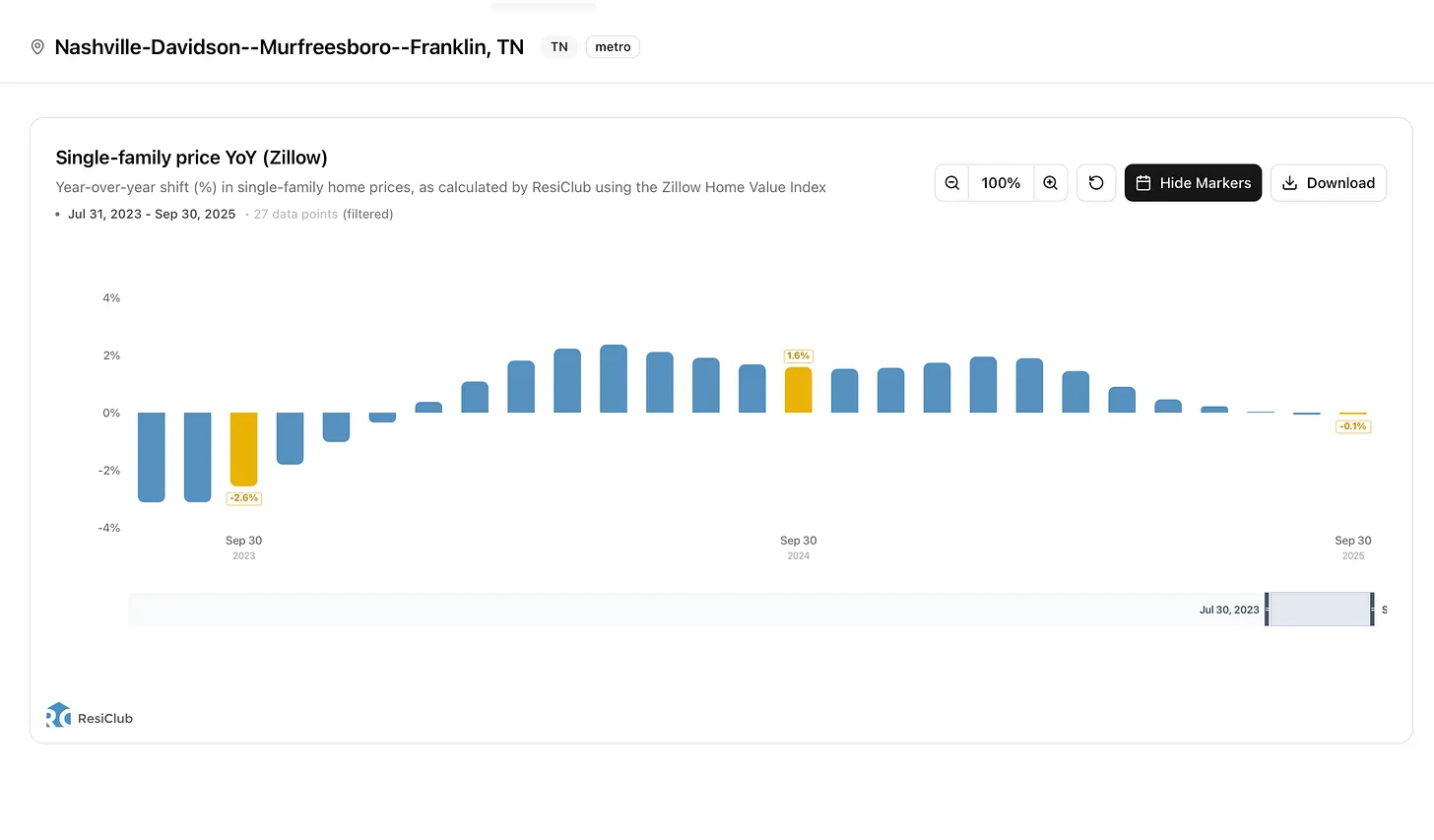

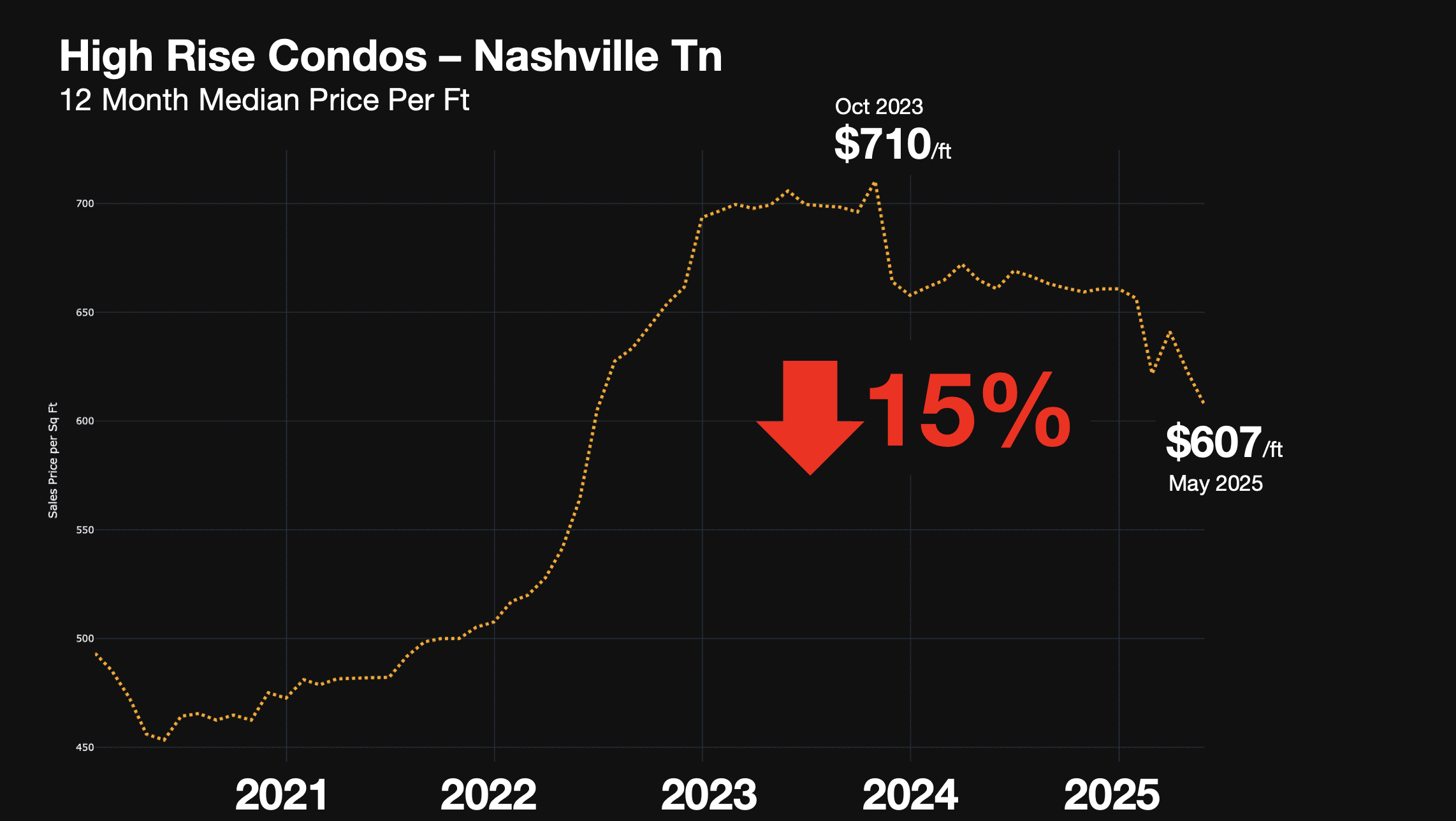

The high-rise condo market in Nashville, Tennessee, has hit some wild turbulence lately, with some properties experiencing price drops of 20% to 30% within just the past 18 months. Yet, strangely enough, the median condo prices overall have stayed flat over the last three years. How can this be? High Rise condos sit above the median price and only make up about 10% of the overall condo market in Greater Nashville.

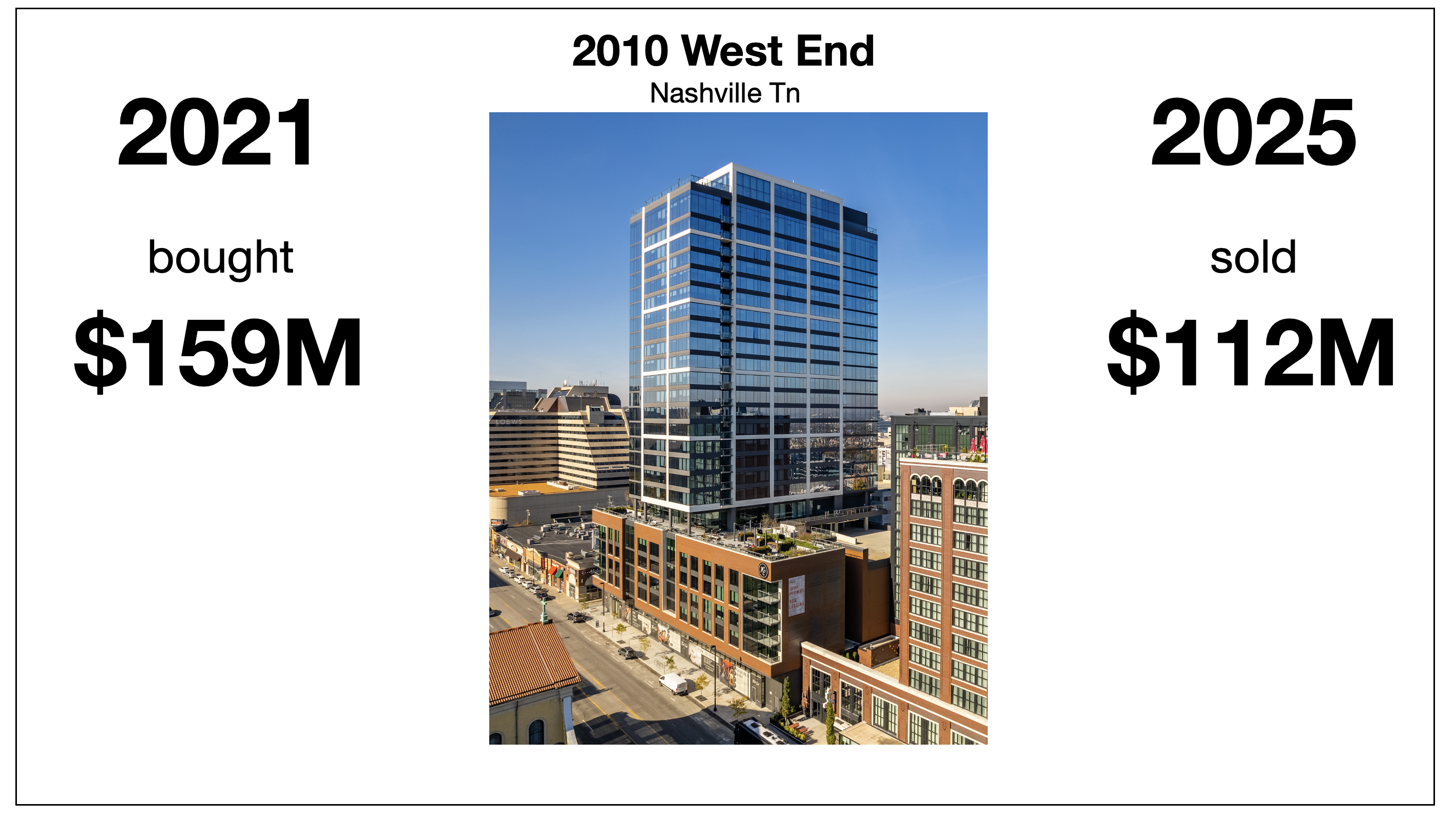

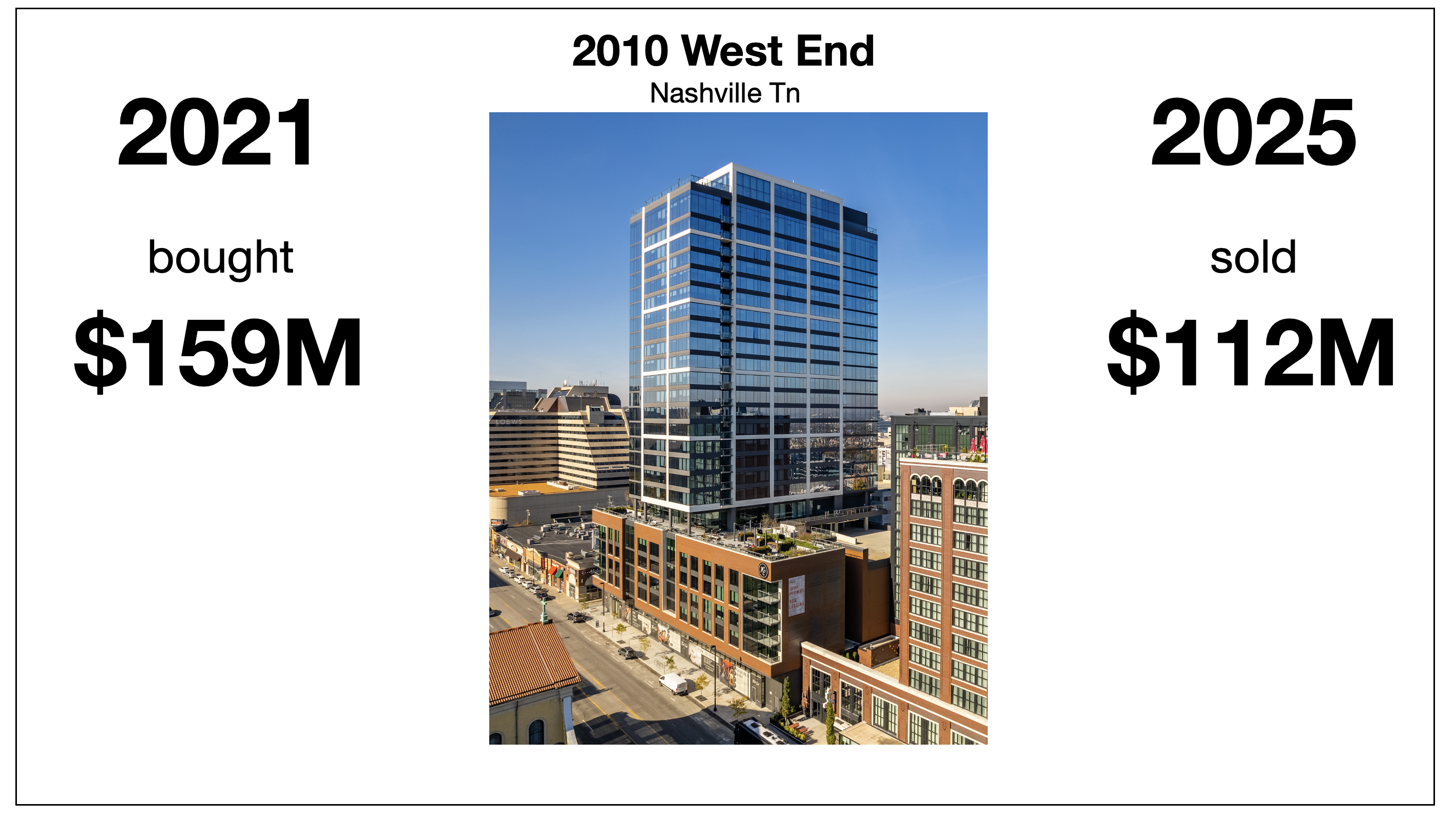

To truly grasp what's happening, we have to rewind to 2021—when Nashville was red-hot, especially in luxury apartments. Investors poured in, convinced rents would skyrocket indefinitely. One infamous example was Adam Neumann (yes, that Adam Neumann of WeWork infamy), who along with some partners bought the luxury high-rise at 2010 West End for a staggering $159 million, expecting rents to keep rising.

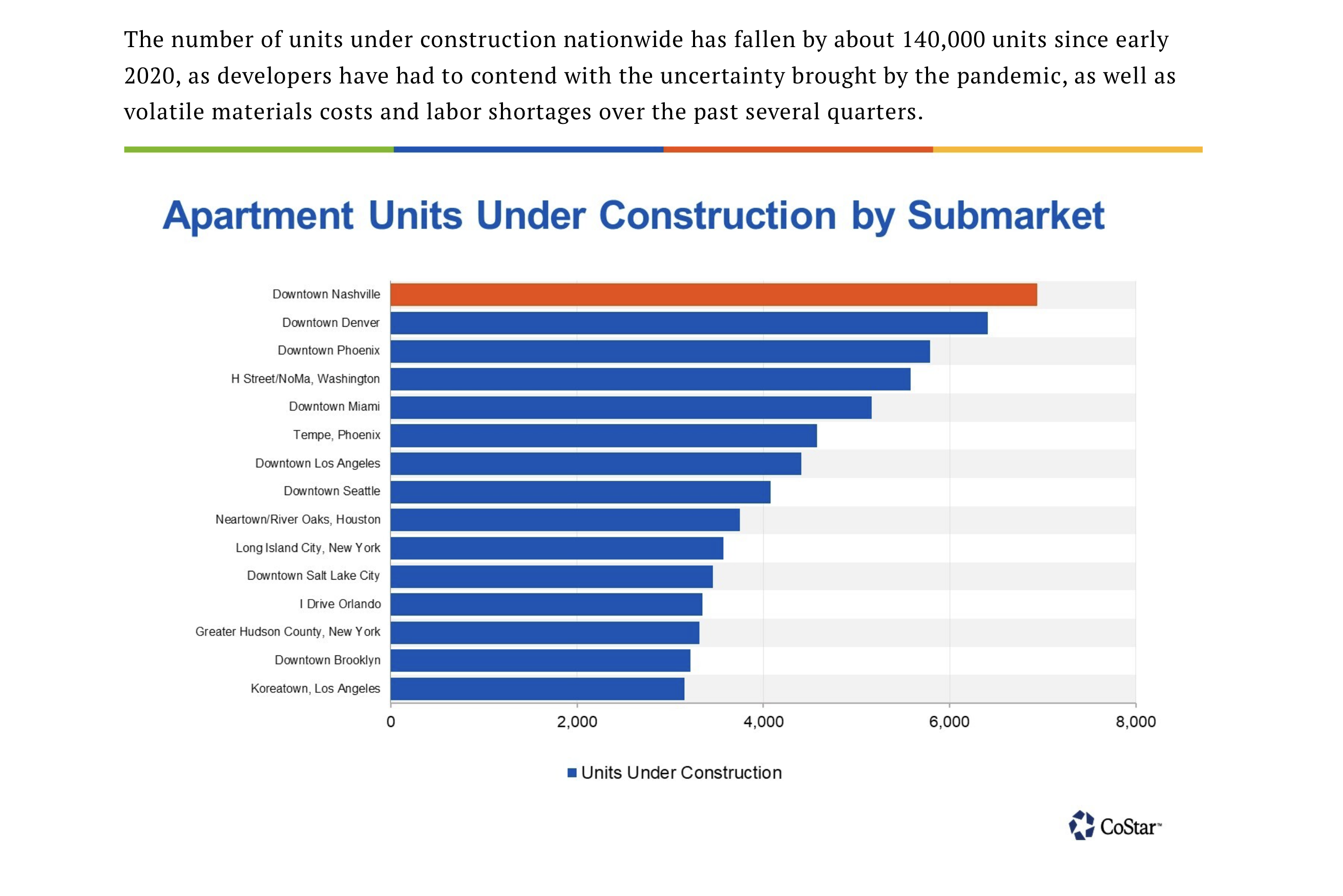

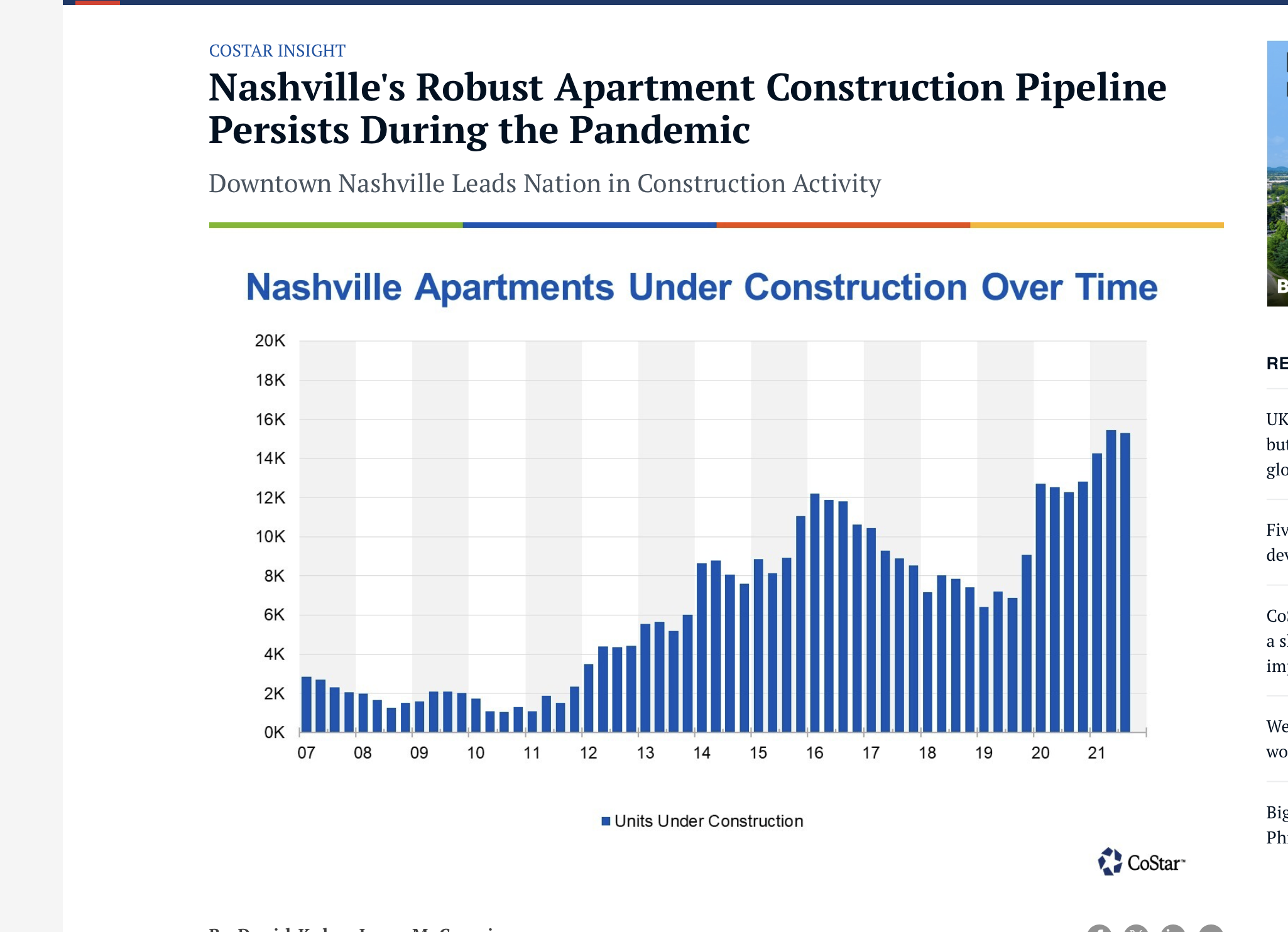

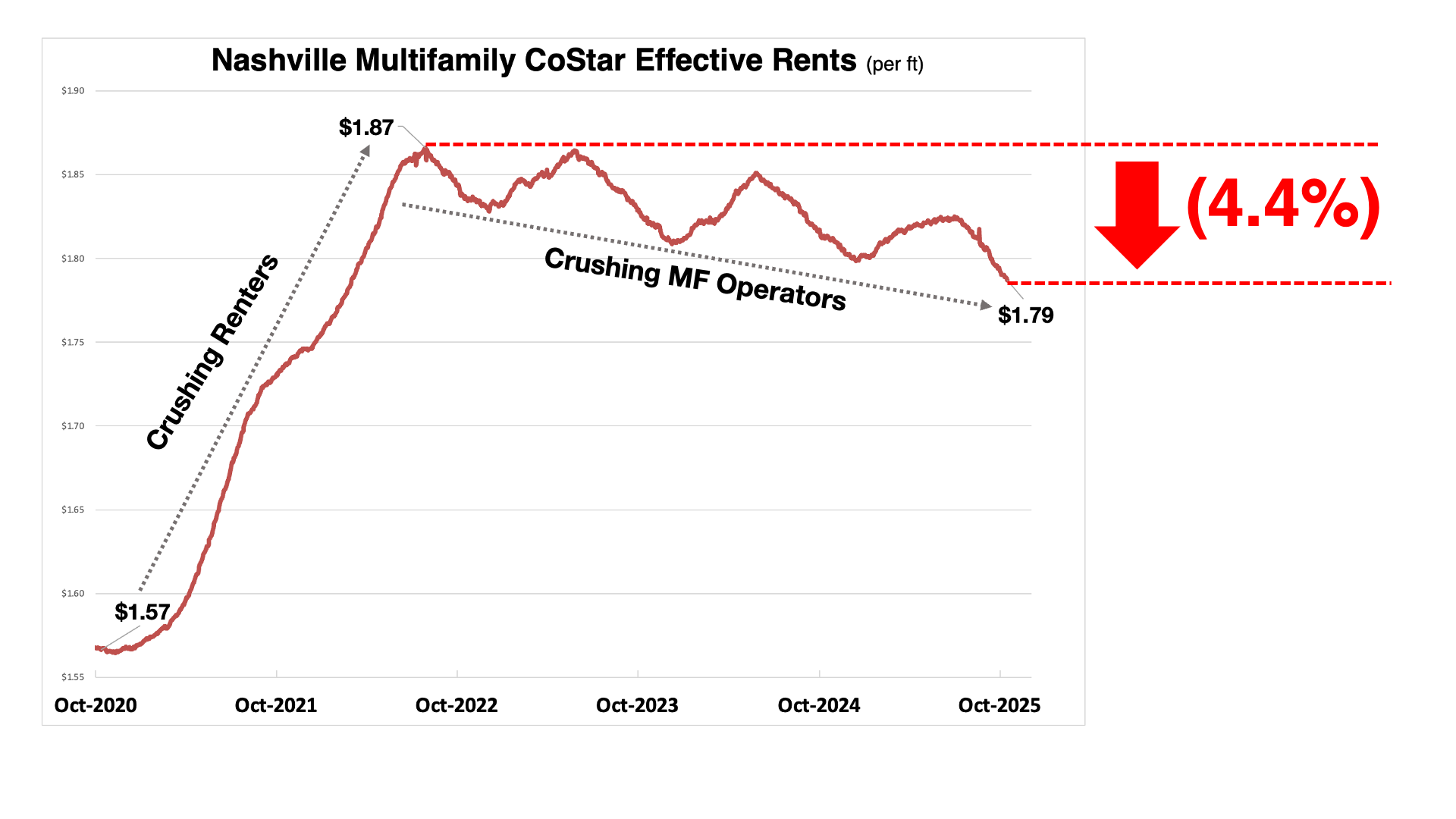

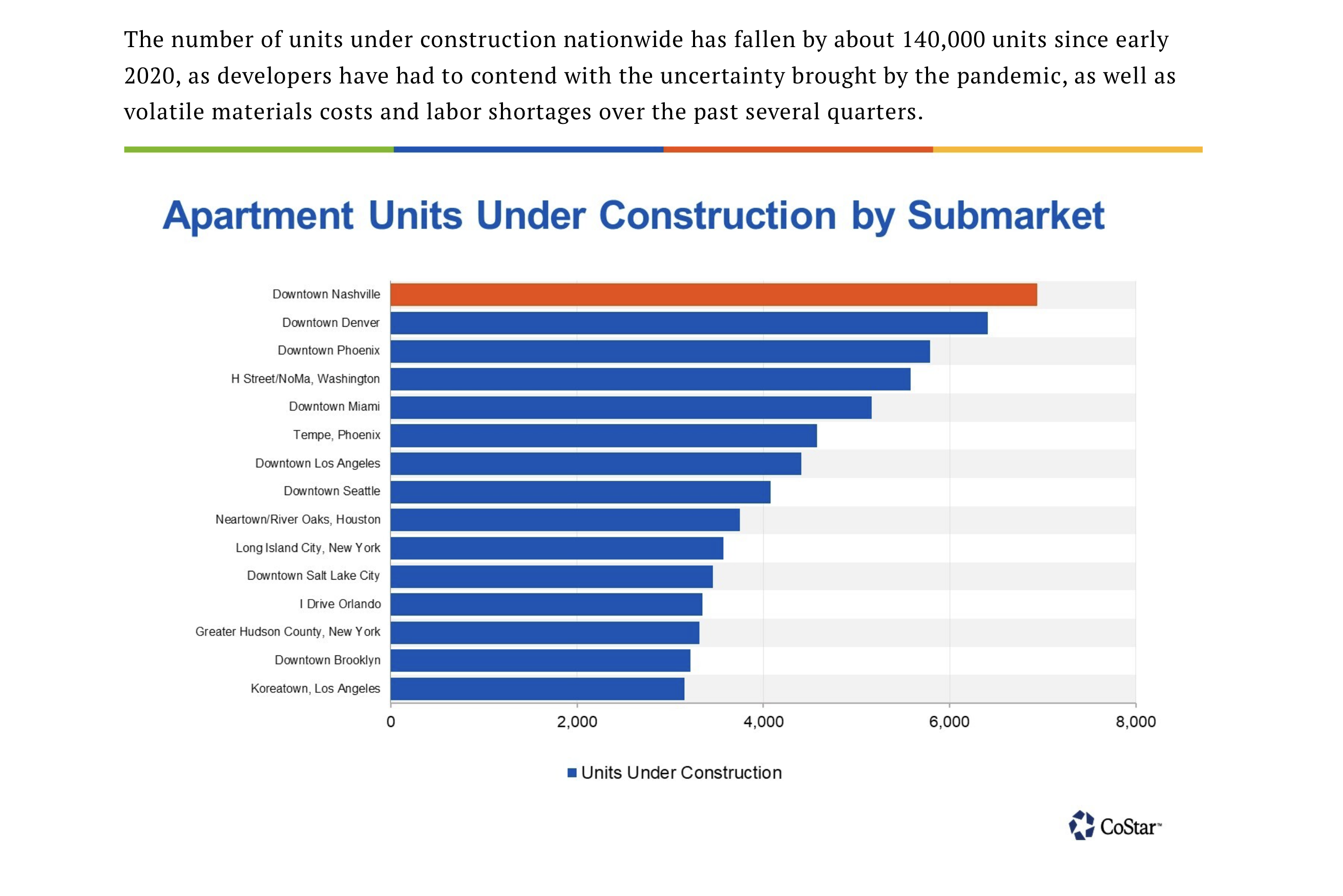

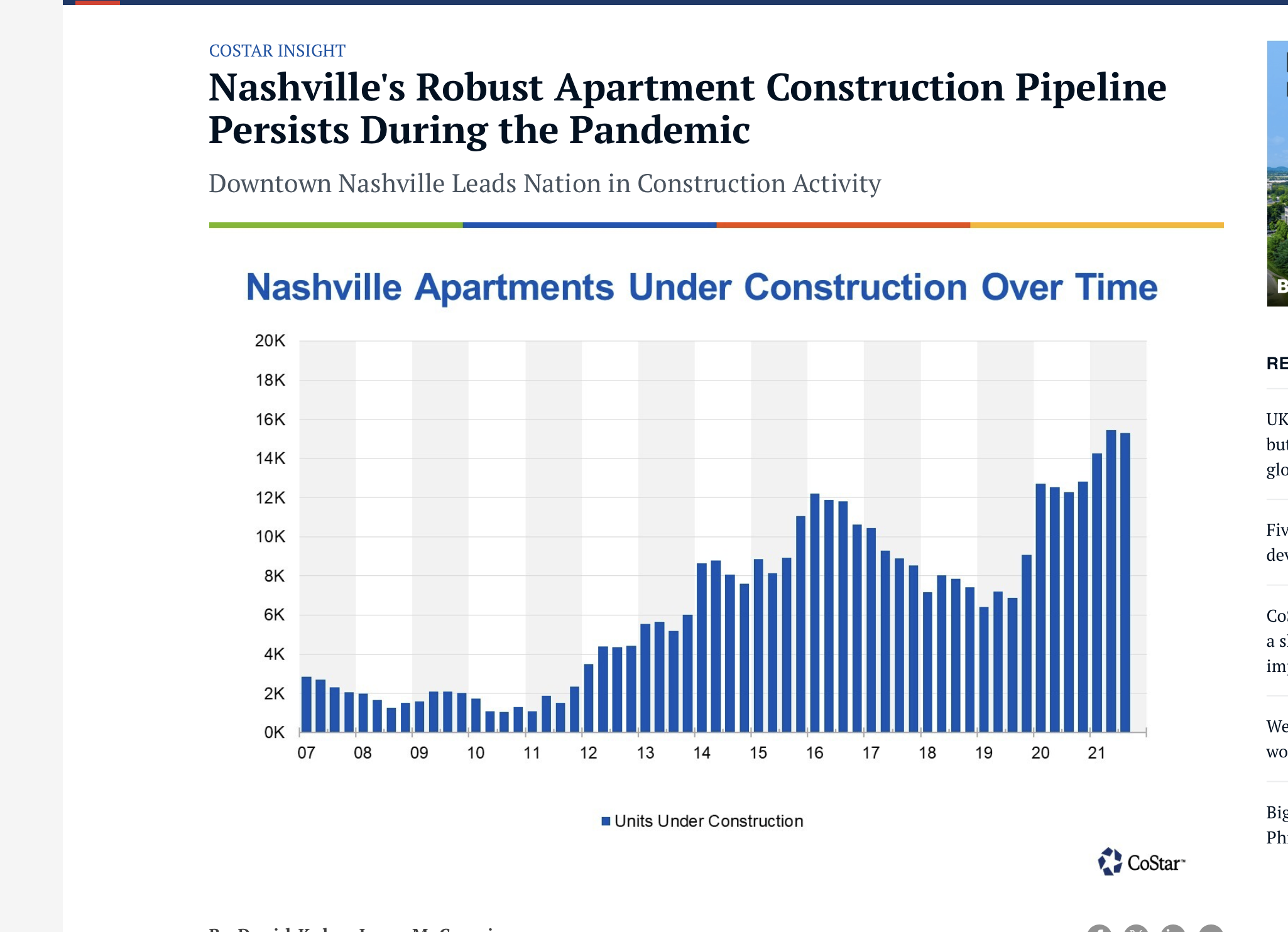

But instead of rents climbing, they quickly reversed direction. Nashville's luxury apartment boom had gone wild—at its peak, nearly 24,000 units were under construction, leading to 13,000 apartments being completed in a single year. With only 4,000 to 8,000 new renters annually, the city was soon drowning in oversupply. Naturally, rents began dropping sharply.

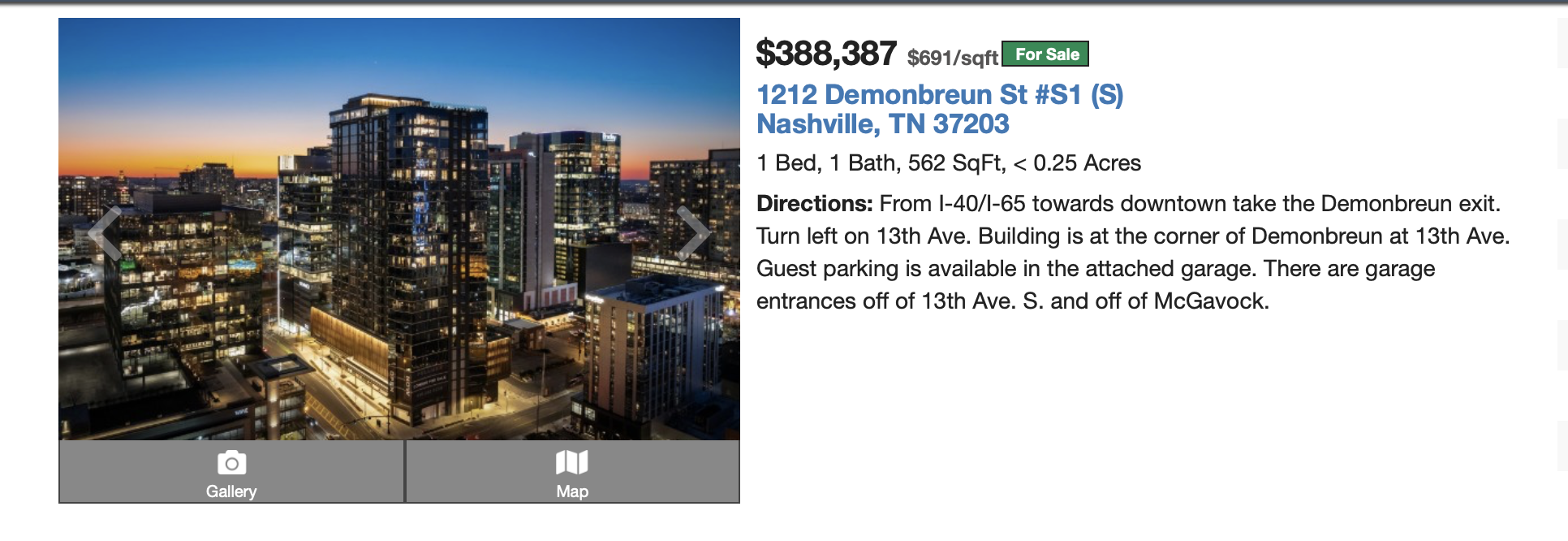

As apartment profitability plummeted, several developers scrambled to pivot to condos. The Emory and the Pullman are prime examples—originally apartment projects that converted into condos, injecting over 600 new units into an already crowded high-rise condo market. Today, we see more condos actively listed for sale than have sold in the past year. This oversupply has created intense downward pressure, causing condo prices to plunge.

Here's the quirky thing about condos: there are generally three ways to value them—comparable sales ("comps"), rental income potential, and replacement cost (the cost to build the same building today). Historically in Nashville, condos haven't made much sense as rental properties because mortgage payments usually far exceed achievable rents. They’ve mostly been second homes or "wealth stores" for people hoping to sell higher later—classic "Greater Fool Theory."

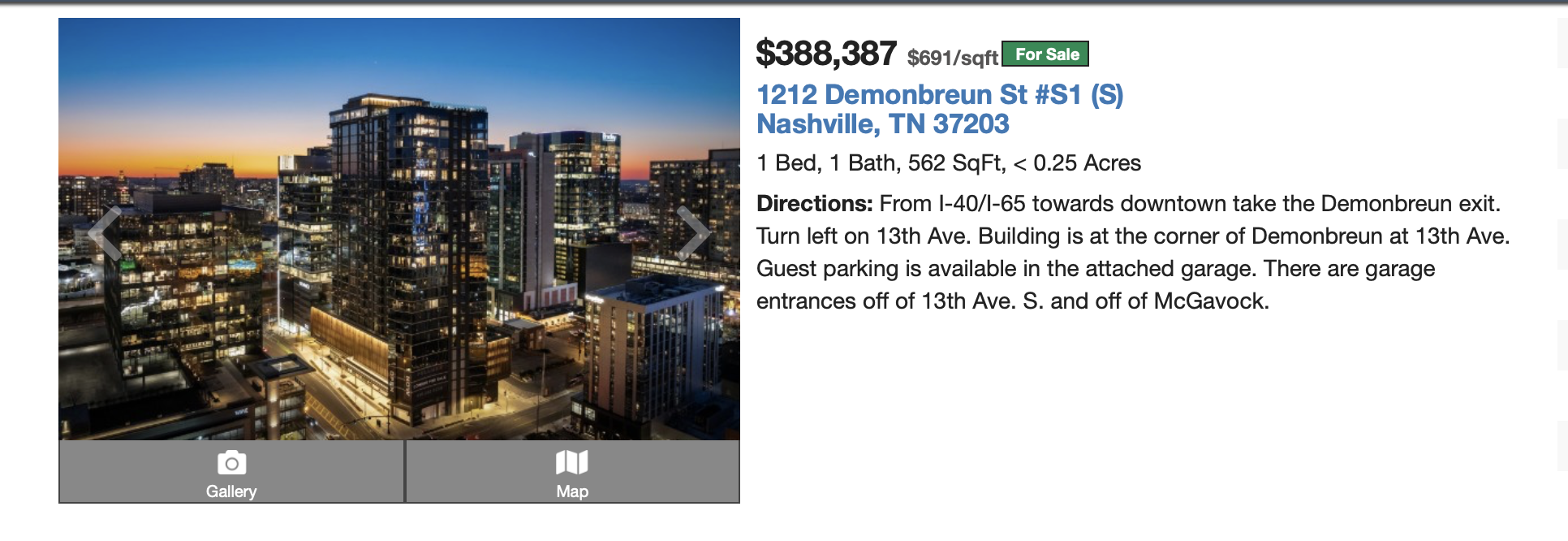

What's intriguing now is that many high-rise condos in Nashville may be approaching or even dropping below their replacement cost. With rising construction costs—thanks to pricier materials, labor shortages, and tariffs—replacement cost continues climbing. This means current prices might actually be hitting a floor, as developers become less inclined to build more.

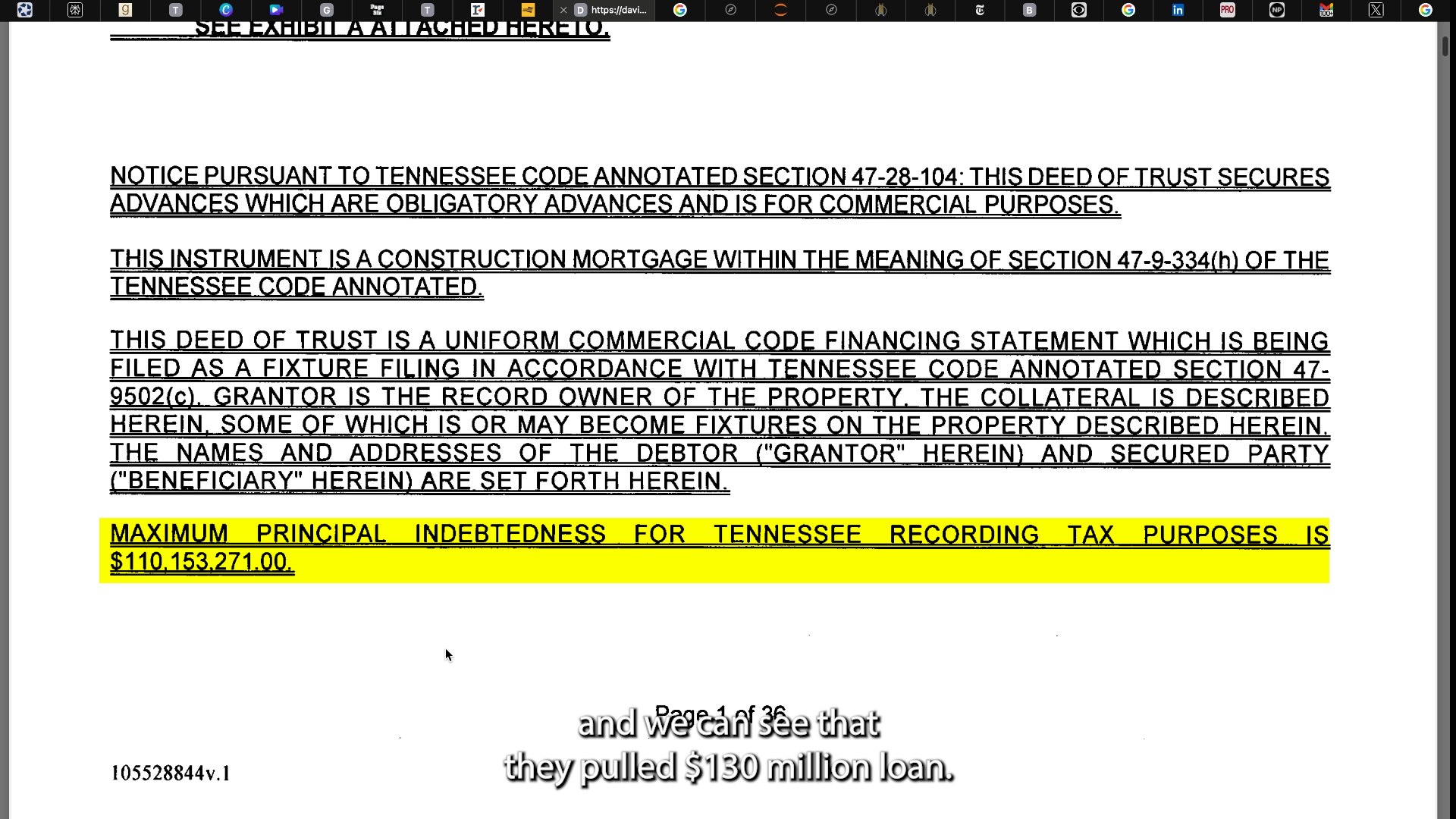

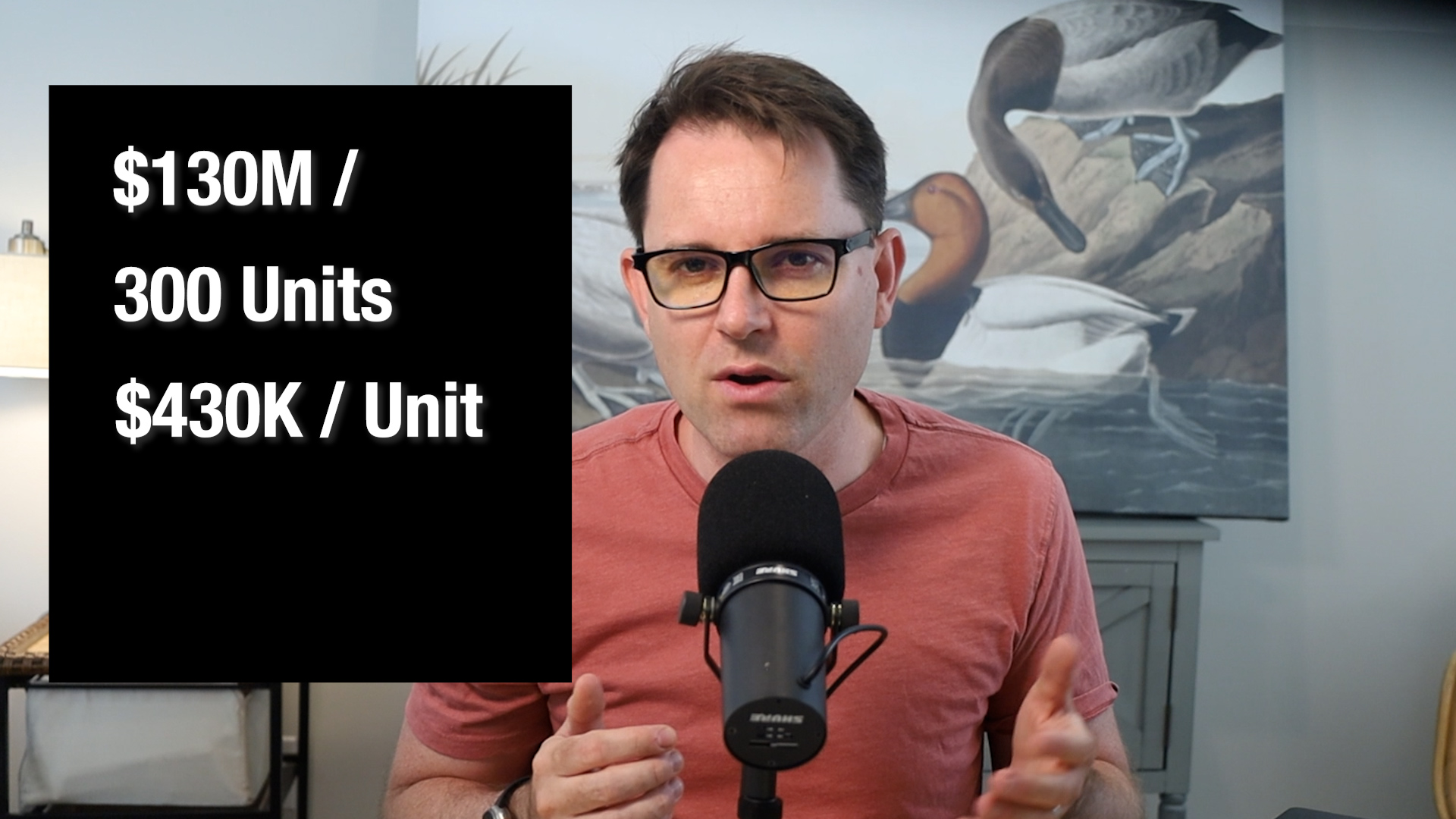

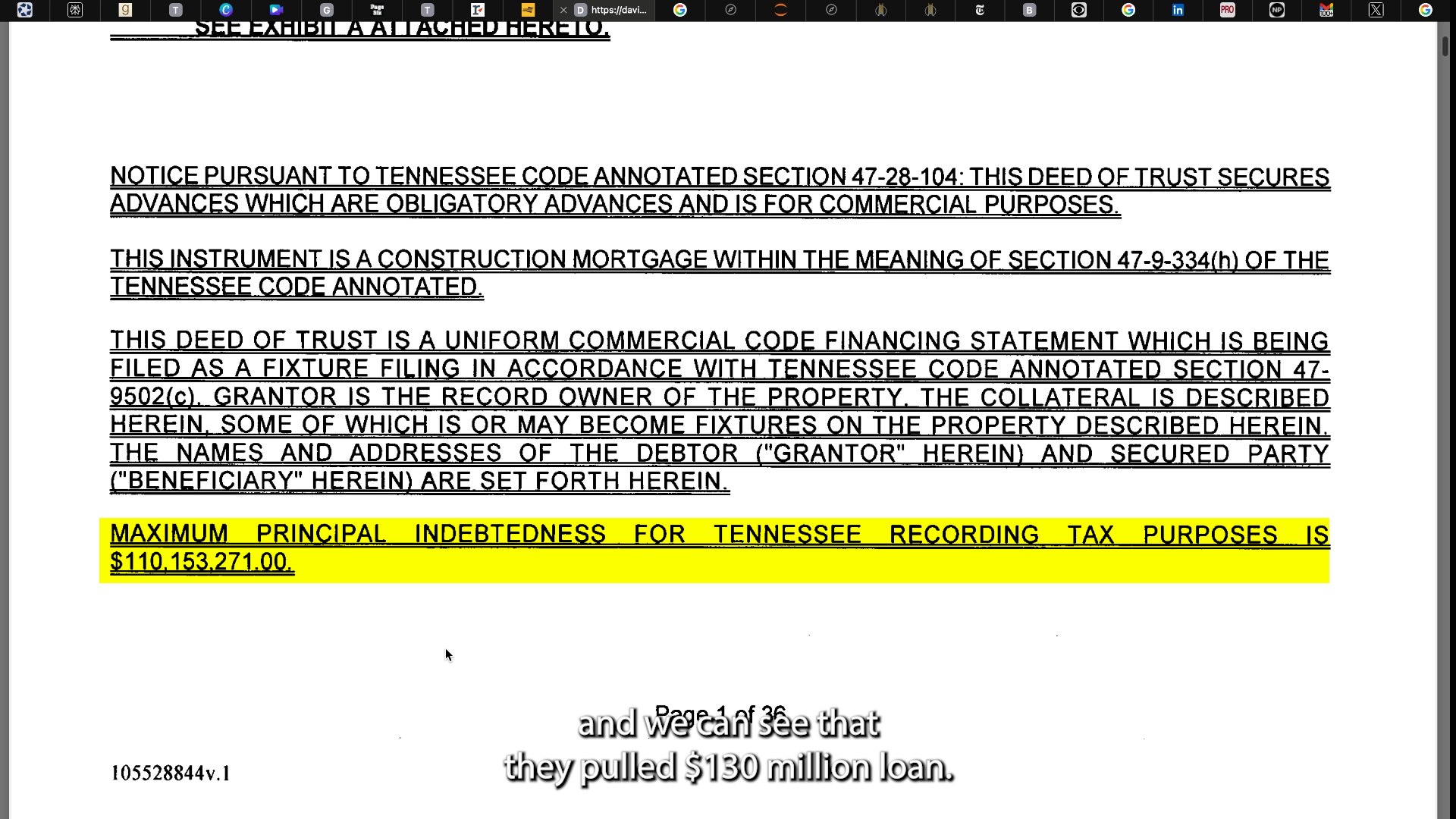

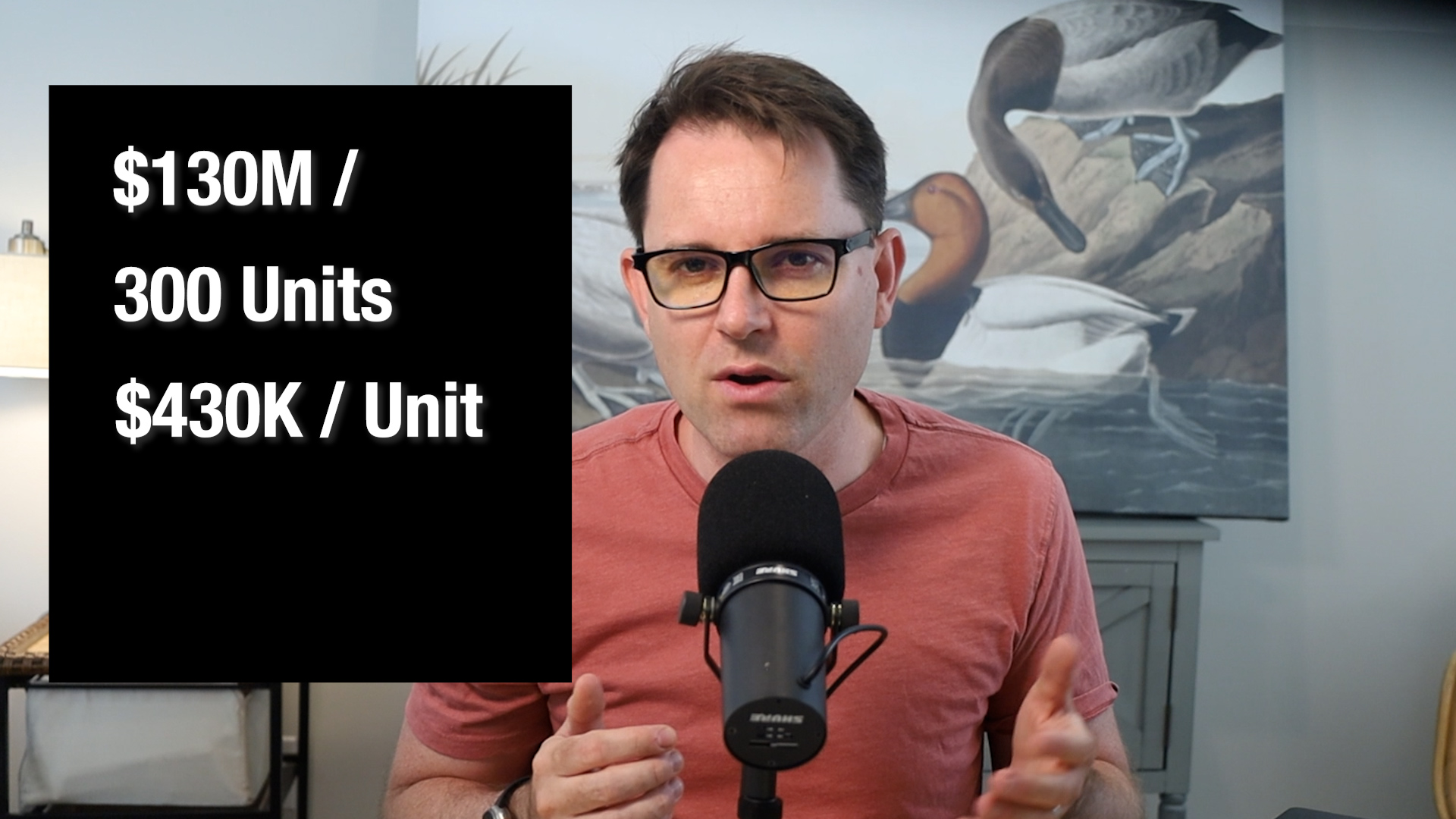

Let's look at the Pullman. Construction loan of $110M + estimated down payment $20M = $130M. With 300 units, the avg cost is $430K a unit. Now to get an even more accurate picture we would want to divide the $130M by the livable sqft and apply that to the units but I don't have that.

Yet amid all this chaos, the ultra-luxury penthouse market continues thriving. Record-breaking deals keep happening—like a recent $15 million condo sale at Four Seasons, a $10 million deal at 505, and high-priced sales at Broadwest. So while regular high-rise condos suffer price drops, Nashville's top luxury units seem to be soaring.

Nashville’s condo market is undergoing a dramatic shakeout: high-rise condos are facing steep declines, but the ultra-luxury penthouse keeps hitting record highs. It's a fascinating split.