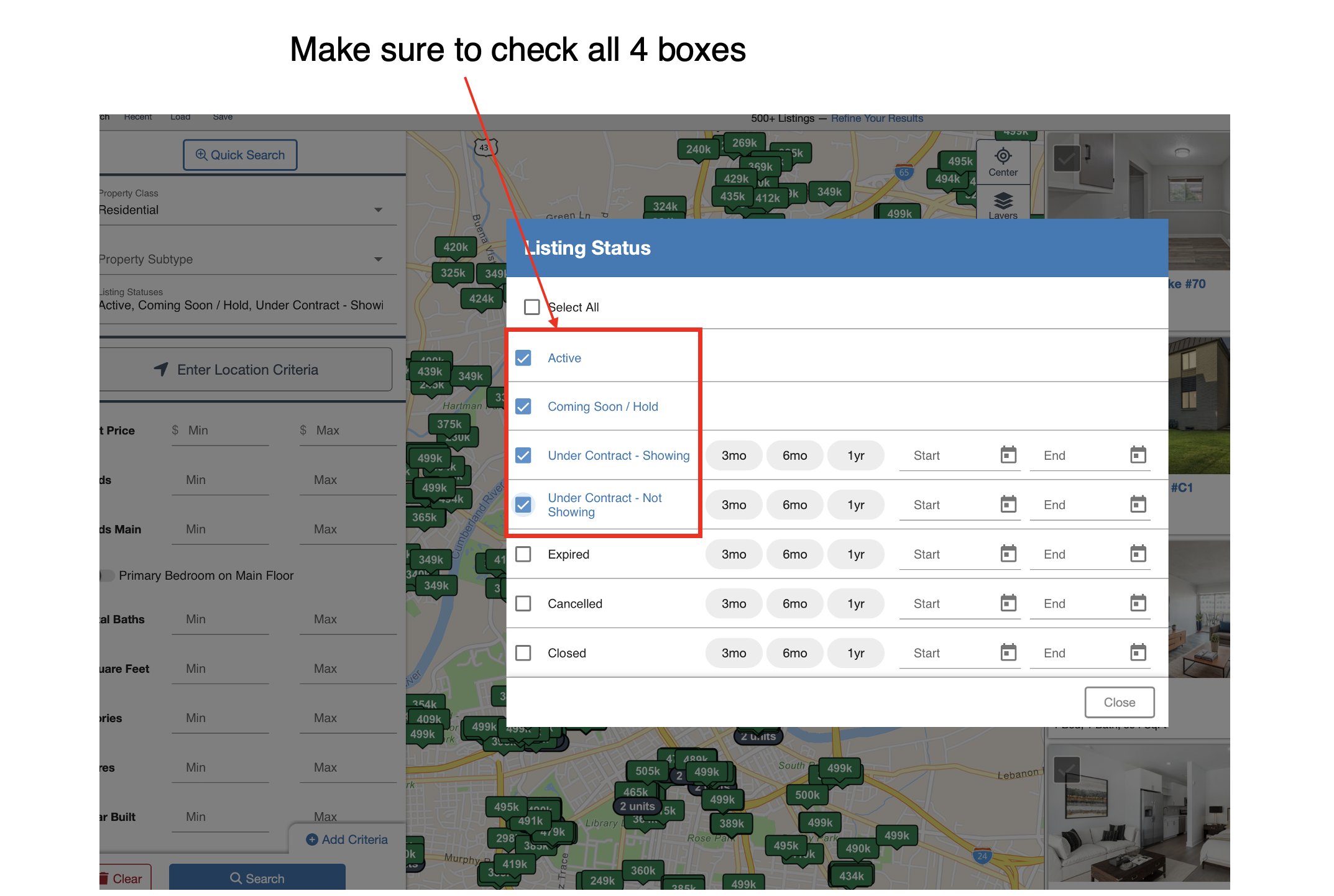

- Personally, I like RealTracs to monitor these ratios and identify undervalued opportunities, but I believe you can do it with many other platforms like Zillow and Redfin. I also created a tool specifically for this.

Key Market Headwinds to Watch

Despite the current strength in home prices, the market is VERY slow, and several headwinds could influence future market stability:

- Student Loan Repayments: With Nashville being home to many colleges and recent graduates, the resumption of student loan payments may strain buyer affordability.

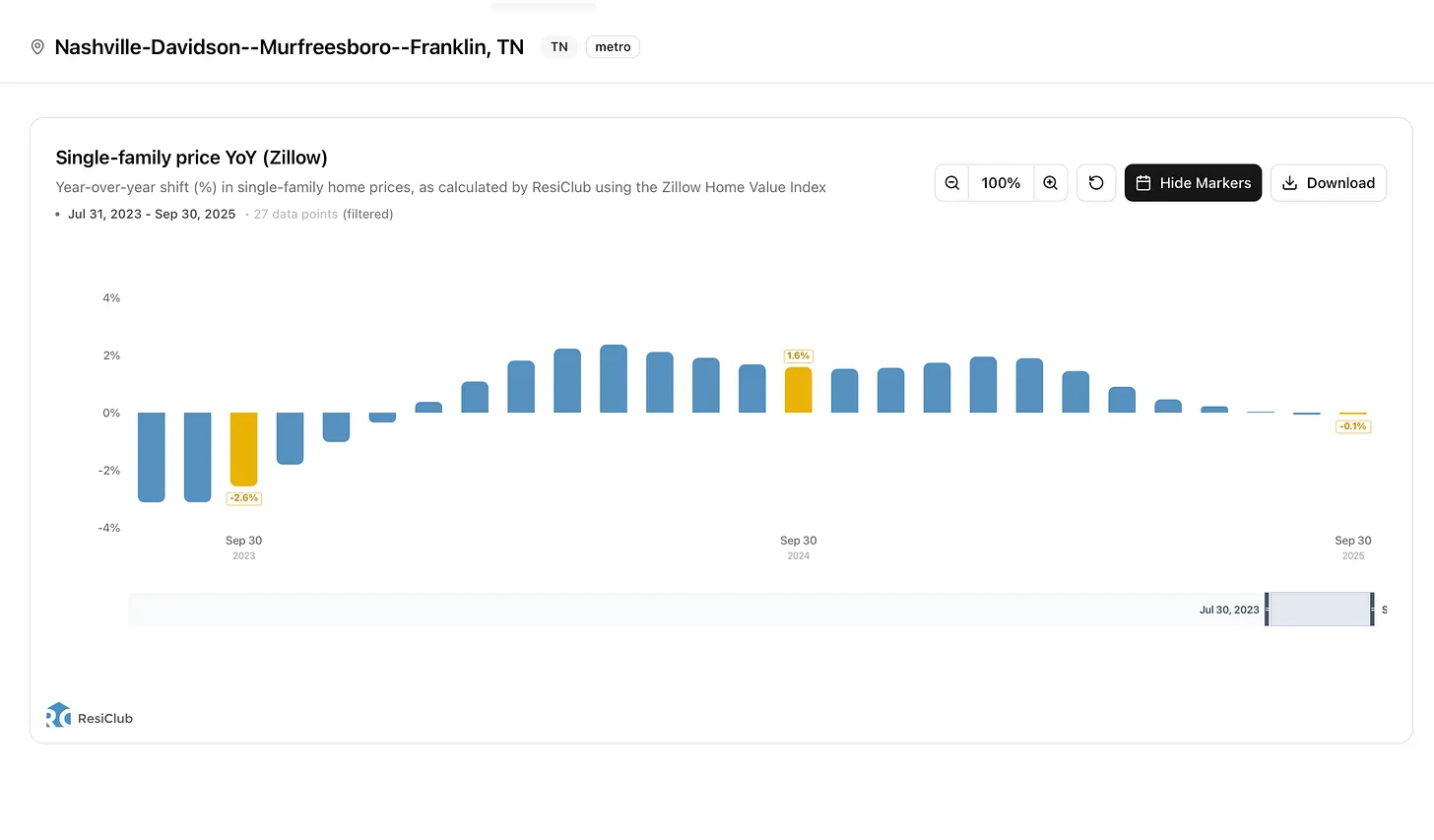

- Rising Inventory: Although inventory growth was slightly disappointing in May, it's still expanding. Continued increases could eventually pressure prices downward.

- Interest Rates: Persistent high interest rates could further dampen demand, though investor activity might offset some of this impact.

- Inflation and Government Spending: Ongoing inflation remains a significant factor, potentially limiting buyer purchasing power despite nominal wage increases.